[ad_1]

Entry 2018.11.30 13:08

The worst economic situation, the time of the meeting with Trump … The reduction of the delivery in the small manufacturing PMI

China's manufacturing industry is getting worse after the US-China summit.

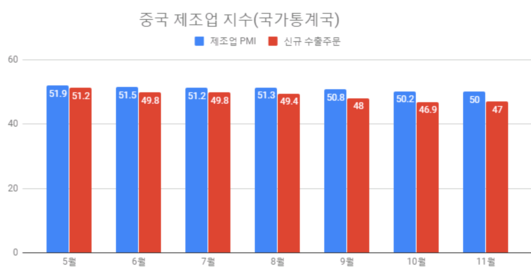

The National Bureau of Statistics (NBS) announced yesterday that the manufacturing PMI (PMI) of the 11 was lower than the forecast (50.2%) that it would be 50%, which represents the lowest level since July 2016 (49.9%).

If the PMI exceeds 50%, it means economic expansion and it is low, an economic contraction. The Chinese manufacturing sector is about to enter a recession phase for three consecutive months of deterioration. The manufacturing PMI announced by the Chinese government has increased since July (49.9) in 2016 and has risen for 27 consecutive months until October of this year.

Chinese President PMI Manufacturing, Donald Trump, and Chinese President Shi Jingping will meet in Buenos Aires, Argentina this weekend (the first day), while China is experiencing a weakened economy. I deal with the United States "(Hong Kong South China Morning Post) supports the observation.

The Chinese manufacturing industry has deteriorated mainly because of its small size. By company size, the small business manufacturing PMI decreased by 0.6 point to 49.2%. The PMI of small manufacturing firms entered recession for the first time in October. The medium-sized manufacturing PMI rebounded 1.4% in November to 49.1%, but is still in contraction. In the case of large companies, 50.6% are still in the expansion stage, but have lost 1 percentage point compared to delivery.

"The new export orders index and the new import index are 47% and 47.1% respectively," said Zhao Qinghang, senior official at the National Bureau of Statistics. "This is due to the slowdown in the global economic recovery and the increasing instability of trade frictions, and the pressure on imports and exports is increasing." In particular, the main index of raw material purchase prices and the issue price index fell to 50.3% and 46.4%, the lowest annual rate.

According to Zao Statistics, the PMI index in energy-intensive industries fell to 48.4%, a feature of November's manufacturing industry. Zhaoqing explains that strengthening the fight against environmental pollution in some areas is due to the winter.

China has lowered the level of environmental pollution control this winter compared to last year due to concerns about the increase in the economic slowdown, but the policy of Environmental protection remains a pressure factor for the economic downturn. Recently, China should deepen the Chinese authorities' concerns about defending the economic slowdown, as smog spreads and the need to strengthen the crackdown on environmental pollution.

The non-manufacturing combined PMI for November was 53.4%, down 0.5 percentage points from the previous month. The PMI in the field of road traffic, restaurants and real estate fell below the critical threshold. On the other hand, PMIs such as courier services and telecommunication services accounted for more than 56% of the total, while the financial sector such as insurance of banking stocks continued to grow at an average rate 60% or more.

China's total PMI in November rose from 0.3% to 52.8%. Zao said, "Although the production and management activities of Chinese enterprises continue to grow, vitality is gradually declining."

"The Chinese economy has not yet reached its lowest level," said Larry Hoo, an economist with the Macquarie Securities group. We are in the process of launching a policy to stimulate economic recovery, including the reduction of interest rates, in the first quarter of next year. "He predicted that China's economic growth will slow down. at 6.2% next year, down from 6.6% this year, largely due to the global economy, which is slower than the direct effects of the trade war, and the real estate market Chinese.

Andrew Fork, founder of Tribhu China, said: "China's stimulus measures have not been effective and private companies are in trouble." The prospects for Chinese policy are uncertain and the trade war between the United States and China has not yet had a real impact. "This is not a reason to be optimistic if you are a Chinese manufacturer," he said. "The impact of trade friction between the United States and China on the Chinese economy will appear in the first half of next year," he said. "It is difficult to offset the downward pressures on the economy because of the current policy".

The trade war between the United States and China has shown that China suffers relatively large damage, but there is growing evidence that the United States will suffer damage if it is prolonged.

"The US economy is expected to be stronger than China's, where growth is slowing this year compared to last year," said Derek Caesar, economist at the American Enterprise Institute (AEI) . "But as the US government expects as of January 1, If we increase import tariffs by 10 to 25 percent, the investment climate in the US badet market will weaken, as it appears in the Chinese market this year. "Stephen Kyle Cornell, a professor at the University, warned," If the additional US tariffs come into effect in January, the US stock market will be more vulnerable than the Chinese stock market. "

Source link