[ad_1]

Entry 2018.11.29 11:37

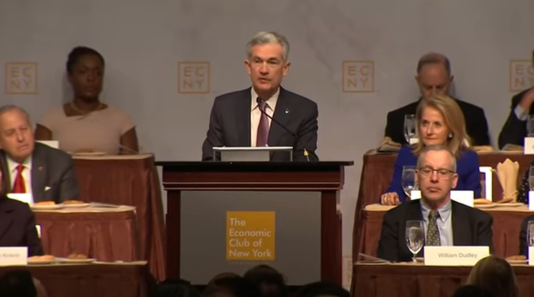

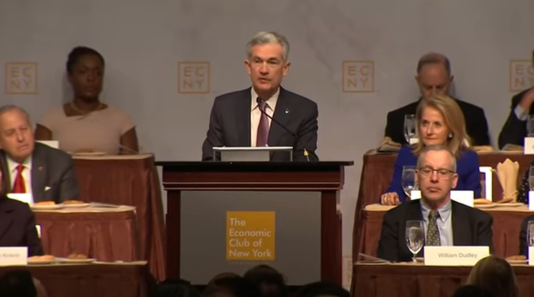

"The interest rate remains low compared to historical standards," Powell said in a speech delivered by the New York Economic Club. It lies just below a wide range of neutral levels that neither slow down nor overheat the US economy. He predicted that even in early October, the benchmark interest rate is still far from being neutral.

Market participants welcomed his remarks, which show a remarkable difference from just two months ago. Powell's statement has been interpreted as a signal to accelerate rate hikes. The Dow, the S & P 500 and Nasdaq all rose more than 2%.

Oliver Perkes Broderman, senior market strategist at Asset Management, said: "Mr Powell told the mayor and President Trump that he wished it." We opened the possibility of slowing down. "" The Fed has opened the door to stopping the cycle of rising interest rates quarterly and to the adoption of a flexible approach, faster than expected, "said Ian Lingen, head of the US interest rate strategy at BMO Capital Markets.

However, there are also voices that require a broad interpretation of Powell's remarks. He pointed out that market participants wanting to end the tightening were reacting prematurely, without directly mentioning the possibility of ending the tightening policy. "Market participants may misinterpret what Powell said," said Tom Pocelli, Chief Economist at RBC Capital, "Powell's remarks may not mean he's going to stop impressing." "

Powell, on the other hand, has laid a solid foundation for the US economy as the basis for maintaining rising interest rates. Powell said: "The US economy is close to full employment and prices are stable." He pointed out that the Federal Reserve will monitor economic indicators closely and decide to raise interest rates in the future. Experts point out that market players have neglected this.

Paul Ashworth, economist at Capital Economics, told the media market observer in the US economy: "I do not think Powell is easing against monetary policy. 39, US inflation is weakened or the economy is slowing down now. " "It's just that the market reacts excessively."

Shepardson noted that the range of neutral interest rates was between 2.5 and 3.5% in the September forecast. He argued that interest rates could further increase since the current base rate is between 2.0 and 2.25%.

It is possible to raise interest rates once again to the lowest level of the neutral range (2.5%) and to increase the base rate more than five times if the maximum level (3.5% ) is the goal. With an unemployment rate of 3.7% and a steady decline in the rate of decline, the Federal Reserve may decide the pace of rate hikes based on economic indicators.

Powell said he was aware of President Donald Trump's daily attacks against rising interest rates from the Federal Reserve. In his Washington Post interview, President Trump said, "I'm not happy at all after choosing Jay (Powell's title)." According to my intuition, they are completely wrong about what they do. "Criticized.

Source link