[ad_1]

(Bloomberg) – Shares of General Motors Co. hit their highest level in nearly three months after a Deutsche Bank analyst speculated the automaker could ditch its electric vehicle unit to create more value.

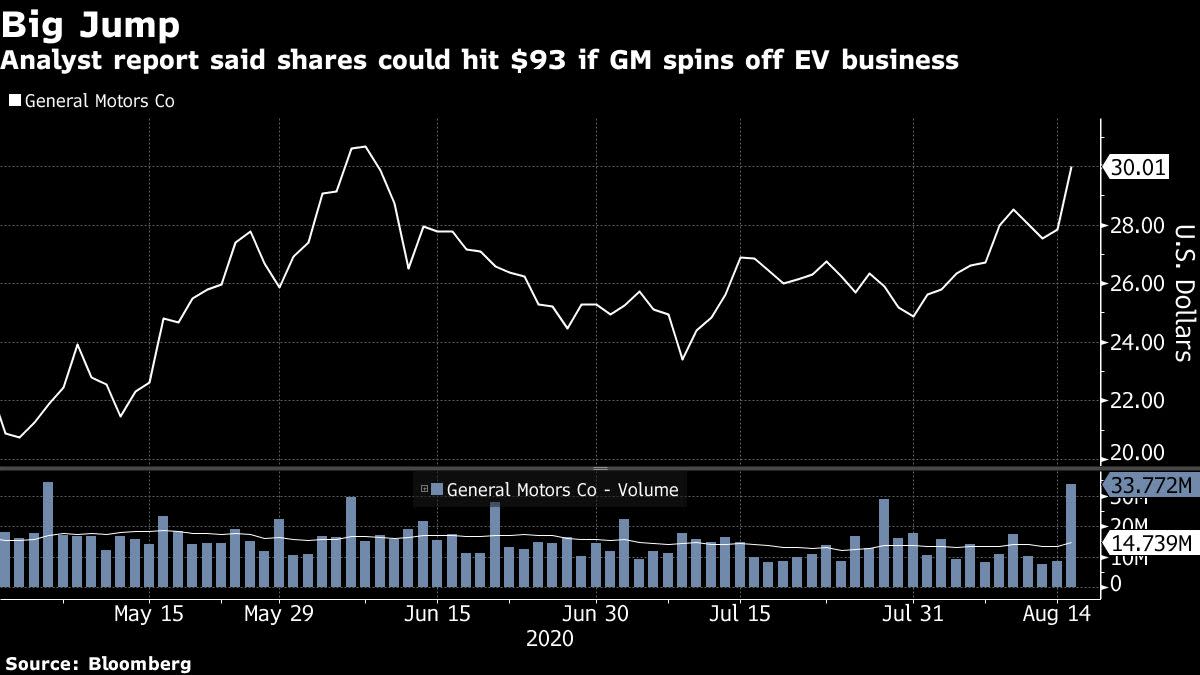

The stock slashed a 10.5% gain in Monday’s trading before closing 7.7% higher at $ 30.01 a share – the biggest one-day jump since May 18 and its close the highest since June 8. in a report released on Monday, the automaker could be worth as much as $ 93 per share if GM launches its electric vehicle business.

GM recently pondered such a move, Bloomberg reported earlier this month, relaunching a thoughtful idea for the first time internally two years ago. A spokesperson declined to comment beyond reference to comments made by its chief executive, Mary Barra, last month.

Asked about the possibility during a July 31, second-quarter earnings call, CEO Barra did not dismiss the idea, saying “nothing is off the table,” although the company has nothing said about its preparation.

GM plans to sell more than 20 models of electric vehicles around 2023. The company could be sold for $ 20 billion and possibly be worth up to $ 100 billion, according to the Deutsche Bank report. GM’s core business, which sells sport utility vehicles and gasoline-powered pickup trucks, generates money, but is considered to be in long-term decline and is less exciting to investors than the electric car plans of the company, he said.

Despite Monday’s share gains, the Detroit-based automaker’s stock is down 18% so far this year, while all-electric rival Tesla Inc. is worth eight times that of GM. By abandoning its EV business, GM could gain the kind of momentum that Tesla and a handful of startups have that have attracted capital despite the lack of vehicles on the market.

Battery cars have captured the imaginations of investors in recent weeks, sending Tesla shares to successive record highs and increasing the value of electric startups like Nikola Inc., Fisker Inc. and Lordstown Motors Corp., all of which have took a quick follow up researching public listings after being acquired by special purpose acquisition companies.

(Updates with chart; An earlier version of this story has been corrected to indicate stocks closed at a nearly three-month high)

For more articles like this please visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted source of business news.

© 2020 Bloomberg LP

[ad_2]

Source link