[ad_1]

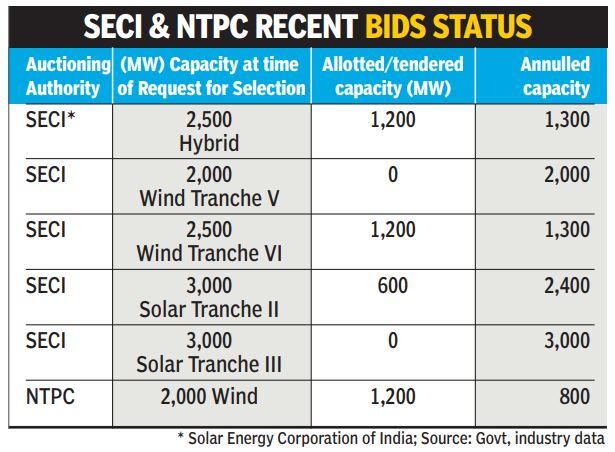

This is the second auction of a renewable energy project to have failed in a month, as the political paradox prevented investors from taking the total capacity canceled until the next day. this day at more than 10.8 GW (gigabyte). This could be a blow to the Center's goal of installing a renewable energy capacity of 175 GW (gigawatt) by 2022.

The tender for hybrid projects, which consists of housing wind and solar energy units on the same site, has been extended until November 14th. Investors were sidelined despite halving the supply of 2,500 MW.

In the absence of bidders, last month, the SECI had been obliged to renew for the fifth time until November 12 a call for tenders for the implementation of projects. 39, solar energy of 10 GW, providing for the establishment of a solar generation capacity of 3 GW per year closing date.

The reduction of the size of the offer and the extensions have become the order of the day. Industry organizations believe that this has created uncertainty among domestic players and is creating distrust of foreign investors. The allegations of cartelization on the part of bidders complained of by the department also did not help to dispel the feelings.

Developers say that capping tariffs in competitive bids makes investments unsustainable. They say that competition, wind density and solar irradiance should determine the rates. SECI had set the tariff ceiling for hybrid projects at 2.60 rupees per unit. The developers say that it does not work for them and point to the price of 2.76 rupees discovered in a recent SECI offer for wind energy projects. They say that this tariff was discovered because the developers were forced to bid with Category B or substandard lands because there was no land available in Category A "Wind Density". The same goes for hybrid projects, the tariff ceiling is not viable.

With regard to solar offerings, the lack of interest from developers is largely attributed to the recent government-imposed safeguard right and the subsequent decision to allow developers to pbad on the impact. on consumers, while fixing a tariff ceiling.

In May, SECI submitted a 5 GW offering of manufacturing capabilities to be rolled out across the country. The manufacturing capacity was to be connected to solar projects connected to ISTS for a total capacity of 10 GW. Subsequently, SECI reduced the capacity of the manufacturing tender from 5 GW to 3 GW. The minimum capacity of developers able to bid for manufacturing has also been reduced from 1 GW to 600 MW (megawatts).

In the case of the call for tenders for the establishment of solar energy projects of 10 GW (Giga Watt) related to a solar generation capacity of 3 GW per year, SECI had set a tariff ceiling of Rs 2.75 per unit, which removed investors.

The developers say that the bidding has forced them to enter the manufacturing sector, which is not their main skill. Companies can bid for a minimum 2000 MW PPA, after which a 600 MW solar generation capacity must be put in place. The government's commitment over the last two years is another drag on the deal, but developers believe it takes at least five years to match the efficiency of Chinese manufacturers and the subsidies they receive.

India depends on China for 85% of the solar equipment used in the country and developers are struggling to compete with Chinese solar panels without the support of the government. The maximum allowable rate also has a deterrent effect for projects that also involve the establishment of manufacturing capacity.

Source link