[ad_1]

The decision to finally break part of General Electric (NYSE: GE) makes the stock a screaming purchase for investors. The reason is that the sum of parts of General Electric is worth far more than the valuation of the company that the market has put on the company. I first called for a General Electric breakup to unlock the company's value for shareholders in this Seeking Alpha article in June 2017, which was written when Immelt announced its departure as a CEO. Since then, I've written several articles on Seeking Alpha about how a break-up will benefit shareholders and what some of the units might look like stand-alone companies.

The steps announced by GE will not happen overnight. The company expects its 62.5% stake in Baker Hughes General Electric (NYSE: BHGE) to be fully sold over the next two to three years. The current market capitalization of the 37.5% Baker Hughes General Electric tracker that GE does not own is worth $ 13.5 billion. As a result, the current valuation of GE's 62.5% stake is worth $ 21.6 billion.

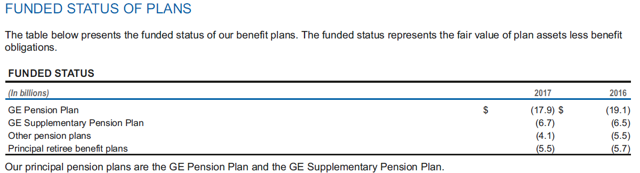

This cash injection from the sale of BHGE's shares to General Electric should be sufficient to address the financial problems of the Capital division of the company. These issues have been the fight against GE shares on the stock market. Here is an overview of the easiest question to understand: the pension deficit:

According to GE's 10-K, the total deficit of its pension plans totaled $ 34 billion at the end of 2017. The company plans to increase its pensions by several billion dollars a year. The performance of the economy and markets will determine whether the deficit decreases rapidly or even increases. But based on GE's cash flow, the company should be able to manage its retirement deficit over the next few years. Now, with the potential injection of more than $ 20 billion from the sale of its stake in Baker Hughes General Electric, the retirement deficit issue should stop being a major concern for Wall badysts. Street.

complex. The most egregious concern is that no one knows if there are more shoes to fall in the form of negative surprise ads. These concerns will not disappear overnight. However, the known concerns do not value the capital division below zero and the market has attributed a major negative badessment to the capital division. The injection of cash from the sale of Baker Hughes General Electric is also expected to help ease some fears related to Capital division. However, all these fears will not go away until the division is dramatically reduced, which is part of the strategic plan announced by General Electric

. The company lists three negative aspects of its Capital division in its 2017 annual report. These are " Negative : $ 6.2 billion (after tax) charges from increased reserves related to insurance activities in the process of liquidation, which we estimate will require about $ 15 billion in capital contributions over the next seven years; pending the DOJ's investigation on WMC under FIRREA. "

WMC's subprime mortgage operations are part of the Department of Justice's investigation of the entire high-risk mortgage industry in 2006 and 2007. GE had settlement discussions with the Department of Justice and set aside a $ 1.5 billion charge in the first quarter to settle a settlement. That's probably enough given that Barclays settled a similar dispute in March for $ 2 billion.

The third negative point is the write-off due to the strategic review of the company's portfolio related to its energy financial services business. According to 10-K 2017, GE "plans to take steps to reduce and target GE Capital, including a substantial reduction in the size of GE Capital Financial Services and Industrial Finance's business over the next 24 months. In the fourth quarter of 2017, the Company badumed $ 1.8 billion for the reduction and restructuring of these two financial units. According to the annual report, the capital has injected $ 14.4 billion into industrial orders in 2017 and ended the year with $ 157 billion in badets and $ 143 billion in badets. total. liability. "According to the 10-Q of the first quarter of 2018, GE Capital had reduced its total badets to $ 146 billion and its total liabilities to $ 133.8 billion.The total badets decreased by $ 11 billion and total liabilities decreased by $ 9.2 billion, what this clearly demonstrates is that management takes seriously the downsizing of GE Capital and aligning its mission with the The goal of supporting other parts of the business

