[ad_1]

Entry: 2018.07.15 14:16

| Correction: 2018.07.15 14:24

If the head of the household is not homeless and the combined annual income of the couple is less than 60 million won (70 million won or less for the first-time buyer), the borrowing rate may be borrowed will be reduced to 0.25 percentage points.

The Ministry of Lands, Transport and Maritime Affairs declared October 15: "From the new receipt on the 16th, the bridge loan rate will be reduced from 0.1% to 0.25% according to the combined level of matrimonial income. "

It is a commodity that lends money at a low interest rate of up to 200 million won when a household of less than 70 million Wons buys a house of less than 500 million won.

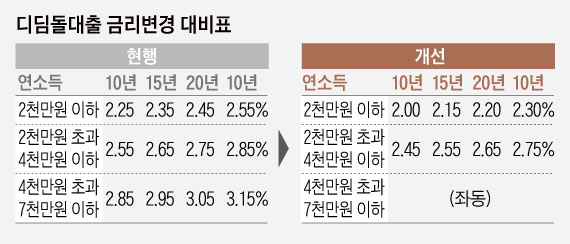

However, from the 16th, the interest rate of the loan will be 2.25% lower than the combined annual income of 20 million won, and the government will use the housing city fund to borrow the Borrowings Currently, interest rates range from 2.25% to 3.15% to 2.30% and 2.5% to 2.85% to 2.45% and 2.75%, respectively. However, the current interest rate of 2.85% ~ 3.15% remains between 40,000 ~ 70 million won.

When several households, persons with disabilities and older households join underwriting savings and use the electronic contract system Real estate preferential rates apply to loans up to 1.60% Can receive.

The government has decided to extend the deferral of capital repayments for child care workers in the future. Until now, it has been possible to defer repayment of principal for a period of one year during the loan period in case of default, but it can be suspended for up to two years during the loan period, even before the default.

An official from the Ministry of Land, Infrastructure and Transport said, "The burden of non-resident ordinary citizens using phased loans will be reduced from 120,000 to 280,000 won per household per year," the ministry said. .

Source link