[ad_1]

Alibaba shares (BABA – Get Report) are trading up 1.2% to $ 160 Monday at the trading session, while the company proposes a potential stock split.

Specifically, the management suggests a division of shares from eight to one. At current prices, the stock price would fall to around $ 20, although this would obviously not change the value of the current holdings of investors or the total market capitalization of the company.

Do not forget that when a company undergoes a stock split, it only changes the price of the stock and not the value of its holdings. For example, if an investor had 10 Alibaba shares traded at $ 160, the value of their position would be $ 1,600. After a split of eight to one, the same investor would own 80 shares at a price of $ 20, for a total value of $ 1,600.

It's an illusion, essentially, but in which management teams strive to make their stock more attractive. That's why we've already seen Apple (AAPL – Get the Report), Exxon Mobil (XOM – Get the Report) and split their shares. That's also why names such as Procter & Gamble (PG – Get Report) and Coca-Cola (KO – Get Report) are still trading at what many investors consider to be reasonable prices despite decades of success.

Conversely, rejecting the split is exactly the same as how we get Berkshire Hathaway A shares (BRK.A – Get Report) north of $ 300,000 per share.

The Alibaba split will be voted in about a month, July 15, no later than July 2020. The event will therefore have a lot of time, provided it is approved. The announcement comes before Alibaba's proposed secondary listing in Hong Kong.

Will this affect the trading of shares?

Apple is a stake in Jim Cramer Action Alerts PLUS club member. Do you want to be alerted before Jim Cramer buys or sells AAPL? Learn more now

Alibaba shares

The announcement of the stock split helps boost Alibaba's shares that day, but nothing says how long this increase will last. First, we do not know if the stock split will be approved. Even if this is the case, the titles of the trade war will probably be the engine of Alibaba, and Chinese stocks as a whole, more than the stock-specific news.

That said, if the news of the trade war goes down or at least improves, the stock will start trading again on its merits. If the split of shares is approved, it could create a positive catalyst for investors, even if it does not change the value of the company. In many cases, we see shares bid higher in the stock split date, although it is not clear if this will happen in Alibaba shares.

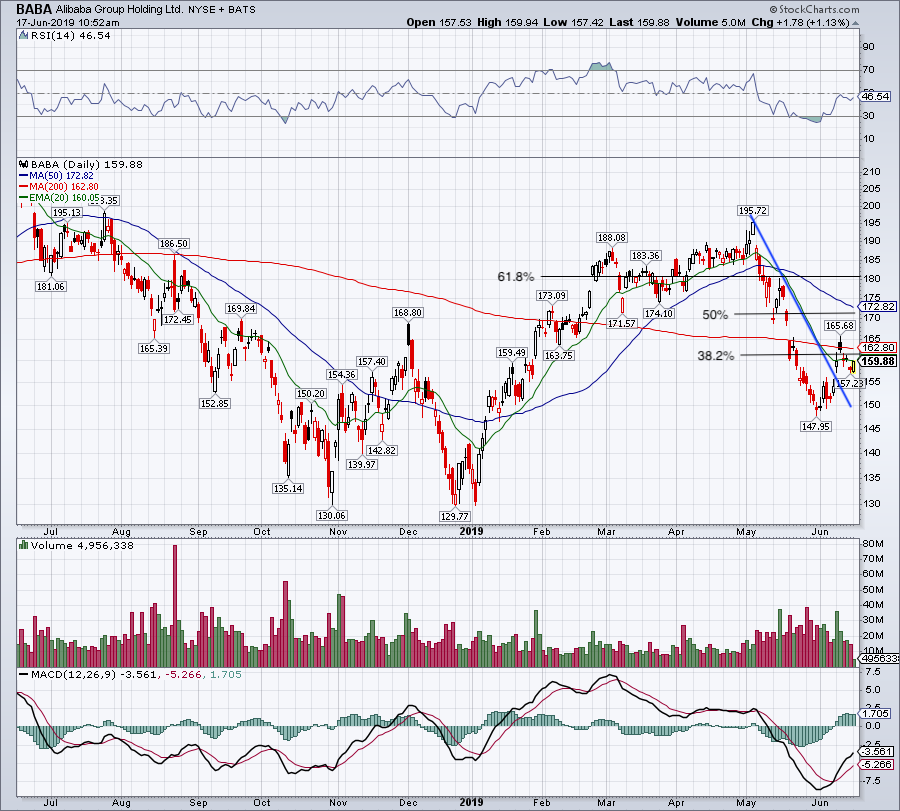

At this point, the bulls must see BABA's shares recover the 20-day moving average, for just over $ 160. Recovering the 200 days would also be a great benefit, at $ 162.80. Between the two is a great level, with the 38.2% close to $ 161. The next target is the range of $ 161 to $ 163 and the 50% retracement and 50-day moving average near $ 171 to $ 172.

If the $ 161 to $ 163 zone dominates Alibaba's stock and pushes it down, investors need to see how the stock trades at $ 150. This level supported Alibaba at the end of May. If that should hold, a rebound and a new resistance test of $ 161 to $ 163 are possible. The fact of not holding Alibaba stocks in the no man's land.

[ad_2]

Source link