[ad_1]

Don’t read too much about stock market volatility on Friday, especially when it comes to tech giants.

This is Advice from Goldman Sachs Group Inc. Why? Because that’s probably just a short-term side effect of a record increase in options trading this month.

The open interest in at-the-money options, that is, those at or near the share price, which expired on the last trading day of the week, could cause a stir, the company said. bank in a report Friday. This is because in cases where there is large amounts of such activity, delta hedging – which refers to a type of option market price drift that sellers are trying to offset – can have an impact. on the trading of the underlying stock.

If traders hedging their delta positions are net long on at-the-money options, expiration-related flows could dampen stock price movements, causing the stock to stabilize near the strike price with great open interest like a pin). On the other hand, the hedging activity of those who are net short could exacerbate stock price movements.

“Market makers covering the delta of their unusually large option portfolios will be active. This flow is likely to dampen the volatility of some names while exacerbating stock price swings in others, ”wrote Goldman strategists led by Vishal Vivek.

Expiry-related activity could have more of an impact if open interest represents a significant percentage of the share’s volume, Vivek and his team said. They identified a list of stocks that could potentially have a large expiration flow, including Molson Coors Beverage Co. (TAP), Dexcom Inc. (DXCM), PVH Corp. (PVH), 3M Co. (MMM) and Hershey Co (HSY).

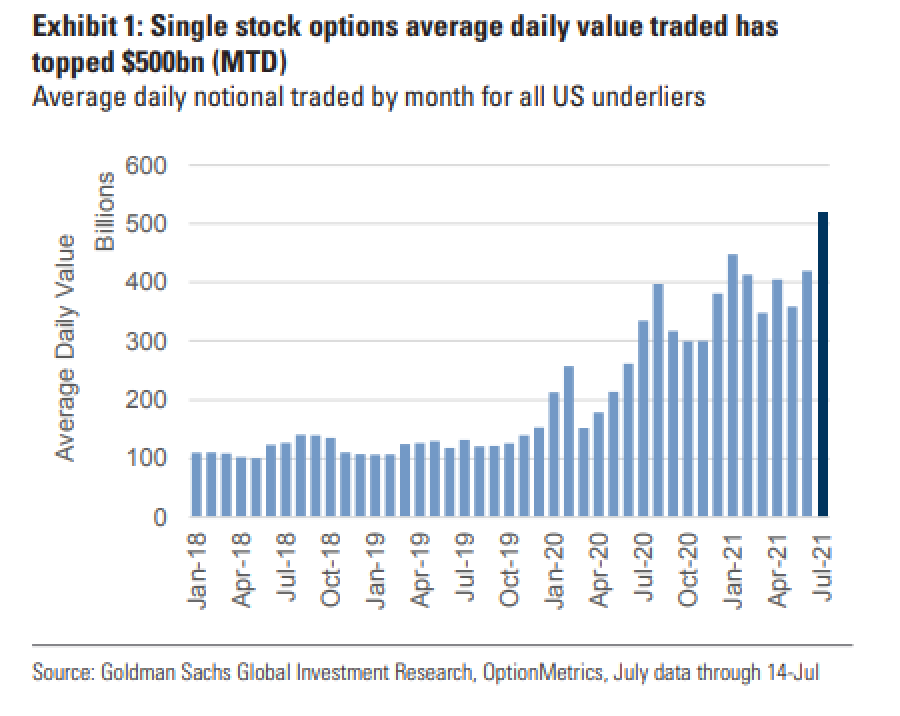

Overall, options trading activity increased in July, taking the average daily notional amount traded to a record high, according to Goldman. About $ 534 billion in options have changed hands on average every day this month, more than half of which are call options. That’s above last year’s average of around $ 367 billion. Strategists say investors are increasingly focusing on short-term options trading. Those with an expiration of less than two weeks account for three-quarters of all transactions.

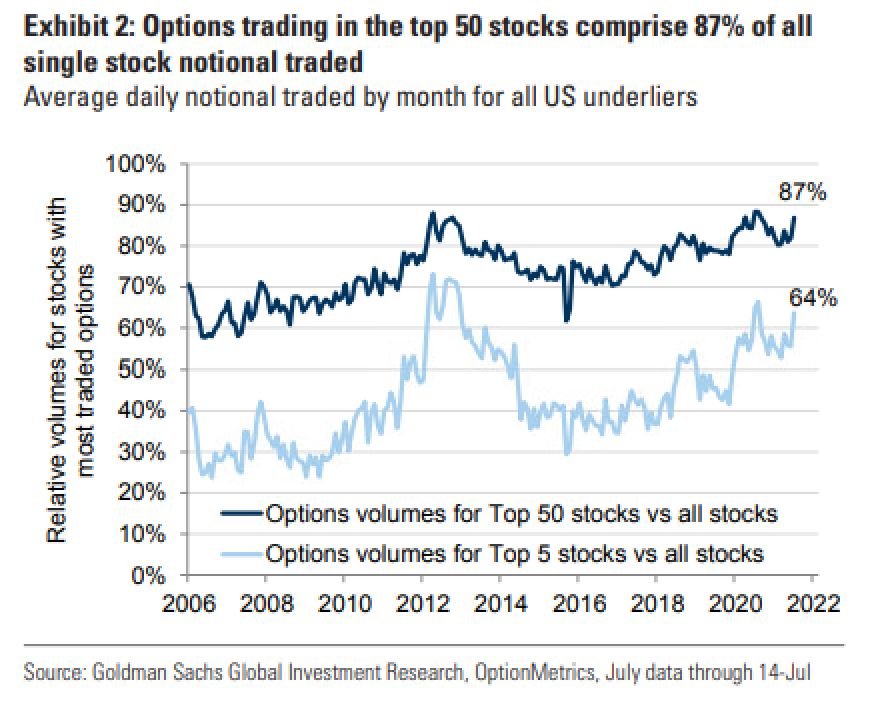

And much has been concentrated in a handful of stocks, with over 60% of the total traded in July attributable to just five names – Amazon.com Inc., Tesla Inc., Apple Inc., Nvidia Corp., and Alphabet Inc. Almost 90% of all trading this month has been in 50 stocks, Goldman said.

Meanwhile, the strategists of Susquehanna International Group also points out that call volumes in technology names have increased. Amazon.com’s bullish options saw a “noticeable increase” while Apple’s peaked in 2021 earlier this week, the company’s Christopher Jacobson wrote in a note Thursday.

The intensification of activity is helping to increase implied volatility even as stocks have rallied in recent weeks, Jacobson said. “Given the role these heavily weighted names have played in strength at the broader index level, we find the activity worth watching.”

– With the help of Katherine Greifeld

[ad_2]

Source link