[ad_1]

A choppy October so far points north for Thursday’s stocks. Less pressure on the debt ceiling and falling natural gas prices after Wednesday’s chaos and Russia’s offer to help Europe could help.

Some are not too worried.

But the list of what could hurt this market seems to grow longer by the day. Strategists at global investment research provider TS Lombard have narrowed the list down to a few really big things that require special attention from investors.

“The kind of market action we’re seeing these days – slower gains and more two-way action – should be the norm during this phase. But somehow it looks different. this time around, and we think there are three main reasons for that, “write chief strategy officer Andrea Cicione and economist Krzysztof Halladin. Their list:

-

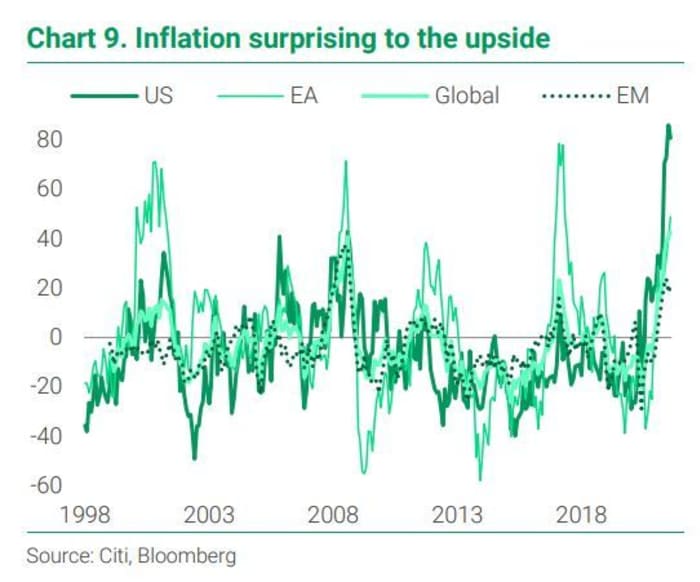

Stagflation risk – the chances of procyclical inflation becoming countercyclical increase and raise the specter of the ‘s’ word.

-

A bursting Chinese property bubble – Evergrande’s downfall may not be a Lehman moment, but China’s growth will take a hit.

-

Tightening monetary policy – By raising assets since March 2020, its absence will be a hindrance for both stocks and bonds.

Each of these, or more likely a combination, would tip their constructive equities equities toward a more careful equilibrium, say Cicione and Halladin.

The biggest risk for portfolios is stagflation (already here, according to Bank of America) because a countercyclical reversal in prices can trigger a devaluation of corporate earnings, which then weighs on equities. Bonds are also falling, as fixed income investors need more compensation and drive up yields. Thus, the diversification benefits of this classic 60/40 portfolio are lost because bonds add to risk rather than hedge it.

TS Lombard advises to watch for surging energy prices that could dampen the recovery, wage growth in the labor market, continued supply chain disruptions, company margins that are already near record highs ( measuring business forecasts rather than actual levels) and declining consumer confidence. Gold may offer some, but not complete, protection against stagflation, according to the research provider.

How to play it? A short cash position, such as the iShares 7-10 Year Treasury Bond IEF ETF,

or for equities, a long position in iShares Edge MSCI USA Quality Factor QUAL,

and short on SPDR S&P 500 ETF Trust SPY,

are some of Cicione’s suggestions.

As for the Evergrande crisis in China, the pair notes that almost every country that has gone through a credit bubble has experienced slower gross domestic product over the next five years. Strategists see this as very likely in China, given that so much wealth is tied to real estate and land is often used as collateral for a loan, and they say the fall in real estate and land prices are coming down. would spread, with global repercussions.

TS Lombard

Monitor real estate sales, new developer finance, real estate prices – paying close attention to Tier 3 cities – iron ore and industrial metal prices for national investment directions and pricing. shipping for the health of the export sector. Strategists note that China’s credit impulse tops the global 10-month purchasing manager indices. A suggestion to protect against a collapse in China – a long US dollar / Chinese yuan USDCNY,

position.

