[ad_1]

![[김현석의 월스트리트나우]Bold forecasts on the results of FOMC meetings](https://img.hankyung.com/photo/cts/201906/64c8d7d73a050be5401c35475afc8343.jpg)

The Federal Open Market Committee (FOMC) announced in June that it would be able to gauge the direction of the New York stock market.

The results of the meeting will be announced at 2 pm Eastern Time on June 19 and at 3 am on the 20th, and will be followed by a press conference by the Fed Chairman, Reserve Federal.

There were three things that could be variables at this Wednesday (local time) meeting.

Mario Draghi, governor of the European Central Bank (ECB), said earlier in the morning: "If inflation does not improve steadily, we need additional stimulus, such as cuts interest rates and bond purchase programs. " The European stock market jumped and interest rates on eurozone and euro bonds fell as it considered considering further stimulus measures by the governor of Draghi. French 10-year Treasury securities fell into negative territory for the first time.

Draghi's suggestion of a stimulus package due to the possibility of a recession could put pressure on Powell. Once Japan and the ECB are engaged in a process of easing, we can remain frozen and, if the economic situation worsens, we can reverse all our responsibilities.

The second, President Donald Trump and Chinese President Shijiazhuang agreed to hold a summit on enlargement at the G20 summit to be held in Japan on March 28-29. As trade negotiations between the United States and China will lead to breakthroughs, it is necessary to adjust interest rates after monitoring them.

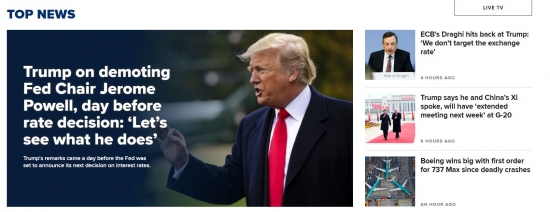

Third, President Trump told reporters, "Do you want Powell to be fired," in response to the news of the "Powell Haim Promotion" that was staged today? "Let's see what he does."

The FOMC is a very stressful time for Mr. Powell in the day ahead. If we return to a relaxed posture, we will be accused of political action. However, if we maintain the current trend, we can confuse the financial market and overcome the blame for economic deterioration.

![[김현석의 월스트리트나우]Bold forecasts on the results of FOMC meetings](https://img.hankyung.com/photo/cts/201906/90f4d5338b97efbb9b0d78eacb5a06b5.jpg)

Whatever the case may be, the results are coming soon. Based on the opinion of Wall Street experts, we will anticipate the audacity of the results of the day's meetings.

Rates Interest rates will freeze.

It is reasonable to adjust the interest rate after reading the results of the G20 summit meeting.

Interest rates are expected to drop at the end of July. Investment banks predicting interest rate cuts are expected to cut interest rates by more than 50 basis points in July, in response to the economic downturn that hit its first downturn. Barclays is forecasting a 75bp cut this year, including 50bp in July and 25bp in September.

This will change the badessment of the economic situation.

Modify the badessment of the economic situation of monetary policy statements. Meanwhile, the economy is growing at a steady pace, with the phrase "some indicators are slowing down".

This will suggest a policy change.

![[김현석의 월스트리트나우]Bold forecasts on the results of FOMC meetings](https://img.hankyung.com/photo/cts/201906/4c8c2f39e3ebdeff871fbea80a151604.jpg)

Delete the word "patiently" in the declaration. Instead, it will indicate that it will reduce interest rates in the future by stating that "we can take the appropriate steps to maintain the economy".

Identify trade disputes as negative risk factors.

In the statement, trade disputes are identified as downside risk factors. In the meantime, the expression of trade has never been explicitly included in the declaration.

Rate The expected target base rate on the viscosity graph will be revised downward, but the width will not be large.

We are downgrading our guidance for the base rate on the viscosity chart. However, since some of the members who claim to freeze the interest rate are also votes, the downward trend towards the average value will not be very strong.

The financial markets want President Powell to lower interest rates in July and at least September by means of a statement and a press conference.

If that does not happen, the December Tentrum, where Wall Street positions in interest rates "far from being neutral" at the end of last year, can still happen again .

New York = correspondent Kim Hyun-seok [email protected]

Source link