[ad_1]

Bullish, the cryptocurrency exchange backed by Block.one, revealed its intention to go public via a PSPC deal on Friday, making it the latest company in the digital asset market to announce its intention to list its shares on a stock exchange. .

As part of the deal, Bullish will merge with Far Peak Acquisition Corp (NYSE: FPAC), a SPAC company led by former New York Stock Exchange chairman Tom Farley. Farley will take the reins as Bullish’s new CEO. The deal values the company at $ 9 billion, according to a press release.

The proceeds from the capital increase include $ 300 million of private investments committed in public shares of EFM Asset Management as well as BlackRock and Galaxy Digital.

The transaction, which is expected to be finalized by the end of 2021, will bring to market the last state-owned company in the digital asset market, joining Coinbase and Bakkt, the latter of which also announced its own PSPC deal.

At $ 9 billion, Bullish’s valuation would be a quarter of Coinbase’s $ 45 billion valuation. Coinbase is the largest cryptocurrency exchange in the United States with over 56 million verified users. Bullish just released an invite-only pilot, according to a deck. The company was launched in May.

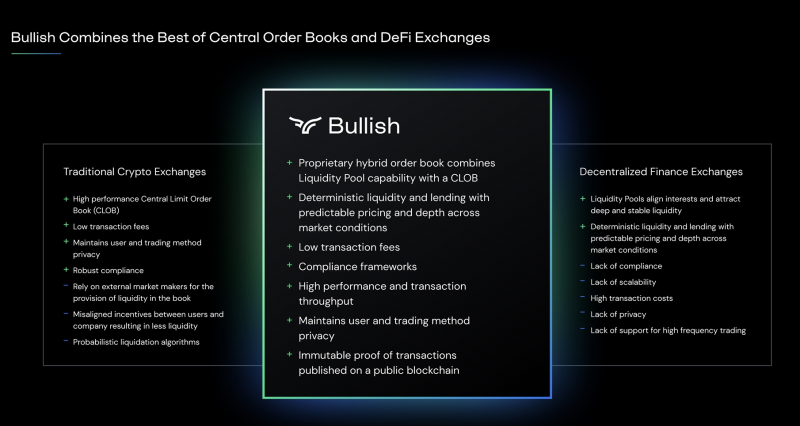

The company hopes to woo customers with a hybrid-style order book that borrows from both decentralized and centralized funding platform structures, according to an investor pitch.

“Bullish is well positioned to strategically deliver value to its potential shareholders by capitalizing on market trends and placing technological innovation at the heart of its identity,” said Farley. “We are only in the first or second round of the cryptocurrency market and I am delighted to join the bullish team as we revolutionize the future of digital assets through advanced financial technologies. “

Related reading

[ad_2]

Source link