[ad_1]

|

[아시아경제 문채석 기자] The management division of the National Pension Fund plans to invest 6.3 trillion won in national private investment in selecting six national private investment trust management companies in the second half He said.

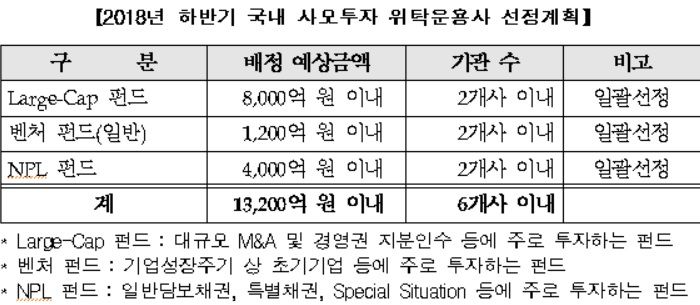

The Fund Management Division plans to select a total of 6 consignment management companies for large-cap funds, venture capital funds (general) and NPL fund types, and to allocate funds totaling 1 430 trillion won

The estimated amount of allocation of large cap funds is less than 800 trillion won, and the expected number of institutions is two. This fund is mainly invested in major acquisitions · investing primarily in mergers and acquisitions and management rights takeovers.

Venture capital funds should allocate less than 120 billion won, and two institutions should enter. Venture Capital Fund This is a fund that invests primarily in the top companies in the growth cycle of the company.

NPL funds will be allocated to less than 400 billion won, and two institutions will be recruited. This fund is a fund that invests primarily in covered bonds in general, special bonds and special situations. Lee Jae-wook, head of the investment team of the National Investment Alternative Investment Office, said: "We will increase the size of large-cap investment funds in order to obtain opportunities. investment plans in the domestic M & A market. "We plan to select a venture capital fund management company in the second half to reflect the growth in market size." We plan to diversify the target by selecting an NPL fund with a specialized operational strategy. "

|

The Fund Management Division selected in the first half of 2008 eight trust fund management companies for secondary funds, venture capital funds and funds venture capital firm in the domestic private investment sector and received funds totaling W 550 billion

The Management Division of Funds will begin submitting investment proposals starting in September and will decide to finalize the trust management company in the fourth quarter.

var js, fjs = d.getElementsByTagName (s) [0];

if (d.getElementById (id)) returns;

js = d.createElement (s); js.id = id;

js.src = "https://connect.facebook.net/eu_US/sdk.js#xfbml=1&version=v2.6";

fjs.parentNode.insertBefore (js, fjs);

} (document, 'script', 'facebook-jssdk'));

[ad_2]

Source link

Tags investors Korea national pension Private