[ad_1]

Collection is expected to reach $ 1.01 billion to invest in energy and infrastructure

Andrés Venegas Loaiza – [email protected]

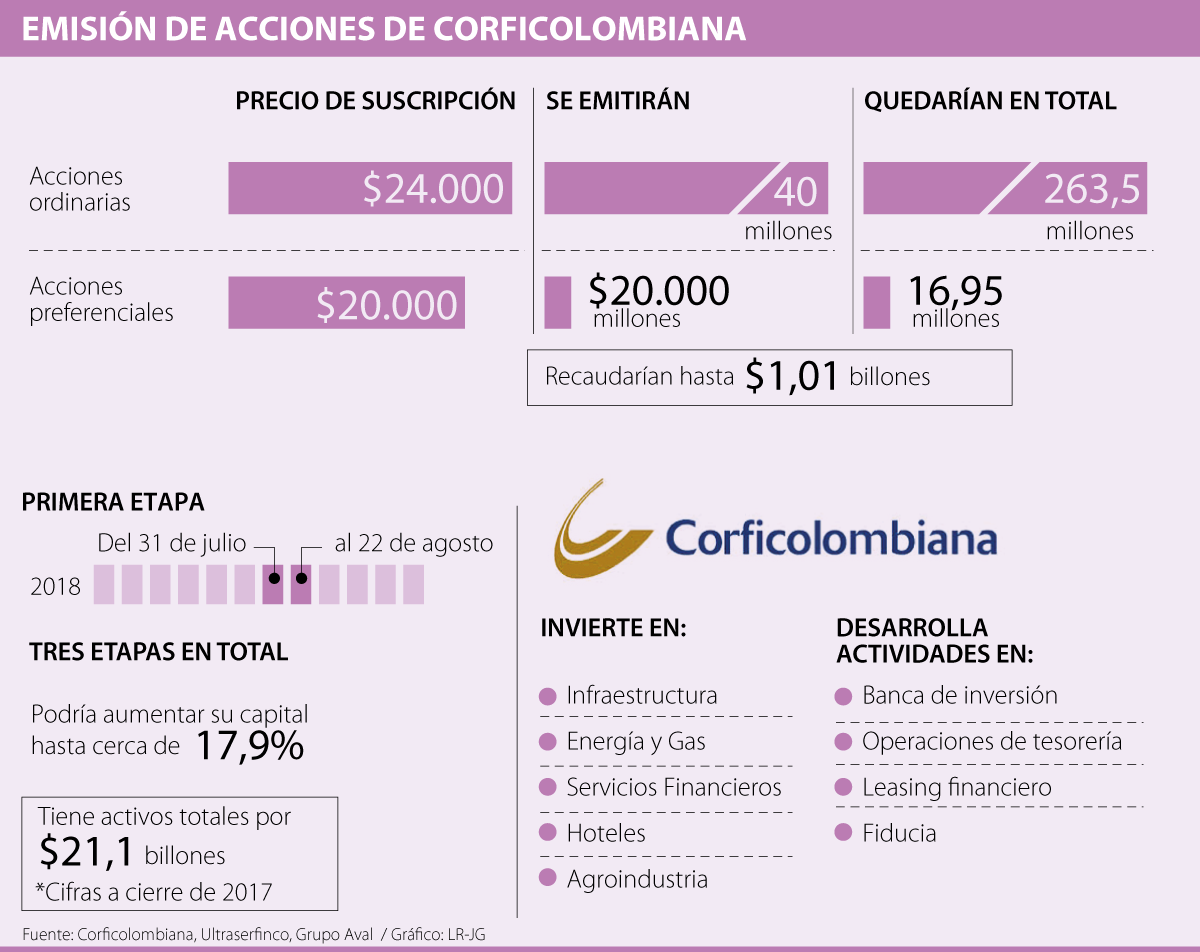

The Corporación Financiera, Corficolombiana, announced the conditions for the issuance of the shares announced after the Financial Superintendency's approval on July 26th.

The subscription price of each of its common shares will be $ 24,000, while the price of each of the preferred shares will be $ 20,000. The entity authorized the issuance of a total of 40 million common shares and a little more than 2.5 million preferred shares, with no right to vote.

The amount of proposed shares The issue would bring the number of common and preferred shares to 263.5 million and 16.95 million, respectively, according to Ultraserfinco. This represents a capital increase of 17.9%.

The first of three stages of the issue will be addressed to the current shareholders of the company, which will begin today and will extend over 15 business days ending August 22nd.

The second stage will begin two days after the end of the first stage, then the balance of the available shares will be published between the current shareholders and the badignees "who have fully subscribed the shares", common and preferential shares corresponding to them in the first stage . For the last step, the legal representative will offer the remaining shares for sale from the previous two steps.

The placement agents will be Casa de Bolsa, as a chief agent, as well as recognized companies such as Credicorp Capital, Davivienda Corredores, Ultraserfinco, BTG Pactual and Valores Bancolombia

Diego Franco, Director of Franco Group SA, has stated that it was a fixed-demand transaction, stating that "most likely, this transaction is purchased primarily by the shareholders of the company itself." In addition, he pointed out that "Being part of such an important conglomerate" will be in high demand, "even if it is generated by the same institutions and will continue to have the same role in the market."

The totality of resources obtained in this issue will be intended to carry out operations and enterprises "legally authorized to financial companies" as stated by the company in its public announcement, including making investments and reducing its liability .

Corficolombiana has investments in five sectors: infrastructure, energy and gas, financial services, hotels and agribusiness. In addition to Investment Banking activities, it develops treasury, leasing and trust operations through its subsidiaries. At the end of 2017, its total badets were $ 21.1 billion.

Source link