[ad_1]

The president of the third largest IT services exporter in India, awaiting judicial settlement for nearly decades, said the productivity of tax revenues would be higher if the cost of tax administration could be used to increase the tax base.

Indian IT service companies have long been engaged in a long-standing fight against tax litigation regarding the tax incentives they have claimed through the Software Technology Parks of India (STPI) and the Special Economic Zone (STPI) ( SEZ). The top four companies – TCS, Infosys, Wipro, Cognizant – have close to Rs 13,300 crore ($ 2 billion) in tax litigation.

One of Wipro's tax litigation has been pending for more than 30 years (since the 1985-86 fiscal year) and the company has over Rs 1900 crore in tax litigation, according to its annual report .

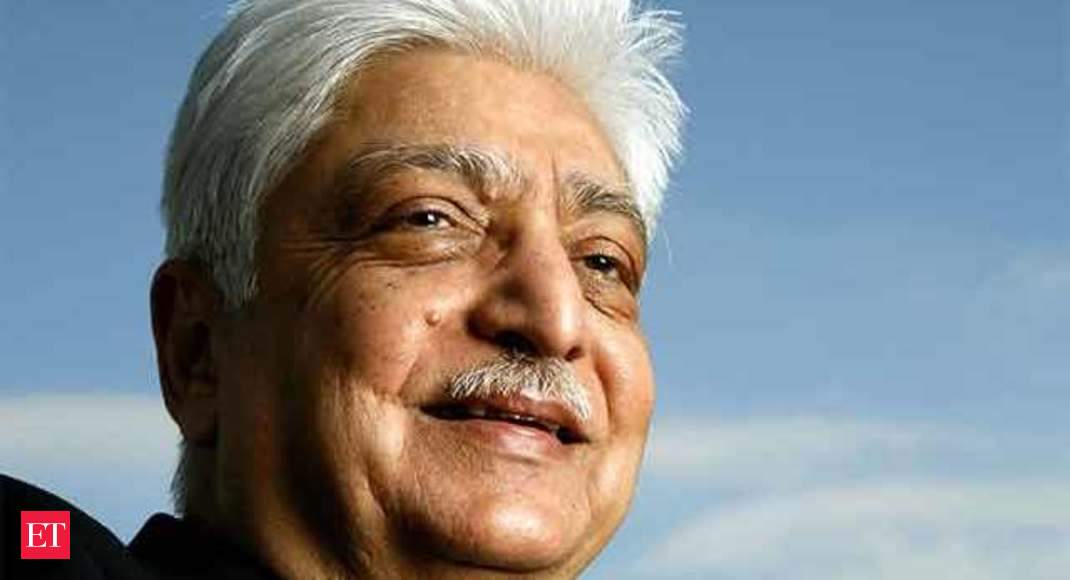

"It must be recognized that the cost of tax administration as a percentage of total tax collection is one of the lowest among OECD countries (Organization for Economic Co-operation and Development and this is laudable, however, the revenue productivity would be higher if this tax administration cost could be directed towards increasing the tax base rather than a repetitive and costly litigation, said Premji at the 158th Annual Income Tax Day in Bangalore.

He cited the enormous possibility of broadening the tax base by referring to the Economic Survey that the total hanging of tax cases in direct and indirect taxes is worth around Rs 7.6 lakh crore, which is close to 5% of GDP.

At the same time, Premji said the government should streamline the badessment process for larger litigation cases in order to reduce costs. "Eventually, the responsibility for revenue collection should be separated from

responsibility to carry out sustainable tax badessments. In some foreign countries, disputes are often settled at the valuation stage, which saves both parties a lot of time and money and gives taxpayers the guarantees they need. they are in dire need of tax matters. Departmental empowerment to resolve disputes amicably is very important, "he said.

[ad_2]

Source link