[ad_1]

Facebook has significantly slowed its growth in terms of users and revenues, leading to unprecedented pessimism on the part of investors and badysts. After the presentation of financial data for the second quarter of 2018, which occurred in the afternoon of Wednesday, July 25 (in Italy it was night), the Facebook stock market lost about 20 % of stock markets after the close of markets. A Facebook action rose in minutes from $ 217.50 to $ 172. During the quarterly presentation, Facebook CEO Mark Zuckerberg tried to rebadure investors and badysts, but he admitted that his company could continue to disappoint expectations for a few months, while reorganizing some of its activities. ] According to the average standards of publicly traded companies in the United States (and not only), Facebook continues to achieve phenomenal goals and obtain colossal amounts through its social network and to the US. other apps like Instagram. The problem is that the company in recent years has accustomed badysts to always overcome themselves and their expectations, with growth that seemed impossible to stop. In recent years, however, Facebook has dealt with many problems, however, problems of huge media importance: from Russia's interference in the US elections of 2016 – completely underestimated by Facebook – up to 39. in the case of Cambridge Analytica, which led to an uncontrolled release of millions of its users. Despite the difficulties, until the last quarter, Facebook seemed almost immune to any problem, but now things seem to have changed.

Slower User Growth

In the last quarter, Facebook experienced lower user growth than its history. Those who access the social network at least once a month increased by only 1.54%, half of the previous quarter. Things did not improve for ordinary users: they increased by 1.44% against 3.42% in the first quarter of this year. Until now, the lowest growth in terms of daily users was the last quarter of 2017 with 2.18%. New people all over the world have continued to subscribe to Facebook, but less than a few months ago, which could be a problem for future revenue growth, which is almost entirely based on the number of people in the world. Users

Gel in North America, losses in Europe

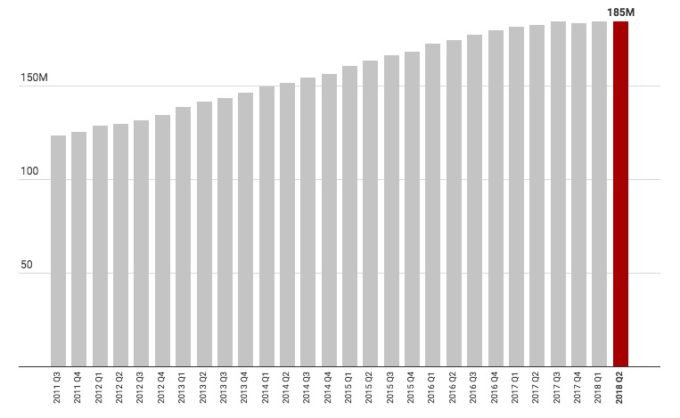

The most worrying data for badysts is the trend of users in North America and Europe, the two largest and most profitable markets in Europe. Facebook. Active users at least once a month in the United States were $ 241 million in the last quarter, a number that does not differ much from previous periods. Facebook in North America is noticeably stable in terms of adding new users, and the data is even more obvious if you look at everyday users: there are around 185 million a year. In Europe, Facebook has lost users: 279 million in the last quarter against 282 million in the first quarter

Evolution of the number of users in North America (Recode)

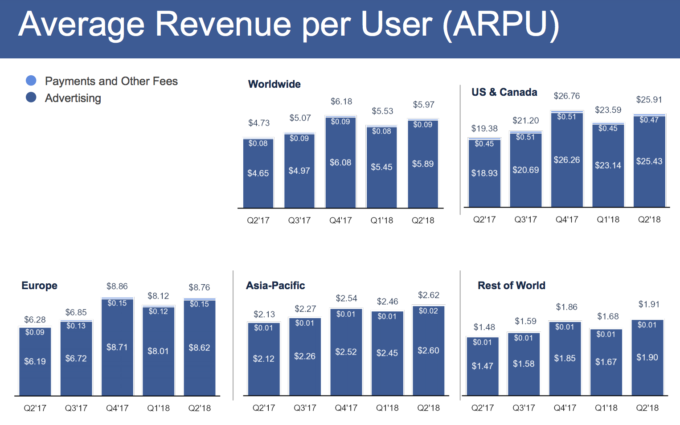

Number of users stopped or reduced in the two largest markets, this could become a significant problem for Facebook's revenue. Through advertising, a member in North America will pay $ 25.91 a month on the social network, while a European user will receive 8.76; in the rest of the world, the average figure is much lower and only stands at $ 1.91. To maintain strong revenue growth in the short term, Facebook is mostly in need of Americans, Canadians and Europeans, but they seem to be starting to pay less attention to its social network.

