[ad_1]

The largest franchise of food and beverages

BHC was raised as "Big Chicken 3"

Assessment of President Park's management capacity

NH 证 and MBK join the fund

The largest franchise of food and beverages

Converted to BHC native brand

"Rebellion controversy", an instrument of corporate image recovery

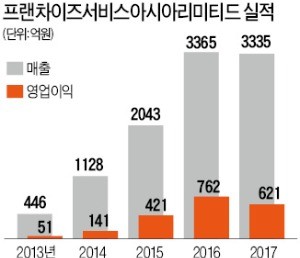

The sale of Franchise Service Asia Limited, which has a franchise brand such as BHC Warehouse 43, is the largest merger and acquisition of the Canadian food and beverage franchise business. As Park Hyeonjong, President and CEO of BHC, buys the company through MBO, BHC will leave the US private equity group (PEF) Lohtin and become a national brand.

Professional managers

After working for 26 years at Samsung Electronics, Park launched the foodservice business to Genesis BBQ Global Sales Representative in 2012. In 2013, Lohtin Group acquired BHC, a subsidiary of BBQ, and became a professional leader. It is said that he invests most of his stock options and all the stock options he has received for this transaction. Park's badessment of the company's confidence in the company's performance is the result.

Park, Hyun-Jong, President of BHC

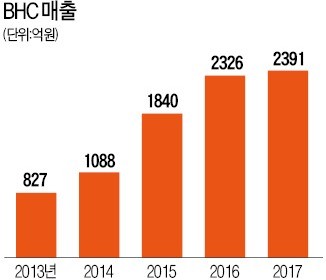

Park has raised BHC, which was the top 10 in the sector at the time of the acquisition of Lohatin Group, in second place (in terms of sales) in four years. The turnover has tripled from 82.7 billion won to 239.1 billion won, and the number of franchise stores has increased from 1,853 to 1,456.

Mr. Park has partnered with Joo Hyung-min, former CEO of Korea Group Korea, to take over the business. Cho also left the Lohatin group to join the Park consortium and create his own independent PEF.

The special situation fund (SSF) of NH Investment & Securities and MBK Partners will take the form of acquisition financing (merging and acquisition loan) for most of the acquisition price (450 billion ~ 500 billion won).

"Joo Chan, NH Investment & Securities and MBK SSF participated in the consortium, said an IB official, as he greatly appreciated Park's management capabilities and entrepreneurial spirit, which have proven themselves. "

Write a new MBO record

This transaction is the largest MBO in Korea. Yoon Yun-su, president of Fila Korea, bought 18 billion won in 2005 and bought Fila Korea at the Fila headquarters in Italy, which resulted in the first MBO, but the following cases were rare. In 2016, 20 million won MBO of Leading Investment & Securities were awarded, but this is the first time for an MBO of hundreds of billions of won.

Lee Sung-hoon, a partner at KL Partners, said, "The national market is not easy to acquire for MBO and the management system is not established." The largest number of mergers and acquisitions in the franchise sector F & B, established by Equity Partners in 2016 after the acquisition of Burger King Korea for $ 200 billion, more than doubled.

Foreign equity capital funds leaving BHC

The transaction is also expected to serve as a catalyst for restoring BHC's brand image, which has been disrupted by "controversy". BHC franchisees have accused officials of the headquarters of fraud and embezzlement at the Seoul Central District Attorney's Office: "At the end of August, there was a suspicion of diverted advertising costs by franchise owners and an interference in profits the supply and supply of cooking oil.

The headquarters explained: "The Fair Trade Commission investigation did not pose any problem." Given that BHC franchisees have highlighted the PEF governance structure, focused on short-term profits, this merger should be an opportunity to find win-win solutions with head office.

Management Acquisition (MBO)

buyback by management. This means that management and employees take over the management rights of the company or certain business units. This is an badessment that positively affects management consistency and job stability because employees become shareholders of the company and participate as members of management.

Jung Young-Hyo reporter [email protected]

Ky Kyung Han Ky com, Reprint and Redistribution Prohibited

Source link