[ad_1]

It was in the middle of 2015.

"I can catch that falling knife," I thought.

As the fundamentals and geopolitics of the oil market are constantly changing, the news cycle never ends.

"I can say that the bear market for crude oil is at its lowest," I said.

The news can give traders a false idea of what will happen.

I recommended buying crude oil.

Crude oil had dropped about 46% from its peak when I made that bet.

I thought that my economic logic and my research would translate into good business.

This is not the case.

Prices fell again by 46% until the trough of February 2016.

My trust misled me. I've streamlined my path in a losing bet.

This experience has reminded me of the right way to look at the crude oil market.

I am grateful for the losses. They teach me important lessons about trading and about myself.

I only enter a position when I believe that my odds of winning are higher than losing. Otherwise, there is no reason to place the trade.

If the odds swing against me in an open trade, I do not rationalize.

I cut the loss and move on.

I did not do it in 2015. But this loss is your gain.

Traders must ignore OPEC forecasts

OPEC has lowered its outlook on world demand for crude oil.

Again.

OPEC is the agreement that historically determined oil prices by controlling a large proportion of total oil production.

Its members are trying to prevent a collapse in crude oil prices.

OPEC member countries are considered oil states because their economies are so dependent on the energy sector.

It is therefore not good for OPEC to continue to lower its estimates of global oil demand.

Petro-States do not want the growth of demand to fall, as this can lead to falling prices.

When crude prices fall, producers in these oil-producing countries can not claim as much for their crude oil.

In February, OPEC reduced its global demand forecast for 2019 by 50,000 barrels a day.

In itself, it does not matter.

But its forecast for 2019 is now 14.4%, or 2.1 million barrels a day, which is lower than the initial estimate made in July 2018.

It's a bigger problem.

But we should ignore it.

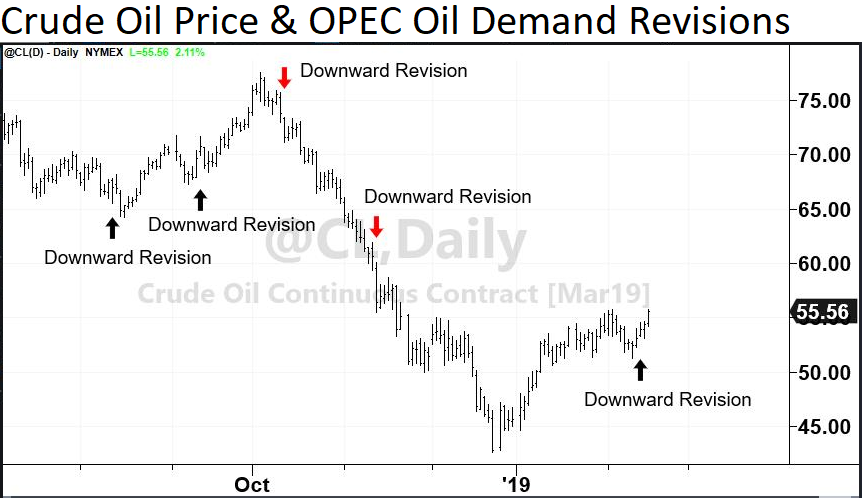

Take a look at what the price of crude oil did when OPEC released its demand revisions in August, September, October, and November of last year:

The price rebounded after revisions to the demand in August and September.

And the price fell after revisions to demand in October and November.

In other words, there is no correlation between OPEC's revised forecasts and price developments.

As far as I know, crude oil traders should not worry about what OPEC is saying about demand.

But they should worry about how investors feel about the economy.

The S & P 500 Index suggests it's time to buy the dip

The price of crude oil was strongly correlated with the S & P 500 index during the revision of demand by OPEC last year.

When the stock market rose, the price of oil also rose. When the stock market dropped, the price of oil also dropped.

Last week, when OPEC lowered its demand forecast, the price action was not different.

Inventories have increased. Oil has increased.

I expect this trend to continue throughout the first half of the year, although the price of oil may fall as the stock market consolidates its recent gains.

It will probably happen soon. But I do not foresee that it lasts more than two weeks.

The renewed risk appetite for equities and the seasonal vigor of future crude oil prices will drive oil up until April.

This is not the time to worry about forecasts of OPEC demand.

This is an old news.

It is now time to buy the dip.

We have recommended several large exchange traded crude oil funds in the pages of Investor daily winner.

If you followed, you could have made money at this year's rally.

Anthony Planas recommended to the readers of this publication, December 28, "to consider adding the SPDR S & P ETF for Oil and Gas Exploration and Production (NYSE: XOP) to your wallet. This ETF has grown 17.3% since then.

I guess there is more where it comes from.

Anthony also wrote on January 25 that "we are optimistic at the moment in the oil services sector." VanEck Vectors Oil Services ETF (NYSE: OIH) is a great speculative way to play this idea.

And on January 30, I alerted the readers of the Select SPDR ETF (NYSE: XLE). It's a mean expose your portfolio to the shares of the major oil producers.

Each of these ETFs tracks the shares of oil and energy companies.

They evolve closely with the price of crude oil.

And they could even outperform crude oil in the coming months.

Good investment,

John Ross

Senior Analyst, Banyan Hill Publishing

[ad_2]

Source link