[ad_1]

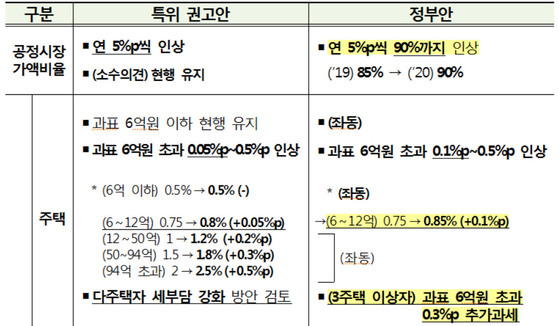

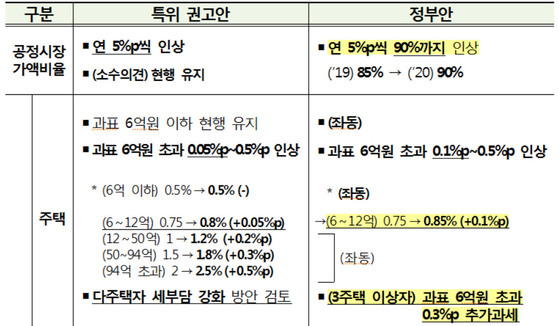

This plan was mainly reflected in the "Financial Reform Recommendation" issued by the Special Committee on Financial Reform on March 3. However, the progressive tax rate of 600-1.2 billion won in housing tax was higher than the recommendation.

Source: Ministry of Strategy and Finance

First, the annualized rate of taxation increased the tax rate by sector to enhance progressivity. The tax standard of between 600 million and 1.2 billion won is 0.75% to 0.85%, from 1.2 billion won to 1.2 billion won by 1% and 5 billion won to 9.4 billion won from 1.5% to 1.8%. 2.5%. The current tax rate will be kept below 600 million won. "The level of taxation between 600 million and 1.2 billion won is equivalent to high-priced housing, but the rate of increase is relatively low," said the official. "We increased the tax rate by 0.05 percentage points higher than the recommended rate.

In addition, according to the point that it is not reasonable to". impose the same tax on multiple housing of more than three houses and residential use, it is decided to tax 0.3%. "However, to minimize the impact on the local housing market, which has a high proportion of low-cost housing, the government does not levy additional tax on the market value of less than 1.9 billion won (more than 600 million won). "

The ratio of the fair market value, which determines how much will reflect the published price when determining the tax base, is currently going from 80% to 85% next year and 90% next year. The higher the tax rate, the higher the tax burden.The adjustment of the fair market value can be adjusted by the d Decree of & # 39; Presidential Decree considering the & # 39; changes in the property market and the financial situation.

![Calculation of tax burden before and after tax deduction [자료: 기획재정부]](http://pds.joins.com//news/component/htmlphoto_mmdata/201807/06/7e83ef8d-bebb-40b6-a356-db92e0f4de71.jpg)

Calculation of tax burden before and after tax deduction [자료: 기획재정부]

A resident who has a land price of 2.4 billion won (price of 3.4 billion won) If the tax rate increases according to the revised bill, the general tax of the following year will have to increase from 15.9 million won (28.7%) to 7.13 million won. Three owners whose official price is 3.5 billion won (market price of 5 billion won) will increase their property tax from 15.76 million won to 27.55 million won, which will earn them 11.79 million won (74.8%).

The global property tax is subject to taxation of 274,000 (as of 2016), accounting for about 2% of total homeowners. Of these, 26 million people are affected by the increase in the tax rate, and 3 residents with more than 600 million won are late. The estimated increase in tax revenue is estimated at 74.2 billion won.

![Tax Burden Before and After Tax Deduction [자료: 기획재정부]](http://pds.joins.com//news/component/htmlphoto_mmdata/201807/06/9896a2b5-332b-43a6-a240-9fe791b733f2.jpg)

Tax Burden Before and After Tax Deduction [자료: 기획재정부]

This time, the tax reform minimizes "tax resistance" Of a resident and increases the burden in the big picture. This is a tweezers that can maximize the propagandist effect of the pursuit of "tax equality" while reducing side effects such as public backlash and declining consumption.

Park Won-gab, Chief Specialist of Kookmin Bank's WM STAR Advisory Group, said, "We have clarified the timing and magnitude of the fair market value ratio and clarified some of the uncertainties in tax policy. . , Which is larger than the recommendation, which is badyzed as an attempt to prevent the polarization of the housing market due to "hold his own home".

However, many badysts believe that the impact of the rise in the stock tax will have a limited impact on the overall market. It is estimated that those directly affected by the reform plan are fewer than expected. Professor Shim Kyong-kwan, a professor of real estate at Konkuk University, said, "The Gangnam region, which has entered the booming period, has a limited price-cutting effect." However, the local real estate and parts of the metropolitan area are likely to shock.

Reporters for damages [email protected]

[ad_2]

Source link