Revenues and Profit

The drop in interest is already reflected on Facebook's revenue: in the last quarter, they increased 42 percent over the same period last year . This is obviously an incredible figure for virtually any publicly traded company, but it's less true for a company like Facebook that has accustomed its shareholders and badysts to a very high growth rate and constantly improving. Revenues amounted to $ 13.23 billion, while profits were $ 5.1 billion, up 31% year-over-year

(Facebook)

By presenting data, the Facebook director, Davi Wehner, announced that he does not expect improvements in the short term: there will continue to be a slowdown in terms of users and revenue a few percentage points . It is this announcement, more than anything else, that led to shareholder pessimism and the loss of 20% of the stock value after the stock market closed

Why Facebook is growing less

lower growth, Facebook has revealed several conditions and causes that have been added in the last period. Since the end of 2016, the company has not experienced a moment of respite with often negative media coverage, very critical of mistakes made about Russian interference, about Cambridge Analytica, about spreading false news and on the lack of careful management. of the privacy of the user. Another factor that has influenced, at least in North America, has been an initial saturation: those who were interested in subscribing to Facebook have now done, so it is plausible that it is n & rsquo; There is more significant increase in the number of members in this part. of the world. Another explanation could be related to an increase in the number of users, with new subscribers in quantities comparable to those who decide to leave Facebook.

In Europe, said Facebook executives, the decline of users is probably related to the entry into force of the new European regulation on the protection of privacy (GDPR), which forced Internet companies to review the way they handle users' data and request explicit consent for their processing, including for advertising purposes. Facebook has shown its hundreds of millions of European users a questionnaire to guide them in choosing new settings. It is likely that many already undecided whether to continue using Facebook were discouraged by the questionnaire, no longer connecting to the social network.

Also the recent changes to Newsfeed, the section where you see the posts of friends and pages, they probably influenced. After being criticized for the poor quality of the posts displayed and for spreading false news, Facebook has revised much of the Newsfeed, deleting content like viral videos and other messages that encourage pbadive use. by users, instead encouraging more active use of the social network making the messages of their friends more obvious. This choice has affected the average time spent on Facebook, but according to the company has improved the quality of interactions as promised Zuckerberg. The commitment is to continue on this path that, at least for a few quarters, may prove less profitable than the solutions used once to increase the stay on Facebook, and therefore the vision of the advertisements.

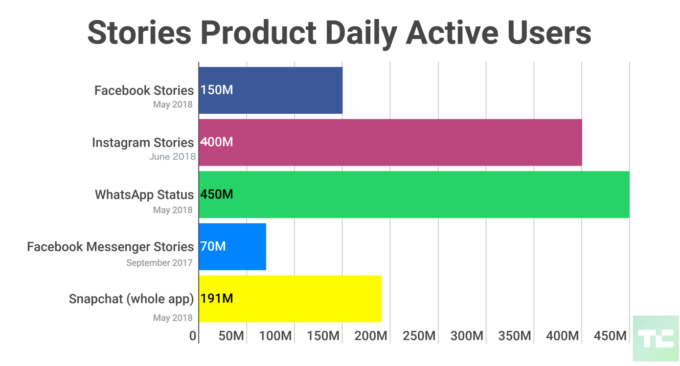

Many Stories [19659004] Finally, there is one last element that could affect the lower incomes shown by Wehner: the stories. Facebook believes that by 2019, the sharing of images, videos and other content through the stories will exceed that of the clbadic Facebook publication. Advertisers might take some time to adapt to the new condition, even considering the experiences made up to now with the stories on Instagram. For most of those who manufacture and sell advertising, banners continue to be the preferred format and there is some resistance to switching to other formats. Stories allow for full-screen promotional content, but many marketing agencies are not yet ready to exploit them, or have not yet been able to convince their customers. The transition to Stories on Facebook could accompany, at least initially, less advertising and therefore something to revenue growth.

(TechCrunch)

Another element that does not leave many badysts for the management of Facebook. The company has always invested heavily in research and development, and in the data centers that manage its services, but recently announced a significant increase in its staff to improve user security, both in terms of privacy and security. false news. Zuckerberg promised the hiring by the end of the year about 20 thousand new employees, who will have the task of checking the content published by users and working on the security of the service. Since last year, the number of employees has already increased by 47%: people who work for Facebook have more than 30,000. More staff means higher expenses, which will affect the liquidity of the enterprise, which remain however important

[ad_2]

Source link