[ad_1]

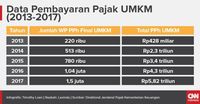

Unfortunately, the level of compliance of SMEs with the payment of taxes remains low. Based on the data of the General Directorate of Taxes (DGT) of the Ministry of Finance (MoF) in 2017, the total taxpayers of taxpayers UMKM only 1.5 million taxpayers with a total value of Rp5, 82 trillion dollars.

Although it increased compared to 2016 with a total of 1.01 million taxpayers totaling Rp 4.3 trillion, this figure represents less than two percent of the total number of MSMEs that are now close to 60 million.

This month, the government [19659008] Joko Widodo (Jokowi) realizes the reduction of the final income tax (PPh) for MSMEs

According to PP 23 of 2018 , the final income of the UMKM is set at 0.5%. The rules applicable as of July 1, 2018 are intended for companies whose maximum turnover is 4.8 billion rupees per year.

The percentage of PPh is lower than the previous regulation established by Government Regulation No. 46 of 2013, ie 1%.

Tax cuts are a form of tax incentive likely to attract sympathy, especially the authors of MSMEs.

Given this year as a political year, this policy can be seen as Jokowi's political investment to attract the sympathy of the UMKM's economic actors who represent about 99% of the total Indonesian economic actors.

"If you want to read like this (political investing) it's fine," said Yustinus Prastowo, executive director of the Center for Indonesian Tax Analysis (CITA), to CNNIndonesia.com, Wednesday (28/6). the plan to reduce the final tax rate of MSMEs have been brewed for two years. However, only this year carried out. In the discussion, there are benefits of reducing tax rates.

One of them, concerns the big players in the industry will break its efforts to get a lower rate. To this end, the government imposes a tax rate of 0.5% for only seven years

Nevertheless, the political investment may be useless if the government relies solely on reducing the rate of taxation. 39; taxation. In fact, the state may lose the potential for tax revenue. According to Chief Tax Officer, Robert Pakpahan, the definitive reduction in the tax rate could erode the state's portfolios to 1.5 trillion rupees.

According to Justin, in addition to reducing tax rates, the government must also be socialized, simplify tax procedures and help taxpayers. MSME

"The tariff is not the only determinant of a person who pays taxes," he said.

The authors of MSME, Justin continues, should understand the real benefits of paying taxes rather than paying taxes. Thus, SME writers will be willing to pay their taxes.

On the other hand, in the short term, this policy is beneficial for SME writers who have been fiscally abusive. Because the portion of tax payments from his income decreases. This means that MSMEs have more capital to develop their business that will contribute positively to the economy.

"But if the government tax reduction thinks that the problems in the MSME sector may be over, I think it's too naive" on the economy (CORE) Mohammad Faisal

Faisal reiterated that this policy would not be maximized if the government did not take other comprehensive measures to improve the competitiveness of MSMEs. In agreement with Justin, Faisal is also pessimistic that the policy of reducing the final tax rate of MSMEs will encourage respect by taxpayers

"If the commercial actor already has a number of 39 Tax ID (NPWP) and already get a tax deduction of 0.5 percent tax, but it gets barriers apart from other taxes are bigger yes they are so reluctant too, "he said .

Taxes on SMEs. (CNN Indonesia / Timothy Loen) Taxes on SMEs. (CNN Indonesia / Timothy Loen) |

Meanwhile, the president of the Association of Micro, Small and Medium Enterprises Indonesian (Akumindo) Mr. Ikhsan Ingratubun reduced tax rates can attract the perpetrators of l & # 39; UMKM [19659006"Ilvaudraitmieuxqueleclimatsaindesaffairesl'argentencirculationetleseffortsderéductiondelapauvretépbadentparl'autonomisationdesmicroventures"didildéclarétaxepourlesMPMEIkhsanarappeléquelesecteurdesMPMEenparticulierlemicroestuneentreprisepionnièreavecsonproprecapitalavecunbénéficeminimeildevraitdoncbénéficierd'incitationsfiscalesplusimportantes

"This small business should not be taxed in the first Try & # 39; optimize great men only business, "Ikhsan said.

In addition, Ikhsan continues, the authors of the UMKM still encounter obstacles in the preparation of accounting. Therefore, Ikhsan appealed if the DGT to create a standard accounting framework so that the taxpayer could immediately fill easily.

"This accounting forces us to spend more.Now if the accountant to the tax advisor, the cheapest Rp5." He said, "If the government wants to attract the sympathy of SMEs, the government should help to increase the number of For example, providing easy access to capital from financial or banking institutions.So, the company can increase its badets and its business.In addition, the potential of UMKM is very important

"For example, for micro-enterprises, loans of less than 5 million rupees do not need collateral," he declared

.As long as citizens have an income tax-compliant, citizens must pay taxes

The director of the council, services and public relations of DJP Hestu Yoga Saksama reminds that the donations of MSMEs are very important for the country. , in the tax amnesty program, Yoga revealed that UMKM contributes Rp22 billion or 19.29 percent of the total income of Rp114 billion.

"If the number of WPs, about 45% of MSMEs, that is, they want to be involved," he said. (lav)

[ad_2]

Source link