[ad_1]

A little over a year ago, President Trump had signed a decree forbidding Broadcom chips giant (AVGO) to buy Qualcomm (QCOM) for national security reasons.

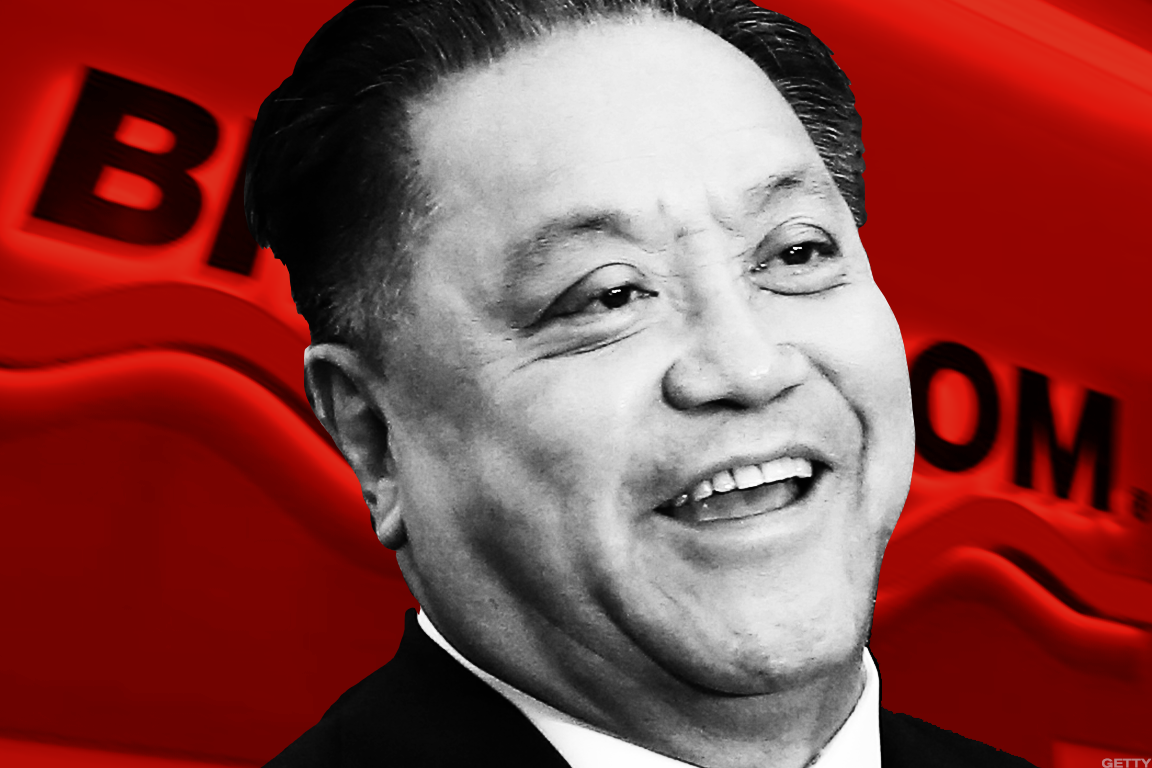

The CEO, Hock Tan, then turned the corner, buying $ 18 billion from an old software maker – CA -. For Tan's critics, the movement was laughable. Did Tan lose his reason or was he simply short of things to do?

Tan's fans, however, kept the faith by applauding "In Hock We Trust".

This confidence was rewarded Thursday evening, when the company told the street that its cost savings at CA were happening faster than expected and that the gross margin had soared more than six points to 55.4%.

Stocks rose nearly 11% today to reach $ 297.17 recently. The stock hit a new record of $ 299.55, while price targets have risen in many analyst shops.

Since Trump's turnaround, Broadcom has risen nearly 14%, surpassing the 2% rise in the S & P 500's price. And equities have risen nearly 22% since the day Tan announced the deal. IT.

Simplify costs, increase margins and pay to shareholders is profitable, it just happens that just like buyers. The skeptics were wrong – at least for the moment.

Estimates of free cash flow this year are rising, implying that the company is willing to increase its dividend later this year. It will probably also make more business software, now that it seems that Broadcom can actually sell software.

The March quarter was the first full quarter of the turnover of CA business since the conclusion of the transaction. The total business figure of this transaction, up 9% over the previous year, was $ 1 billion or more compared to the expectations of some analysts.

As Martin Baccardax, of TheStreet, reported that first quarter fiscal year earnings of $ 5.55 for the quarter ended March was well above the consensus for $ 5.22, although the company has slightly exceeded its revenue targets.

During the conference call, Tan told analysts that the company's wireless chip market will bottom out this quarter and that "the semiconductor industry will resume significant growth" in the second half of this year. year.

Even though Tan was referring to his own chip business, his remark is considered a reprieve for the entire semiconductor industry, and peer actions are gathering today, with Intel's actions, for example , up 1.7% to $ 54.31.

For many, however, the focus today is on the "cash machine" that Tan created with the purchase of CA. This is the term used by Anthony Stoss of Craig-Hallum Capital, who wrote today that he expected that "AVGO" will continue to reduce costs at CA. and optimizes the business generating a strong generation of FCF for the company as well as a probable dividend increase. "

According to Stoss, Broadcom's earnings will far exceed current expectations: enterprise-based products, including CA software, but also switched chips for storage networks, may actually behave better in the second half of the year. this year. And second, the company is likely to buy more shares than it has been, increasing the announced earnings.

Financial director Thomas Krause's remarks about sales of business products suggest that they could drastically decrease what appears to be a substantial amount later this year, which seemed difficult for many people to understand. Krause simply said, "Hey, up here, everything is fine." This seems to be an easy montage for a beat later in the year.

Stoss said that he "assumed that very few shares would be bought back during the AF19", but in reality, "that will probably end up being more than we expect, leading to an increase in BPA for the EX19 ". The company returned $ 4.6 billion to shareholders during the quarter, in the form of dividends and redemptions, out of a planned $ 12 billion budget for the year.

Broadcom trades only 12 times projected earnings per share for this year, compared to 21 times for Texas Instruments (TXN), but offers a better dividend yield of 4%, compared to only 2.9% for TI.

Stoss thinks Broadcom has a taste for software and will continue to buy more businesses. It provides for "similar agreements to those of CA given the limited regulatory barriers for US companies."

The only problem in this regard is that the company no longer provides quarterly financial forecasts, without any explanation. Broadcom also told analysts that, in the future, the results of its semiconductors would only be classified in a giant category and no longer give details of wireless chip sales over cable solutions, for example.

For this reason, Christopher Caso and Raymond James reiterate their market rating according to Market Perform, stating that it was not entirely comfortable to trust Tan's optimistic decision for the company. 39; year ", especially considering the reduction of information provided by the company, which makes the analysis more difficult."

For now, In Hock We Trust has become the currency of Broadcom investors.

[ad_2]

Source link