[ad_1]

Enter 2018.11.30 06:00

Dénucléaire發 Maintain profitability even if the price of electricity production increases

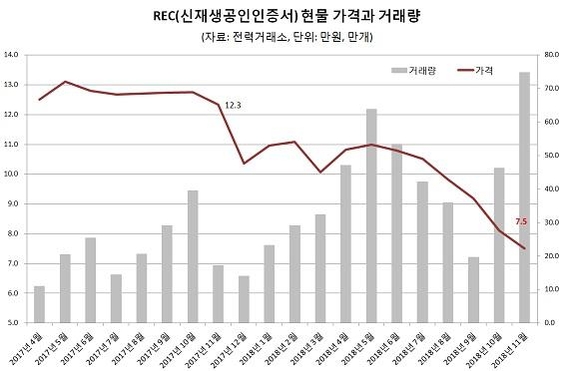

According to the government's plan to promote renewable energy, the price of renewable energy credits from REC has recently fallen by almost 40% in the last year. The supply has increased so much that the demand has been exceeded. REC is one of the sources of revenue for renewable energy companies such as solar power and individuals operating small power plants. The electric power sector expects that the excess supply will continue over the next year and the prices of CERs continue to weaken.

According to the KPX, the average price of REC in the spot market of RECs fell by 39.1% compared to the previous year (123,300 won) to stand at 71,500 won. REB prices began to show weakness from June to July of this year and have fallen since August, dropping more than 6% in one month.

The energy sector sees the prices of the RECs falling as a result of the sudden increase in solar power plants. Photovoltaic power plants have risen sharply since May 2017, when Moon Jae – in 's government entered the market, but demand is almost fixed, so REC has remained. According to the Korea Power Exchange, the capacity of photovoltaic power plants increased from 3.71 million kW at the end of 2016 to 5.06 million kW at the end of 2017 and 6.32 million kW in November 2018. A familiar REC marketer said: "The big development companies have got all the necessary CERs by the end of October of this year." We can buy 20% of the obligation to buy RECs next year in advance, the incentive to buy is low. "

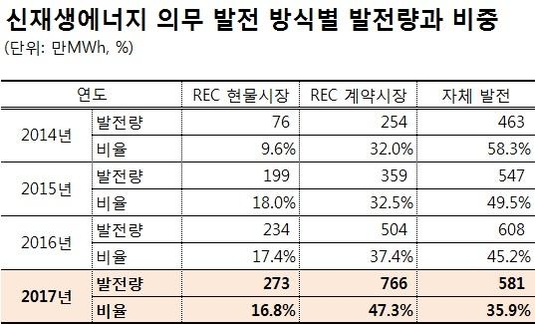

The 2017 CER will be purchased from March 2017 to February 2018 and the 2018 CER will be purchased from March 2018 to February 2019. From March to November of this year, the cash transactions of the RECs amounted to 415,600, or 69, 3% more than in-kind transactions of CERs (245,400) from March to February of this year. Although the share of new generation renewable energy is increasing from 5.0% to 6.0%, the electricity industry believes there is no incentive to buy CERs.

Professor Yoo Jong-min from Hongik University (Economics) said: "The increase in photovoltaic power generation in a situation characterized by many new and renewable sources of energy, such as biombad, has entered in a phase of overabundance. " He said. Park Jong-bae, a professor at Konkuk University (Electrical Engineering), said, "If the spot market price is high and the spot price falls, the long-term contract price will go down."

Professor Yoo said: "Up to now, the profitability of solar power plants will not be seriously affected.However, in many cases, 80 to 90% of total costs are generated by the installation of photovoltaic generators. "Even if the decline in the selling price is low, it can be converted into a loss."

Source link