[ad_1]

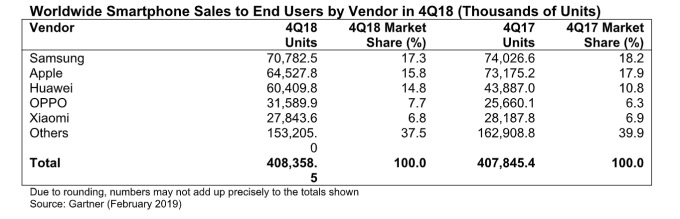

Apple sold 64 million iPhones in the fourth quarter of 2018, up from 73 million in Q4 2017. These figures followed the downward trend of smartphone sales in the fourth quarter of 2018, with growth of only 0.1% over the period and 408.4 million units delivered.

While maintaining its second place with 15.8% market share behind the leader Samsung (17.3%), Apple suffered the biggest decline, reducing its global market share from 18% in the fourth quarter 2017 to 16 % in the fourth quarter of 2018.

The analyst firm said iPhone sales were the worst in Greater China, where Apple's market share dropped to 8.8 percent in Q4, compared with 14.6 percent in Q4 2017. Samsung has also recorded a decrease in market share during the holiday period, registering 17%, down from 18% in 2017.

Huawei, the third, closed the gap on Apple by selling 60 million phones in Q4 2018, against 44 million in Q4 2017, from 10.8% in Q4 2017 to 14.8%. Oppo, in fourth position, increased by 7.6%, compared to 7.3% in the fourth quarter of 2017, against 6.8% for Xiaomi, against 6.9% the previous quarter.

"The demand for entry-level and mid-priced smartphones has remained strong in all markets, but demand for high-end smartphones has continued to slow in the fourth quarter of 2018," said Anshul Gupta, Director of Research at Gartner. "The slowdown in incremental innovation in the high end, coupled with rising prices, has discouraged high-end smartphone replacement decisions."

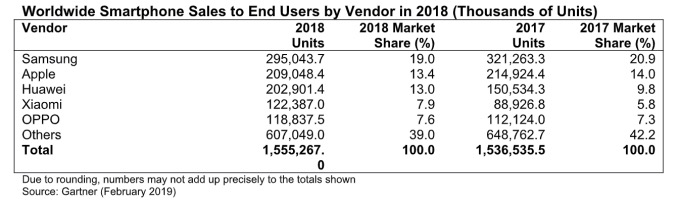

For the whole of 2018, global smartphone sales grew 1.2% year-over-year, with 1.6 billion units delivered. The market leader, Samsung, saw its share fall 1.9% and Apple, 0.6% compared to the previous year, but Huawei, Xiaomi and Oppo recorded overall gains of 3.2%, 2.1% and 0.3%, respectively.

According to Gartner, Chinese brands have actually increased their overall sales thanks to broad appeal in emerging markets such as China and India, while the worst year-to-date declines have been recorded in North America. North and in mature areas of Asia / Pacific.

Beyond the general slowdown in the smartphone market, Gartner put Apple's mediocre quarterly performance at the service of buyers delaying upgrades and offering attractive alternatives to Chinese vendors.

"Apple must not only deal with buyers who delay upgrades while waiting for more innovative smartphones, but it also continues to face compelling alternatives for high-priced and mid-priced smartphones from Chinese vendors These two challenges are limiting the prospects for growth in sales of Apple units, "Gupta said. .

Last month, Apple issued a rare warning that the quarter's business figure would be at least $ 5 billion lower than the level initially set by the company. Apple pointed to several factors, including the subsequent launch of the iPhone XR, the general weakness in China and less. upgrades as customers took advantage of Apple's price reduction on battery replacement in 2018 to extend the life of their current phones.

Apple then achieved a turnover of 84.31 billion USD and a quarterly net profit of 19.965 billion USD, against 88.3 billion USD and a quarterly net profit of 20.1 billion USD for the same quarter of the year. Previous year. However, despite the warning on the results, the quarter was the second best in Apple's history in terms of revenue and comprehensive income, only exceeding the first quarter of 2018.

Apple CEO Tim Cook recently said the company is "rethinking" iPhone prices outside the US and may lower prices to boost sales. Apple has already begun to lower the price of the iPhone for third-party distributors in China. Price reductions could also be introduced in other regions, such as India and Brazil, where the iPhone is prohibitively expensive and is experiencing stalled growth due to high prices.

[ad_2]

Source link