[ad_1]

Entry: 2018.07.31 03:06

All Financial Derivatives such as Futures and Options

The Government has emphasized that this year the revision of the tax law targeted those targeting companies with a large real estate and business.

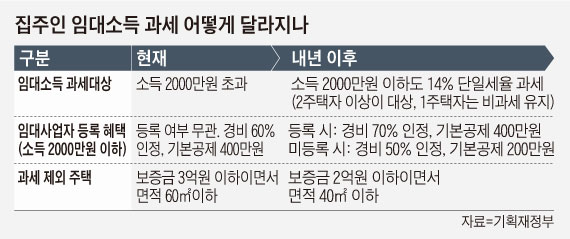

The tax on the landlord who receives the tax as well as the increase in the overall public property tax is decided to increase immediately next year. Even if the landlord now increases the rental income by more than 20 million won, he will collect the tax combined with other income.However, starting next year, if the rental income does not increase. do not reach 20 million won, 14% of rental income will be taxed

The government decided to register the owner as a leasing company. next year to benefit from a lot of tax deductions and cost recognition. If the rental income is less than 20 million yuan under the Income Tax Act, the basic deduction is 4 million yuan, and the required fee rate is 60%. For example, if the rental income is 20 million won, the tax is paid only at 4 million won less the necessary expenditure of 12 million won (60%) and the deduction of 4 million of wons. The government will increase the required fee rate of leasing companies to 70% from next year, keep the basic deduction to 4 million won and reduce the required fee rate to 50% and the deduction basic to 2 million won. Even if the rental income is 20 million won, the tax difference is 1.05 million won depending on whether the business is registered or not. For example, if a landlord who meets the requirements of a separate taxation has a lease of 8 years or more (25% special allowance for a long term lease), the required expense ratio is 70 % and the basic deduction of 4 million won. The amount of the tax is only 70,000 won.

In order to increase the fairness of the taxation of financial derivatives such as futures and options, the government must increase the tax base of derivative financial instruments such as futures and options, As of April of next year, it has decided to allocate transfer income tax to all intangible and other derivatives related to the stock index. The government also asked the government to declare the disposal of real estate abroad worth more than 200 million won, and if it is broken, it will impose 10% of the value unrecognized up to 100 million won.

The government has also decided to strengthen the system of transfer tax, which is the transfer tax imposed when the major shareholders of a company leave Korea because of the tax. immigration.

[ad_2]

Source link