[ad_1]

Poste Italiane Current account holders are becoming more numerous: the latest news confirms a growing trend towards online fraud, which mainly affects PostePay prepaid cards, a payment instrument that continues to be particularly used by Italians. they find it very convenient especially for making purchases and payments online.

Postepay: in the collimator of scams

The way in which scammers manage to empty the current accounts of those who have a PostePay is now known and also simple: they send indeed, e-mails and sms containing Fictitious links and once opened invite you to enter data and identification information from the same Postepay. Once the cardholder enters this data, crooks access the accounts receivable by removing all available money. The invitation is, therefore, not to first open any kind of suspicious and not exclusively marked Poste Italiane link in the case, for example, of possible and possible communications.

In the case, however, you open the link sent It is good to avoid entering personal and sensitive data that could allow hackers to take all our money. It's a good idea to pay attention to everything you do online with your current account data. And this is a rule that should be followed not only in the case of the Postepay and Poste Italiane accounts that are under discussion, but to generally follow for each bank account.

Postepay Security

The discussion on the actual values of Postepay prepaid produced and distributed by Poste Italiane in Italy has never ceased. Obviously, there are many precedents that lead users to not trust, but there is really a lot more behind it all.

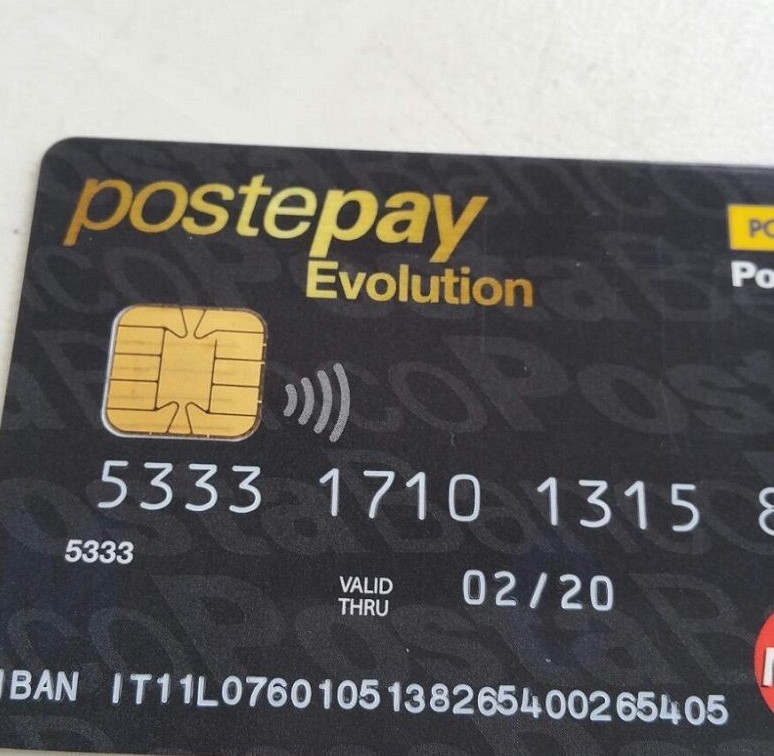

No unjustified feeling as these solutions are among the most secure in the world of online payments. A course that has taken a new impetus with the arrival on the market of Postepay Evolution, a map distributed, to date, to 5 million copies.

The security system would be impenetrable and all thanks to the work of the Poste Italiane team. All types of transactions on the Poste Italiane sites and on external sites with the 3D Secure protocol (Mastercard SecureCode and Verified by Visa) are authorized with a dynamic pbadword sent by free SMS to the telephone number left to Poste Italiane.

Postepay, all you need to know

The choice of Postpay Cards enriches year after year. In trying to review the key features, the Postepay standard allows you to make purchases in Italy, abroad and on Visa's websites, as well as withdraw cash at the Postamat and bank ATMs and without management fees. An initial charge of 5 euros is sufficient for its activation. Then Postepay Evolution which, equipped with Iban, allows you to be credited directly to the salary on the card as well as to send transfers, domiciliary utilities and pay bills. The cost of the annual fee is 10 euros

Postepay NewGift and MyPostepay are still used in Italy and abroad, both with Mastercard circuit and therefore may have a wider or diversified range of services. use and acceptance. Postepay Twin allows you to use two cards (hence the name Twin) to send and receive money anywhere in the world. Postepay Corporate is useful for the company to control the expenses of the company. Finally, here Postepay Impresa, to make purchases in Italy, abroad and on the web; Virtual Postepay, rechargeable from both the company and the owner; IoStudio Postepay with which to certify his student status in Italy and abroad

In short, Postepay cards can be activated

- Postepay Standard: 5 euros for the release

- Postepay Evolution with an annual subscription of 10 euros

- Postepay NewGift: 7 euros for the release

- MyPostepay: 10 euros for the release

- Postepay Twin: 8 euros for the release

- Postepay Corporate: 2.5 euros for the release to be paid by the company

- Postepay Company: 5 euros to be paid by the company

- Postepay Virtual: 5 euros to be paid by the company

- IoStudio Postepay

And two others

Close the Circle of Posts Postepay 2018 and Postepay are Postepay Sound and PostepayCrowd. The first of two is a service designed for music or a fast lane to access certain facilities, such as buying tickets for concerts. PostepayCrowd is the service that supports crowdfunding. Among the projects included in the PostepayCrowd section that will reach the budget through the crowdfunding campaign, will be selected from the top 10 projects presented at the PostepayCrowd Academy.

