[ad_1]

The third bilateral political meeting of the Reserve Bank of India (RBI) coincides with the meeting of the US Federal Reserve. Global markets expect the Fed to keep rates unchanged, but will lead to two additional rate hikes in the course of the year 2018, as US growth does not weaken and signs of strength emerge on the front lines. ;inflation. Will the RBI adopt a similar waiting system with a hawkish tone or will it charge the action with a 25 basis point increase on August 1st?

At the last RBI policy meeting, members of the Monetary Policy Committee (MPC) worries about inflation and rates rose while growth looks optimistic. Since then, the dynamics of inflation has not overtly improved, but development on the macro front shows conflicting perspectives on future inflation.

If the movement of the yield on the ten-year government reference security (G Sec) is an indicator to pbad, he suggests a status quo on the rate for the moment.

Source: Reuters

However, there are enough additional pressure points that have accumulated since the last policy of June

Inflation – a negative surprise of the last policy [19659008] During the previous political deliberation in June 18, RBI had raised its inflation forecast to 4.8-4.9% in the first half of fiscal year 19 and to 4.7% in the second half .

Emerging data points surprised by the rise in the Consumer Price Index (CPI) to 5% June 18 from 4.87 percent in May 18, exceeding the range indicated by the RBI . What deserves to be noted is the evolution of underlying inflation (a measure that excludes transient or temporary volatility in food and energy prices) which has grown month after month to reach 6 , 5% in June. Incidentally, it is the uncomfortably high level of underlying inflation that was one of the key drivers of RBI's fare action at the last meeting.

Source: MOSPI, Moneycontrol Research

Several Other Pressure Points

Pre-election year largesse that could have a negative impact on the l & # 39; Inflation as well as the public deficit are a valid concern as well. As stated in the EU budget, the government recently announced a rise in minimum support prices (MSP) for a wide variety of crops. The government has adopted the crop pricing approach at least 150 percent above the cost of production. As a result, MSPs have been raised between 3.7 and 52.5% and could have a significant impact on CPI inflation by 50 to 60 basis points if properly implemented.

the drop in the populist GST rate, the likely launch of the national health insurance system, inadequate disinvestment goals, capitalization of PSU banks and the list goes on.

The other area of concern has been the weakness of emerging markets peers in recent times. Although the free fall seems to have been halted, the Indian currency has lost nearly 2.6% since the last policy.

On the other hand, the progress of the monsoon has been satisfactory, which could have a sobering effect on inflation. The recent decline in the GST rate on consumer goods should also be supported. Finally, the basic effect of support (from July 18) could moderate inflation in the future.

The Global Factor – Joker in the Platoon

However, the big change of the last policy is in the world arena. The increased noise of a trade war has cast a shadow over the growth prospects of major economies, including China, and the same has had an impact on commodity prices that have been corrected in recent times.

a bearish zone, crude oil prices fell following the increase in production after the last meeting of OPEC.

Source: Reuters

Amid the noise of the trade war and the dissatisfaction of US President Trump on rate hikes, the US Fed could leave rates unchanged at its August 1 meeting. So, RBI could also wait and watch with a hawkish stance similar to the US Fed.

Has growth made a decisive return?

Finally, while RBI seems optimistic and optimistic for growth prospects, the reality of the ground continues to give mixed signals. So far, the quarterly earnings season has had a good start but we can not read too much of it since the base has had an impact on the implementation of the GST

Source: MOSPI

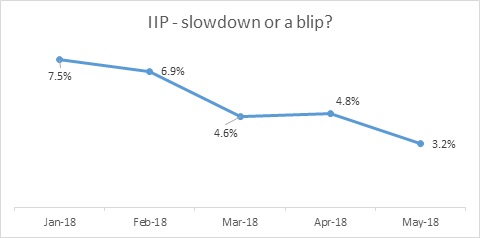

Data from the Industrial Production Index (IIP), which have been widely followed in recent times, show a lack of momentum, but the base could be criticized again, the PII being unstable and the data Meanwhile, credit growth continues to be double-digit, outpacing the growth rate of deposits and bankers indicate that it is becoming more and more difficult to collect deposits without offering a better rate. Thus, the direction of rates is clearly rising, whether the action is tomorrow or two months later is a close call.

[ad_2]

Source link