[ad_1]

The Department of Telecommunications (DoT) on Monday authorized the merger of Vodafone India and Idea Cellular with filing requirements of Rs 3,911 crore as spectrum rights and a bank guarantee of Rs 2,153 crore.

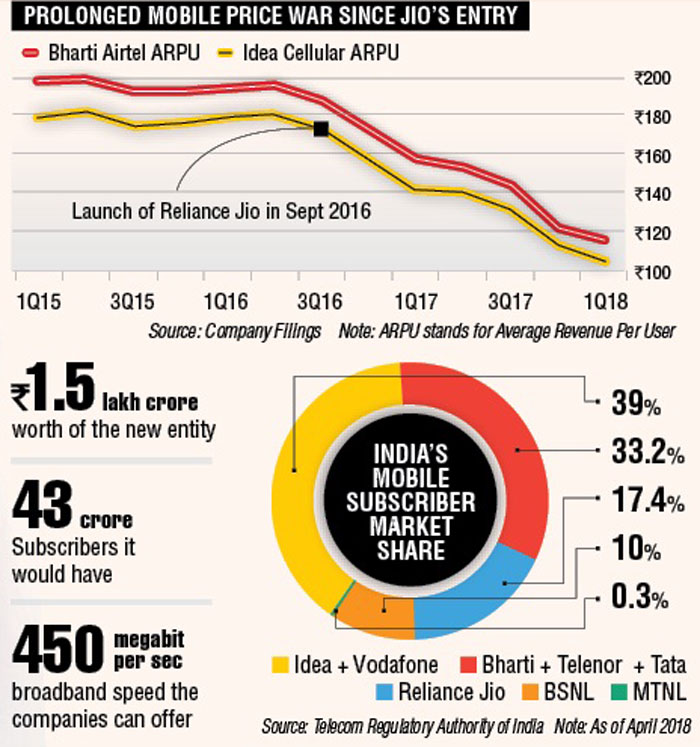

The merger of Vodafone India-Idea Cellular will create the largest mobile phone company outperforming Bharti Airtel and leaving the telecom market with three private players – Bharti Alrtel, Vodafone Idea, Reliance Jio and a BSNL / MTNL telecommunications PSU. The merger will mark the end of the wave of consolidation in the telecom market where many small players have had to leave due to intense competition.

The combined operations of Idea and Vodafone will create the country's largest telecommunications operator with more than $ 23 billion. The group announced Monday that the department had already decided not to take over the merger, subject to the payment of the contribution, said Monday a senior official of DoT

. the recent legal intervention of Airtel-Telenor as a reference to clear the current Vodafone-Idea Cellular.

DNA Money reported on June 26 that the department could raise a claim of Rs 6,500-6,800 crore from both telecom firms.

DoT had previously sought legal advice to raise claims. However, companies can ask the court to defer the filing of spectrum rights, as the issue of single spectrum has already been challenged by telecom players, sources said. . Airtel also recently received a stay from the court for paying broadcasting rights for Telenor India, a subsidiary of Telenor in Norway.

Vodafone will own 45.1% of the combined entity, while Aditya Birla Group led by Kumar Mangalam Birla 26% and Idea shareholders 28.9%. Vodafone Idea will hold 1,850 MHz of spectrum, of which 1,645 MHz of liberalized spectrum acquired by auction

The Aditya Birla Group has the right to acquire up to 9.5% of Vodafone's additional participation in the framework for an agreed mechanism to equalize holdings over time If Vodafone and the Aditya Birla Group's interests in the combined company are no longer equal after four years, Vodafone will sell shares of the company merged to equalize its participation with the Aditya Birla Group over the next five years. Until Equalization is completed, the voting rights of the additional shares held by Vodafone will be limited and the votes will be exercised jointly under the terms of the Shareholders' Agreement.

Birla is proposed to be the non-executive chairman of the merged entity and Balesh Sharma new CEO. Idea's chief financial officer, Akshaya Moondra, will lead the financial operations of the new entity as chief financial officer. Ambrish Jain, currently vice president of Idea Cellular, is expected to become the new chief operating officer.

The last approval must come from the DoT, while the rest is already in place. DoT recently approved the increase of the limit of IDE in Idea Cellular to 100%, against 67.5% of DoT currently.

Vodafone and Idea Cellular had announced a merger last year, following the entry of a new player Reliance Jio, which triggered a report. Analysts at HSBC Global Research said last month that the combined entity Vodafone-Idea could save $ 900 million in operational expenses over the next two fiscal years, but Bharti Airtel and Reliance Jio will take more than a year to bridge the 4G network gap . "Vodafone-Idea's 4G network is expected to continue to follow Reliance Jio and Bharti Airtel, given the 4G spending gap, its investment in 4G in the fourth quarter of fiscal year18, and Business should remain high for a while.The full integration of the network (Vodafone and Idea after the merger) could reduce this gap, but it could last 12 to 15 months. [19659002] About $ 600 million is expected to be saved as a farm during this fiscal year, while $ 300 million will be saved in March 2020. Capital expenditures and integration costs for the four to next five quarters could be covered by recent injections According to HSBC, during the consolidation phase, Airtel acquired Telenor India and announced the acquisition of Tata Group's wireless business, Reliance Jio has agreed to the following: ; ache wireless badets of Reliance Communications and Aircel filed for bankruptcy

. report, the combined 4G spectrum of both companies is capable of offering up to 450 megabits per second of broadband speed on mobile phones in 12 Indian markets.

The management structure has already been announced by companies. The new entity is called to call Vodafone Idea. The combined debt of the two companies is estimated at Rs 1.15 lakh crore.

Source link