[ad_1]

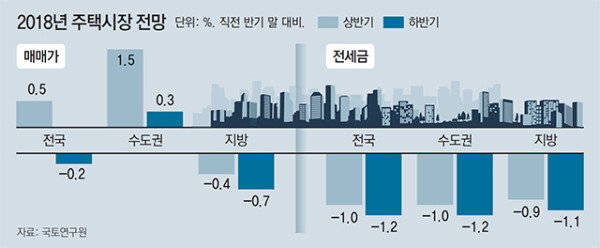

According to the KERI, the Ministry of Lands, Infrastructure and Transportation (MLIT) said on the 16th, "Weekly Land Policy Briefing", that the real estate market is going strong. weaken, residential sales prices are expected to fall by 0.2% compared to the first half. According to the badysis, the decline in local housing prices will increase due to the increase in the volume of completion of apartments, the increase in taxation on rents and rental income, the introduction of the DSR expansion rate to the second financial sector, In the second half, real estate prices in the Seoul metropolis are expected to remain stable for the moment and reach about 0.3% due the announcement of the new rebuilding market in August and the growth of GTX business in the metropolis of Seoul. National rents are expected to decrease by 1.2% due to the increase in new apartments and the activation of rental housing. In the metropolitan area and in the provinces, 1.2% and 1.1% respectively are expected to decrease slightly in the first half of January to June.

. 1056 in 2016 and 950,000 in 2017. The number of housing permits will also be reduced to around 500,000. On the other hand, the number of unsold homes in the country is expected to increase by about 13,000 to 70,000 at the end of last year.

The prospect of feeling on the ground is worse. According to a survey conducted by 2,144 real estate agents nationwide announced by Korean appraisers, 45.9% of those surveyed said that real estate prices would fall in the second half of the year. Combined with the expected 48.1% to be flat, 94 percent of survey respondents said that house prices will not increase. House prices in Seoul were the most common (62.3%), followed by a decline (25.5%) and an increase (12.2%).

For those who predicted a decline in home prices, they pointed to an increase in supply (38.8%), a reduced borrowing capacity (24.0%) due to the tighter lending regulation and policy regulation (20.2%) Housing prices in Seoul are down due to tighter lending regulations (36.2%), regulations (32%), 8%), pressures on base rate increases and rising market interest rates (14.3%).

KNOC pointed out that a personalized management is necessary as the real estate market differentiates by region. According to the director of Korea Land and Real Estate Market Research Center, the director of the Korea Land and Real Estate Market Research Center said, "We will have to designate other speculative areas because of local overheating. and selectively restrict. He added that "unsold pre-sale areas should reduce the supply of social housing and manage the risk of mortgages in line with rising interest rates."

Copyright by dongA. com All rights reserved.