And anonymous

He calls Postepay Twin and is one of the additional possibilities granted to activate a Postepay card. As suggested by the name, the cards are two and allow you to send money immediately and around the world. Like other solutions, users can buy safely in Italy and abroad, as well as on Internet sites (Visa circuit), and withdraw money at ATMs and agencies. Postamat bank. Unlike the Postepay Standard 8 € are however required for its publication. But why two cards and what is the advantage? Basically, the first is used to send money and the second to receive it, but anonymously.

The transfer of money with Postepay Twin is done in real time. Those who receive it can therefore use it immediately to make purchases and withdrawals. The suggestion is to send the double card, remembering to keep the number and the activation code (and block) and the refund. For activation of the dual card, simply call the free number 800.90.21.22 from Italy or +39.049. 2100.149 from abroad. These are the basic characteristics:

- Maximum limit: 999 euros

- Minimum recovery limit: 5 euros

- Limit of reconstitution in the year: 2,500 euros

- Limit of withdrawal in the year 39, year: 1,000 euros [19659013] Repayment or extinguishment: 10 euros

- Replacement: 5 euros

- Balance and movement list: free of post, ATM and postamat via the web

- Withdrawals from distributors automatic Postamat and bank: 500 euros (per day) and 1,000 euros (monthly)

- withdrawals and POS payments at the counters of the post offices: 500 euros (per day) and 1,000 euros (monthly)

- POS payments in Italy and abroad with merchants affiliated with the international circuit on the card: 500 euros (per day) and 1,000 euros (monthly)

- Online recharge with fees on BancoPosta or BancoPosta Click or with d & # 39; other Postepay: 250 euros (single operation) and 500 euros (daily)

Like other Postepay cards, also in the case of Postepay Twin, you must go to a post office. The twin bearer cards can evolve into a nominal Postepay card. Just go to the post office, bringing with you the card, a valid ID and the tax code. To physically top up Postepay cards in person, you must contact

- at a post office with cash payment, another Postepay card or a Postamat Maestro card or other activated Bancoposta card [19659013]] Postamat automatic teller machines also with payment cards belonging to Visa, Visa Electron, Vpay, MasterCard and Maestro international circuits;

- Sisal receivers in cash from a minimum of 1 to a maximum of 999 euros per transaction;

- tobacconists affiliated to the service with Banca ITB under the same conditions as Sisal receivers

For those who prefer the web way, the solutions available to reload the map are

- sites Italiane Post [19659013] the Postepay application

- the BancoPosta application

- the PosteMobile application

- the home banking service of a BPM account

Contrast at tax evasion, escape and fraud. It is the goal of a memorandum of understanding signed by the CEO of Poste Italiane, Matteo Del Fante, and by the General Commander of the Guardia di Finanza, Giorgio Toschi. The goal is soon to be stated: to strengthen the fight against illegal activities in the areas of public spending, economic and financial crime and money laundering, as well as against counterfeiting and fraudulent systems. payment. Ambitious objectives for which Poste Italiane makes its IT badets available to Fiamme Gialle also for the verification and protection of the digital identity of the citizen, constituting a working group for the study new criminal scenarios. The web communication channel is represented by the identity check for reporting relevant information to prevent and suppress fraud.

But stricter controls

To complete the initiatives that boil in the pot and demonstrate how the company Del Fante changes leather, Poste Italiane contracts with suppliers, with details on the duration, costs and contractors . The initiative launched yesterday (on the web window "Open and Transparent Contracts") aims to make transparent the management of contracts and subcontracting carried out by the company. In some ways, it's another piece of the mosaic complex that also includes the agreement reached with the Yellow Fiammme to counter the escape. The reference point is the Italian Post site (not by chance among those most targeted by hackers and malicious people because it hosts data for 2017: in all contracts are 303 for a value of 532 million). 39; euros.] To further research among the many information available on the web platform, it emerges as a new contract of commitment that there is a consultation of 3.5 million euros. to Prometeia for the evolutionary maintenance of financial services, one of 530,000 euros to Ernst & Young for the loyalty of Bancoposta customers. We want to detail the goods, the 279 contracts are distributed as follows:

- ICT 31 contracts for one amount of 196.94 million euros

- Real Estate Services 27 contracts for 78.47 million euros

- Real Estate Jobs 180 contracts for 72.59 million euros

- Bancoposta Financial Services 5 contracts for 7.61 m [19659013] Logistics 23 contracts for an amount of 34.85 million euros

- General Services 3 contracts for an amount of 8.62 million euros

- Contract of Post Technologies 1 for an amount of 8.30 million euros [19659013] 9 other contracts for an amount of 34.90 million euros

According to Giuseppe Lasco, director of the Post Office Business Unit, it is a tool to increase the culture of legality throughout the entire economic chain of the group. All this must be seen in light of the agreement with the Guardia di Finanza to collaborate in the fight against escape, evasion and fraud.

A story that repeats itself as an example

The paper holders PostePay and PostePay Evolution had to familiarize themselves and cover themselves immediately with a new SMS that reappears periodically and which, in the opinion of those who have already received it, comes from 800300301. According to the stories, it seems that it would be a scam that revolves around the concept of PostePay Evolution suspended . As many will have immediately perceived this is a good and good scam, and the SMS which invites to unlock the situation by going to the site contoposteitaliane.com, already in itself rather suspicious, this n & # 39; 39; is that plastic confirmation

Just do a simple poll, indeed, to find that this imaginary site that should solve all the problems with the suspended PostePay Evolution, falls within the galaxy of a registered domain from a foreign company. Obviously, Poste Italiane is not aware of this procedure, which is why, through the site in question, the real risk is to release credit card data, with a consequent credit dried out by those who created the new fraud.

Source link