Finally, the fact that several global central banks are approaching the first rate hikes is not in itself a reason to lower stocks, they say.

TS Lombard

Aside from the usual suspects who keep central bankers awake at night, they advise keeping an eye out for signs of rising wage expectations. One way to play that – shift towards defensive stocks – quality and commodities, the team at TS Lombard explains.

The buzz

The debt ceiling standoff may be over for now, after Democratic senators declared themselves open to a Republican emergency extension offer until December.

US President Joe Biden and Chinese leader Xi Jinping are expected to meet virtually before the end of the year.

Levi LEVI,

the stock surged, after the denim giant beat profits and raised its outlook for the full year.

Rocket Lab shares RKLB,

are on the rise, after the aerospace and satellite service provider announced a deal with NASA.

Weekly jobless claims totaled a lower than expected figure of 326,000. The data comes a day ahead of closely watched September payroll figures which are expected to show a gain of around 500,000 jobs.

In the first blow to the most restrictive abortion law in the United States, a federal judge ordered Texas to suspend Bill 8 from the Senate.

Listen to the Best New Ideas in Money podcast.

The steps

YM00 American Equity Futures,

ES00,

NQ00,

are rising and the yield on the 10-year Treasury bill TMUBMUSD10Y,

is stable at 1.525%. Hong Kong’s Hang Seng HSI Index,

jumped 2.8%, with a rally for Chinese Estates 127,

– former major shareholder of China Evergrande 3333 in difficulty,

– after an offer to become private.

CL00 oil price,

BRN00,

fall, with NGX21 natural gas prices,

following Tuesday’s sharp drop caused by Russia.

Bitcoin’s BTCUSD,

hovers at just under $ 55,000 as a recent ramp-up continues.

Table

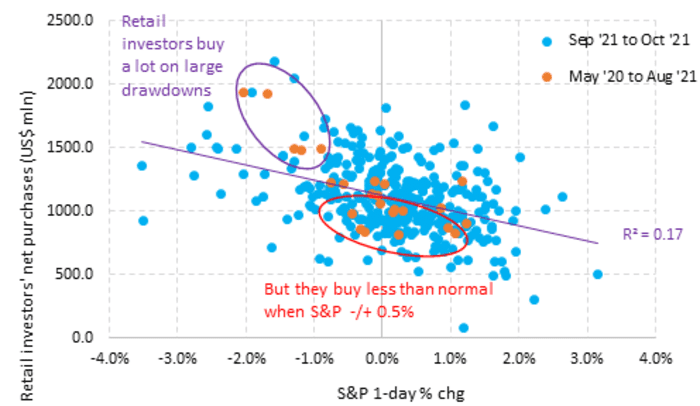

Buying the dip is alive and well – to a point, say senior strategist Ben Onatibia and analyst Giacomo Pierantoni at VandaTrack, a tracker of individual investor purchases.

Retail investors have continued to buy market declines this week, but continue to be price sensitive. “They buy large amounts when the S&P sells above 1%, but they buy very little when stocks are fluctuating between -1% and 1% (chart below). This is another way of saying that institutional selling meets little resistance from retail investors unless the sale reaches dramatic proportions, ”the team explains.

Vanda Research

Random readings

Meet Otis, the three-time champion of Alaska’s biggest bears.

Faced with a shortage of key workers, fast food restaurant chain Raising Cane has sent its corporate staff to the front lines.

Welcome back, Carnegie Hall.

Need to Know starts early and is updated until the opening bell, but sign up here to receive it once in your inbox. The emailed version will be sent at approximately 7:30 a.m. Eastern Time.

Want more for the day ahead? Sign up for Barron’s Daily, a morning investor briefing, featuring exclusive commentary from the editors at Barron’s and MarketWatch.

[ad_2]

Source link