[ad_1]

France’s economy and finance ministry has warned tech companies it expects them to pay the country’s new 3% digital services tax from December, Reuters reported Wednesday.

France collection interrupted the tax earlier this year after the US government’s reaction and threats to trade tariff increases by the Trump administration. The case was referred to the Organization for Economic Co-operation and Development. No agreement has been reached. In July, Treasury Secretary Steve Mnuchin called for negotiations to be delayed during the novel coronavirus pandemic, but EU officials interpreted this as a blocking tactic designed to blow up deals made so far. Donald Trump’s administration then nuclear the talks. The French tax authorities had set December as the deadline for the entry into force of the tax if the negotiations proved unsuccessful.

The problem is the current global tax system, where companies typically only pay taxes in countries they are making a profit. This is particularly controversial when it comes to technology, a mature industry with tax evasion and where it is easy for companies to channel the profits generated in a tax jurisdiction through tax havens like Ireland. The 3% The tax applies to all digital services, but is clearly aimed primarily at tech giants, as it applies to companies with revenue of 25 million euros (around 29.8 million dollars ) in France and 750 million euros (approximately 894 million dollars) worldwide. According to Reuters, ministers were hoping the tax would bring in around 500 million euros (about $ 596 million) this year.

“The companies subject to the tax have received their formal notice to pay the 2020 deposit,” the French finance ministry told Reuters in a statement.

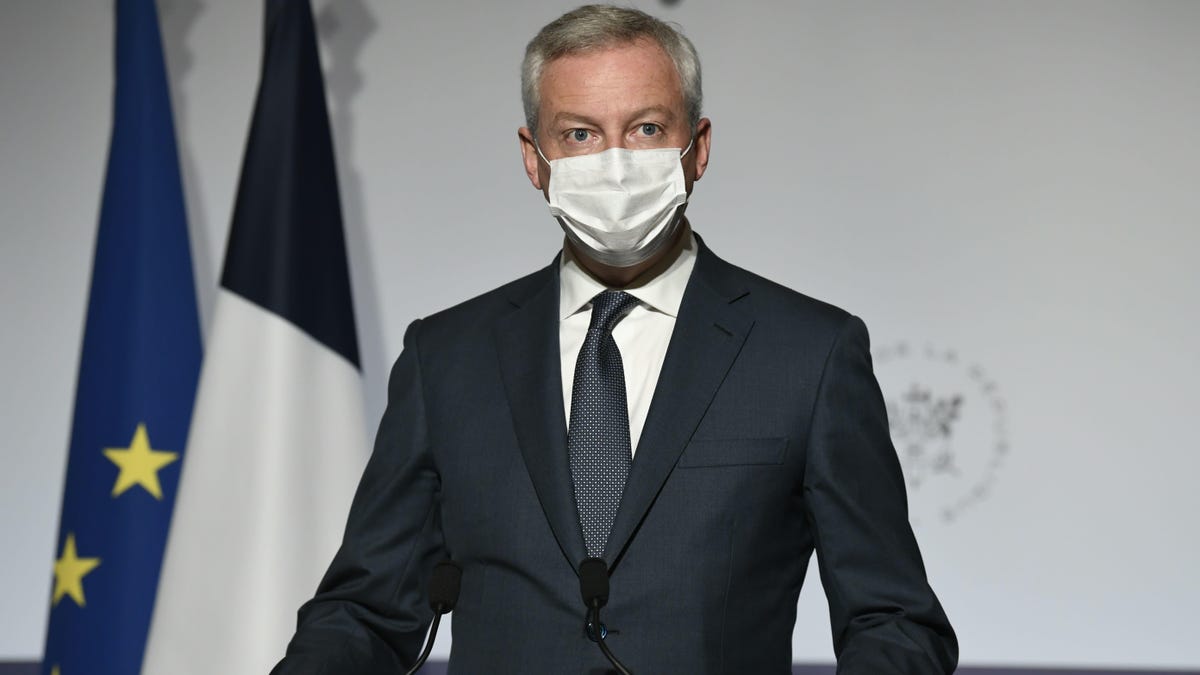

French Finance Minister Bruno Le Maire told Bloomberg Monday that he hoped the incoming Joe Biden administration would act quickly to reach a deal that avoided a prolonged trade standoff, as U.S. retaliatory tariffs are expected to kick in in January. Tariffs, set by the Trump administration in an attempt to roll back France, would be set at 25% on 1.3 billion dollars of French products including cosmetics, soap and handbags, but not cheese, wine or cooking utensils. (Trump had previously threatened to impose 100% prices on 2.4 billion dollars of French goods, but declined after American companies protested that the administration did not understand that it would hurt them much more than France.)

G / O Media can get commission

“We will spare no efforts to convince the new Biden administration to join the consensus, which is currently the case at the OECD on global digital taxation,” Le Maire told Bloomberg.

By CNN, this could put the Biden administration in a difficult position, as opposition to the tax in the United States was not limited to Trump – Democrats were also embittered about the prospect, viewing taxes on digital services as an attack against the American tech industry. as well as a way to siphon US tax dollars abroad. However, an OECD deal that applies to taxes on digital services and other multinationals could also allow the United States to offset the deficit by taxing foreign companies doing business in the United States. If an agreement is not reached, France could propose a tax on digital services at the level of the European Union early 2021.

“Democrats have been as opposed to taxes on digital services as Republicans”, ex-US Treasury Department official Brian Jenn told Bloomberg in February 2020. “While very few Democrats are fans of tariffs, it seems that the tariff approach has at least bought a temporary victory in the case of France.

“Everyone has looked pretty hard at the OECD process and said we need a deal,” said Cathy Schultz, vice president of tax policy at the National Council for Foreign Trade in Washington. . Financial Times. “But if we don’t come to an agreement, these things are just going to become rampant and we are going to have more trade war.”

Other countries are preparing to roll out their own counterparts, such as the UK, which plans to start collecting a digital services tax in April 2021. According to the Times, US trade representative Robert Lighthizer announced this summer “ polls in a number of countries adopting taxes on digital services, including UK, Italy, Austria, Brazil, Indonesia and [European Union]Which could trigger more retaliatory tariffs before Trump leaves office.

French officials threatened that US retaliatory tariffs would not be well received.

“Threats of trade sanctions are not acceptable and the EU would react swiftly and decisively if they materialize”, spokesman for the Ministry of Taxes told Bloomberg last week.

[ad_2]

Source link