[ad_1]

CFOs at large multinational corporations are cautiously optimistic about strategic investments and hiring for 2021. Optimism about a coronavirus vaccine outweighs concerns about the current outbreak of Covid-19 cases in the United States. United States and Europe, according to the results of the CNBC Global CFO Council survey for the fourth quarter of 2020.

In the area of business spending, only 5% of U.S. CFOs said capital spending will decline over the next 12 months, while an equal (47%) of respondents said spending will increase or remain the same. CFOs based in North America reported the lowest level of expected spending declines, with CFOs in Europe (9%) and Asia-Pacific (15%) more likely to say investment will be reduced in 2021.

There will be more pain in the U.S. job market, with 32% of U.S. CFOs saying headcount will decline, but a higher percentage of domestic CFOs (42%) expect headcount to increase. next year, according to the survey.

“This tells me that 30% of CFOs don’t see a vaccine as a panacea for the United States,” said Diane Swonk, chief economist at the audit, tax and advisory firm Grant Thornton. “We should see an explosion of activity once people are free to come together again. We won’t see this explosion if they don’t and it depends heavily on a vaccine and treatments that reduce the consequences. of Covid. “

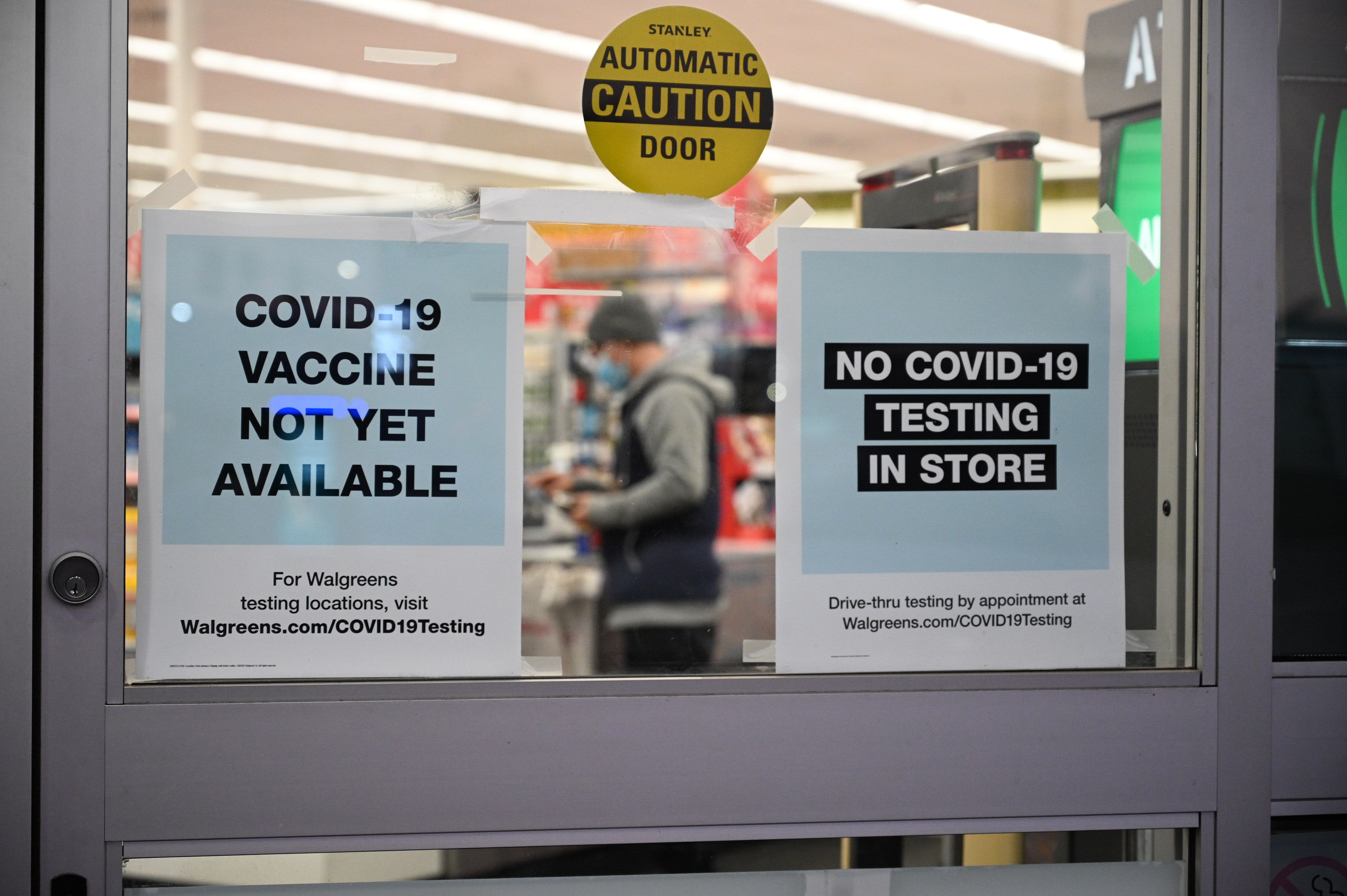

A significant percentage of corporate CFOs are building 2021 spending and hiring plans around vaccine optimism, but the current spike in cases in the US and Europe is hurting confidence.

Robyn Beck | AFP | Getty Images

U.S.-based CFOs reported the highest levels of hiring and firing compared to their counterparts around the world. In Europe, CFOs were twice as likely to say headcount would increase, at 36%, compared to 18% who expect staff cuts. Asia is the only region where CFOs say layoffs (46%) will be more common than job additions (31%).

Swonk said automating jobs outside of the pandemic was likely a factor in downsizing.

The CNBC Global CFO Council represents some of the largest public and private companies in the world, collectively managing more than $ 5 trillion in market value across a wide variety of industries. The Q4 survey was conducted from November 13 to November 13. 29 out of 43 of the Board members.

Covid-19 remains the biggest external risk factor cited by US-based CFOs (68%), but more US CFOs are planning for 2021 based on vaccine promise (58%) than around the current spike in cases (32%).

“Masks, testing and tracing work. Health policy and economic policy are complementary and not competitive,” Swonk said.

When asked what has the most impact on planning for 2021, more CFOs say they are optimistic about a Covid-19 vaccine than fears of an increase in cases in the fourth quarter, but directors Asian-based financiers are the most confident.

Q4 2020 CNBC Global CFO Council survey

In Asia, where the virus is more under control than in the United States and Europe, business planning around a vaccine promise is over 90%. The UK became the first country to approve the Pfizer-BioNTech vaccine on Wednesday, with a decision in the US expected sometime after an FDA meeting on December 10.

As China continues to overtake the United States in terms of economic growth outside of the pandemic – and a recent surge across the United States in Covid-19 cases has led to a deterioration in U.S. GDP for the first quarter 2021 – CNBC survey finds CFOs describe the US economy as “stable” after two quarters of “declining” conditions.

Election results influenced CFO’s vision through 2021, including in the area of corporate tax hikes promised by President-elect Joe Biden – CFOs don’t think a rate hike corporate tax at 28% is likely. Overall, the largest group of CFOs responding to the post-election survey (36%) have a neutral view of the impact of the Biden administration on their businesses over the next four years. CFOs expressing belief that Biden’s first term will be clearly positive or negative for their business were evenly distributed, at 32% for each response.

[ad_2]

Source link