[ad_1]

Instagram only launched ads in Stories about two years ago, but it could generate more than $ 2 billion in revenue Facebook (NASDAQ: FB) this year, according to an estimate of the analyst Nomura Mark Kelley. Kelley sees the format – that Instagram has flown shamelessly to Break (NYSE: SNAP) – Generate $ 7.5 billion advertising revenue for Facebook by 2021, up from $ 750 million last year.

Analysts expect Snap 's revenue to reach about $ 1.5 billion in 2019, up 30% from last year. Snap's goal for 2019 is to re-accelerate revenue growth after a terrible year 2018, but its outlook for the first quarter calls for a continued decline in the growth rate of revenue. .

The growth of Instagram Stories has already proven to be a major hurdle for Snap. This was compounded by a series of missteps last year. Will growth in Stories advertising be a similar barrier to Snap's future growth?

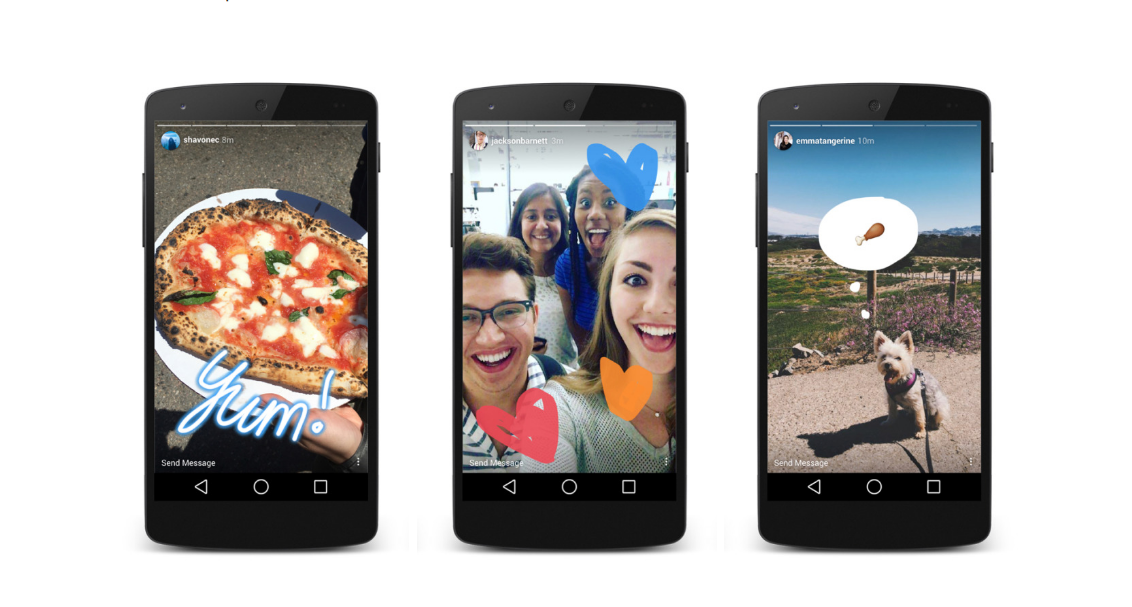

Image source: Instagram

Where does the Stories advertising budget come from?

Facebook has not hidden that a growing percentage of sharing on its platforms is via Stories. Chief Executive Officer Mark Zuckerberg said at the beginning of last year: "Stories are poised to overtake publications in feeds because they are the most common way users share with all social applications. "

In addition to this change, Facebook's chief financial officer, Dave Wehner, recently reported that news and Instagram feeds were saturated with ads. There is simply more room to increase the number of ads that viewers see in these areas without degrading the user experience to the point of reducing their commitment. As a result, the price of Instagram feed ads should increase dramatically, as we saw when Facebook reported having reached the saturation of loading ads in the news feed.

It is therefore logical that Kelley has found that Facebook advertisers with whom he spoke are transferring more of their advertising budget from lead ads to Stories ads, where average prices are lower. The use of the nascent ad format could allow savvy marketers to take advantage of some market inefficiencies and obtain a better return on investment.

This does not mean that Stories steals advertising dollars from the feeds. Kelley notes that "budgets continue to grow at the enterprise level". Indeed, digital advertising in general takes its share of older formats such as television. Analysts expect Facebook's total revenue to grow 23.5 percent this year.

But the transfer of advertising dollars from Facebook's food products to its Stories products indicates that advertisers are looking to spend their money for other products when the price of food ads increases. This does not necessarily mean Instagram Stories. These are advertising dollars that Snap could have earned if Facebook had not been turned to Stories.

Why marketers choose Facebook over Snapchat

Although the advertising products created by Snap and Facebook for their respective Stories products are very similar, Facebook has several advantages over Snap for marketers.

First, marketers already know about Facebook's ad buying platform. More than 7 million companies are advertising on Facebook's family of platforms. There is no need to learn a new system or dedicate a team to the purchase of ads on a separate platform. This reduces the overall costs of marketers, allowing them to pay more for Instagram Stories ad placements compared to Snap Ads.

Facebook also has a lot more data on its users, which can lead to better targeting of ads for small businesses. The combination of its user data, its large number of users and millions of active advertisers ensures that Facebook can deliver more relevant ads than any other social media user. And more relevant ads produce better results for advertisers.

Snap will struggle to overcome these benefits, especially as network effects create a virtuous cycle for Facebook. That's why Kelley expects advertising spend on Instagram Stories will grow much faster than advertising spend on Snapchat.

While marketers are shifting advertising budgets from other domains to digital, they still have limited amounts to spend. And much of this money will go to Instagram Stories and other Facebook Stories products in the foreseeable future.

[ad_2]

Source link