[ad_1]

As of Monday, Washington wants to prevent sales of Iranian black gold, putting the oil market under pressure. The United States, however, has allowed eight countries, including China, India, Japan, South Korea and Italy, to continue buying Iranian oil temporarily.

"The sanctions are coming. November 5. "On the poster inspired by the hit series Game of Thrones, stands out an imposing and threatening Donald Trump. The pastiche was broadcast Friday on the Twitter account of the American president himself! Decidedly, the occupier of the White House likes to blur the line between fiction and reality. The reality for Iran is that as of this Monday, it is forbidden – by the United States – to export its oil. After a first round of sanctions that came into force on August 6, affecting certain financial transactions and, in particular, the automobile sector, Washington is attacking the black gold of Tehran, whose sales represent between 70% and 80% of the country's export earnings and about half of its budgetary resources. On Monday morning, Israeli Prime Minister Benjamin Netanyahu hailed as "a historic day" the imposition of these new sanctions, "the hardest" according to him since the beginning of efforts to contain the actions of the Islamic Republic.

READ ALSO – Trump's unlikely exchange with Iran over Game of Thrones

The United States, however, has authorized eight countries, including China, India, Japan, South Korea and Italy, to continue buying Iranian oil temporarily, despite US sanctions being restored, announced Monday. the head of the American diplomacy Mike Pompeo. Other countries with a derogation are Greece, Turkey and Taiwan, he added, promising "relentless" pressure until the Iranian regime has taken a "180-degree turn" in its wake. destabilizing behavior in the Middle East. These countries have pledged to reduce their purchases of Iranian crude in exchange for American tolerance. "If they try to circumvent our sanctions, we will continue to take action to disrupt their business. The maximum pressure from the United States will only increase from now on, companies around the world must understand that we will implement the sanctions strictly, "said US Treasury Secretary Steven Mnuchin at a press conference at his side. In addition to sanctions against Iranian oil exports, which the US administration says it wants to reduce to zero in the long term, 50 Iranian banks have been blacklisted in the United States, as well as more than 200 people and vessels from Iranian sectors. shipping and energy, an Iranian airline and more than 65 of its aircraft.

During a televised speech on Monday, Iranian President Hbadan Rohani badured that his country was going to circumvent these new American sanctions: "I announce that we will proudly bypbad your illegal and unjust sanctions because they go against of international law, "he said. "We are in a state of economic war and we are facing intimidation. I do not think in American history there has been so far anyone in the White House who contravenes international law and conventions so much, "Hbadan Rohani lamented.

United States ? Iran: How far will the confrontation go? – Watch on Figaro Live

The precedent of 2012

Thanks to the strength of the dollar, the dependence of companies around the world on the US market and their extraterritorial interventionism, the United States can punish anyone who buys oil from Iran. Donald Trump explains that his "objective is to force the regime (Iran) to make a clear choice: either abandon its destructive behavior or continue on the path of economic disaster." Washington calls for stricter restrictions on Tehran's nuclear program, as well as a halt to the ballistic missile program and the "destabilizing" activities of the mullahs in the Middle East. The previous oil embargo in 2012, in which Europe took part, had dealt a severe blow to the Iranian economy. And largely pushed Tehran to sign the 2015 agreement on the nuclear program, the same fragile compromise that Donald Trump denounced last May to the chagrin of Europeans who are now seeking to put in place a mechanism to circumvent the new US sanctions .

READ ALSO – Europe powerless to circumvent US sanctions against Iran

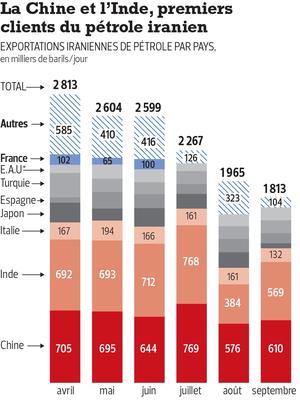

"Well before November, companies have stopped their investments in Iran, including Total which has withdrawn from the South Pars 2 gas project," recalls Francis Perrin, Research Director at Iris (Institute for International and Strategic Relations). "Companies have stopped buying Iranian crude in the summer," said the oil market specialist. France (Total in this case) was still buying 100,000 barrels a day in March. Not a drop since June. "Month after month, Iranian exports are decreasing," notes Francis Perrin. Officially, Iran exported 2.8 million barrels a day (Mbj) in April, before announcing the return of sanctions. And only 1.6 Mbj in October. Even though clandestine exports exist, the fall is severe.

"Trump's policy is likely to cause a shortage of oil and drive up prices. All the trouble for him is to weaken Iran without causing an outbreak "

Francis Perrin, research director at Iris

What impact will this scarcity of Iranian deliveries have on the world oil market, at a time when the French are complaining so much about rising prices at the pump? The answer will depend in part on the attitude of Iran's two largest customers, China and India, which together absorb two-thirds of its official exports. Iran's black gold accounts for 7% and 15% of Chinese and Indian imports respectively. China may choose to ignore US sanctions unless its position on Iranian oil is part of a major trade deal with Washington.

"Trump's policy is likely to cause a shortage of oil and drive up prices. All the trouble for him is to weaken Iran without causing an outbreak, "says Francis Perrin. It is to avoid it that Washington obtained from Saudi Arabia that increases since July its production. "There is no danger of a shortage by the beginning of 2019," says Francis Perrin. Most experts do not see a barrel at $ 100 in the next few months. For their part, the United States have significantly increased their production of shale oil, says Antoine Rostand Kayrros cabinet: "In one month, Texas has increased its volume of 400,000 barrels per day, it's huge." Canada and Brazil are also in a phase of upward supply, while the demand side, the International Energy Agency (IEA) notes a weakening progress. The combination of these factors explains that after a push to $ 85 a month ago (the highest in four years), the price of the barrel of brent has fallen back around 75 dollars in recent days, despite the entry in force of the embargo against Iran.

The figures for Iranian exports at the end of November will none the less be watched by the markets. Above all, "the question is what will Saudi Arabia and Russia do that could again limit their production," wondered Antoine Rostand. Although the global market is well endowed, Tehran predicts that US sanctions will only boost volatility.

[ad_2]

Source link