[ad_1]

One thing is certain, among the many hypotheses, which follow one another on the automobile tax, always in the center of attention. It will be more difficult not to pay, the escape will be hit hard and, unless unforeseen, it is a rule that will come into effect. The others are a few hypotheses, however, as long as they seem more and more likely.

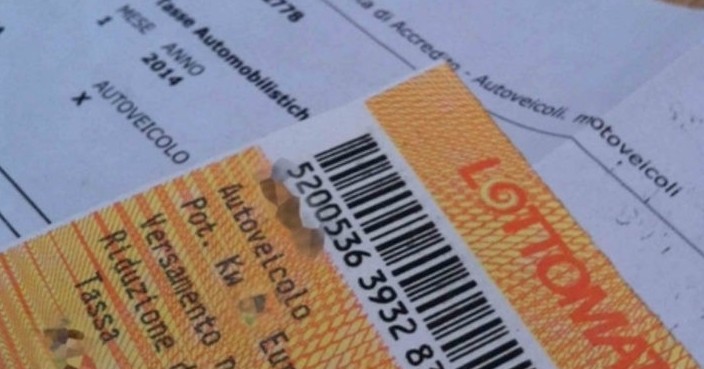

Among the many expenses that a motorist must endure to be in good standing with his vehicle and therefore able to move safely he is most hated in general. Precisely because it is considered an unfair tax by the vast majority of people, the escape from the tax on cars is almost an act. Obviously, it is a bad attitude that also exposes the risk of heavy fines until the administrative stoppage of your car in case the payments are not in order. And now on the subject are provided news that certainly will not please you considering what has just been said. That is to say that there is a strict tightening of controls that should totally exclude the possibility of evading this tax

A hardening of the motor tax

The rigor of the car tax will certainly have repercussions on a tax that well represents the emblem vexation tax for almost all motorists, still needs to be paid. Indeed, from January 1st of next year, it will become much more difficult to avoid the amendment presented to Parliament. That, by linking the payment of the stamp to the possibility of a regular check, it will be very difficult, if not impossible, to find shortcuts.

The amendment in question was introduced by a member of the Democratic Party and is included in the decree. this will make some budget corrections. The workshop to carry out the revision, from 2019, can not proceed before the demonstration of the payment of the tax on the vehicles. If the stamp has not been paid, the revision can not be carried out, and there is a serious risk of incurring heavy penalties that may even go as far as stopping. of the vehicle. Moreover, in case of accident without revision, the insurance company could refuse compensation or, better, claim the owner of the unconditional vehicle.

What could still change …

The next will be the year of the reform of the car tax? Maybe, because two forces are active on the change. On the one hand, there is the government that intends to reduce emissions by raising taxes for the most polluting vehicles. On the other hand, there is also Europe, which aims to standardize the rules for all countries. The combined action of the two leaders could therefore result in a revised possession-related tax. Regardless of its use, motorists are indeed required to pay what the region needs. And in the case of large displacement vehicles, the addition of the super-stamp received by the state is triggered.

This government will not hold hands on the front of cars and news of the sector. Starting from the secular question of the tax on cars and its reform, otherwise its cancellation. The issue also ended on the table of Europe, given the desire of the community executive to standardize the rules.

The impression is that an acceleration can be achieved on the change of which is actually a tax on the possession of the vehicle in the sign of respect for the environment. In essence, the tax on cars could be tied more and even better to the pollution of the product. Unsurprisingly, we also think about the increase of excise duties only on diesel, to finance fiscal measures, but still thinking about the discouraging use of diesel vehicles, a another hot topic, that of insurance. , with the executive who could push the introduction of rewards for those who do not commit offenses

More: in the government contract between the League and the 5-star Movement, we read as national infrastructure plan for charging motorized vehicles electricity must become a dynamic tool capable of intercepting and rapidly resolving problems related to possible infrastructural deficiencies, both at national and local level, in order to actively contribute to the development of electric mobility

This is just another key point – with the revision of the vehicle tax and insurance reform – related to the need for self-reliance. shares in the face of the increasing quotas of electric cars in the fleet.At the agenda also incentives for the purchase of low-emission cars or hybrid and electric cars and the scrapping with textual of cars dated and fueled by gasoline or diesel and the stop to increase VAT (also essential for the possible purchase of a new car) with the sterilization of the safeguard clauses.

If the automobile tax in Italy is calculated on the basis of the power of the vehicle – the higher it is, the higher the amount to be paid – the amount of the euro will be linked to the kilometers traveled during the year . The will of the Transport Committee of the European Parliament is to link the car with a little less to the possession and a little more to its concrete use. And this same concept would apply to all countries, including Italy. However, given the recent promotions and investments in the sector, in addition to the kilometers traveled, the other parameter that will affect the formation of the sum to be paid will be the level of environmental pollution produced by the car.

an electronic device capable of detecting the distance traveled, similar for example to the black box, now used for insurance purposes, so as to detect the information useful for the purpose of calculation. If the intentions are clear, the uncertainty is rather related to timing, considering that a package of changes of this magnitude is unlikely to see the light at a tight juncture or already the next year. Easier to believe that the European car tax can come in a few years. The intention of the Transport Committee of the European Parliament is to introduce it in 2023, with a first experimentation on heavy goods vehicles and those weighing more than 2.4 tons

In the following three years it would be possible to implement the entire car park. European regulation in progress, if the measure proposed by the Transport Committee of the European Parliament was to get the green light from the European Council and the approval of the 27 Member States of the European Union, we must wait until 2026 for the 39, definitive introduction.

Source link