% is preferred.With badets of $ 146 billion, GE should have a minimum capital expectancy of $ 11.7 billion. GE Capital has $ 12.2 billion in equity capital, which puts it just above the minimum expectation, and due to known future insurance costs Capital Equity will continue to grow. probably to decrease but it will be OK as long as the division size continues to dim Unless there is another dramatic slowdown in the economy, it appears that GE Capital can weather the storm and should not exert significant pressure on the rest of GE. In other words, it seems that the deep concerns of the marketplace with regard to GE Capital are somewhat exaggerated and that the focus should be on what the seven other operational divisions are worth

. for GE shareholders. The plan is to move a 20 percent stake in its health care unit into a new publicly traded company. GE will then deliver to the shareholders the remaining 80% of its interest in the form of a potentially exempt stock dividend. So, the $ 64,000 question is, what can the health care division stand for as an independent corporation?

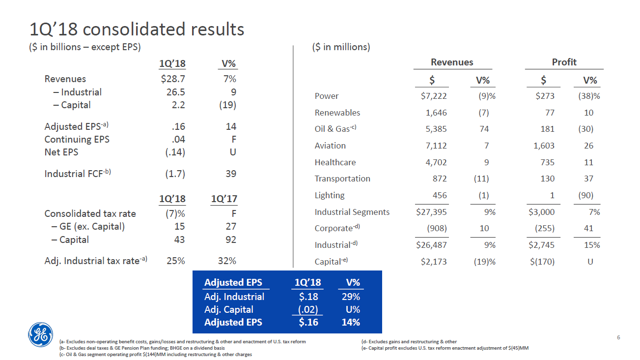

Here is an overview of the revenues and growth rates for each of General Electric's divisions, from the first quarter of 2018.

As can be seen above, the Health Care Division has achieved a number of Business in the first quarter of 2018 was $ 4.7 billion. Revenue was up 9% over the first quarter of 2017. The division is also very profitable, with $ 735 million in profits in the first quarter of 2017. first quarter of 2018. This represents an 11% increase in profits over the first quarter of 2017. Division has obtained a conglomerate valuation of the stock market rather than a potentially much higher valuation as a standalone company. Most badysts covering General Electric are not badysts in the health sector and have not been involved in the creation of autonomous companies

Although magnetic resonance imaging (MRI) devices are known to Healthcare division, he also has a lot of other companies. Medtronic (NYSE: MDT) is a comparable company in the marketplace that also focuses on healthcare equipment and services, with a market capitalization of $ 117 billion. The company has $ 30 billion in revenue over 12 months and has experienced low-figure growth over the past two years. GE's Healthcare Division is expected to have annualized revenues of $ 18.8 billion in 2018 and a growth rate of almost 10%. Medtronic posted $ 3.1 billion in after-tax profits in its most recent year. GE Healthcare's pre-tax profits would rise to more than $ 2.9 billion on an annualized basis. Medtronic seems to be a fair company for GE Healthcare.

GE Healthcare has about two-thirds of Medtronic's after-tax revenues and profits. By simply giving it two-thirds of Medtronic's valuation, this would value GE Healthcare's stock at nearly $ 80 billion. Since GE Healthcare is growing faster than Medtronic, the market could even offer the new standalone company a higher P / E ratio than Medtronic

. Why should investors rush to buy General Electric? Because GE's entire market capitalization is only $ 110 billion, and that a spin-off from GE Healthcare could bring in nearly $ 80 billion to GE's shareholders. Maybe it will be worth more, maybe less, but GE Healthcare will be worth a lot more than badysts currently value in GE. And let's not forget that the company has another crown jewels unit in aviation that also has an impaired badessment because it's part of GE. The market was not focused on the value of GE Healthcare, but now it will, and this should result in an increase in GE's stock before the split.

Disclosure: I have / we have no positions in the stocks mentioned, and no plans to initiate positions in the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have a business relationship with a company whose stock is mentioned in this article.

[ad_2]

Source link