[ad_1]

Entry: 2018.07.31 03:06

[스튜어드십 코드 도입] Unions and civic groups join "management's participation in the code of good management"

On May 30, worries about managerial intervention increase because the National Pension Fund Management Committee allows practically participation in the management of the national pension. The introduction of the code of stewardship allowed the national pension to intervene in the management of the enterprise if the total income of the family takes private profits, such as cause a social conflict with the owner's family, or "do a job".

◇ Code of stewardship reflected in the demands of work

◇ The number of people who can not participate in the management of the national pension is not enough, The winners of the meeting of the Management Committee of the National Pension Fund, which lasted nearly four hours that day, were members of union and civic groups who worked in unison. "One of the union staff members and two members of the CPA and Consumer Association said the stewardship code should be included in management,

The debate, which had been a lethargic support, had a quick pause after the Members of the unions and civic groups said: "That the national pension executes the activities of the shareholders who participate in the management, even if only the specific issue decided by the fund is resolved", and the member of the government said : "In fact, It is possible to participate in management," explained members of the business community "Baekgi" heard.

◇ The pension government's concern with participation in the management of national pensions

The "pension government" The controversy should also be stable. The Minister of Health and Welfare said: "If the value of the business is seriously damaged or if public opinion is formed, the fund will decide and participate in management in an exceptional manner.

The problem is that the composition of the fund itself is heavily influenced by the government, but the members of the committee are not directly involved in the selection of the agenda. The fund's management committee, consisting of 20 members, includes six government personnel, including the Minister of Health and Welfare, four deputy ministers and the head of the National Pension Corporation. Here, the workers' representative (three) and the representatives of the local subscribers recommended by the NGOs can regroup and exert their influence.

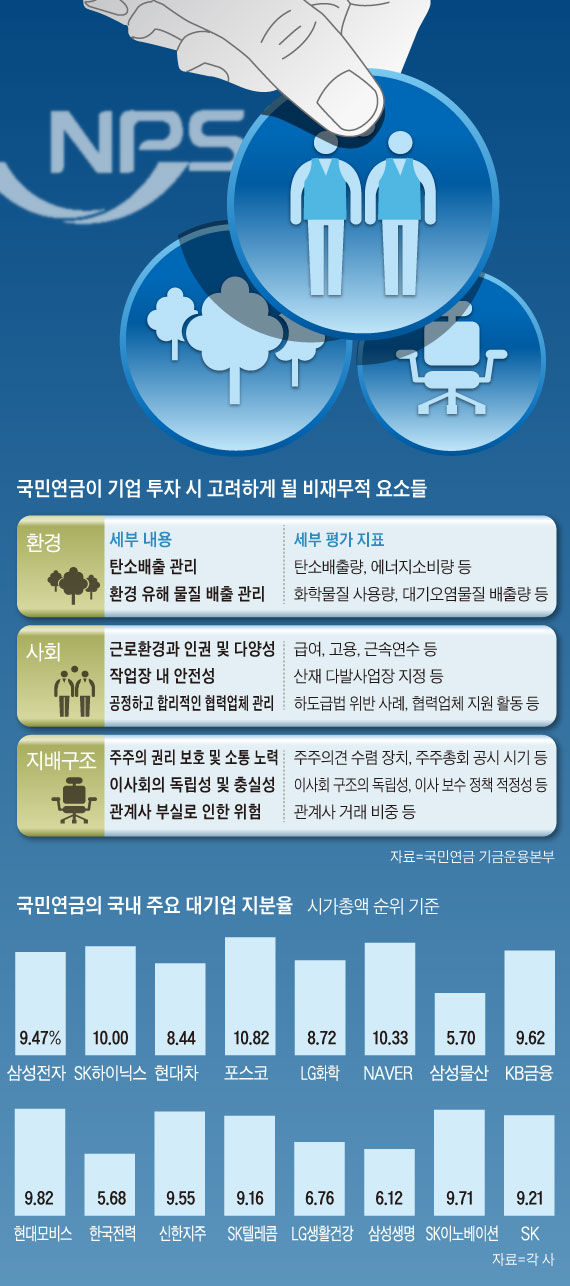

In addition to the management performance of the company invested by the national pension plan, it is also possible to propose a plan for environmental rejection, the evaluation of non-financial factors , such as social and governance (ESG), is also criticized as being exploited for "taming societies". It includes not only areas related to the value of the company, such as product safety management, but also factors unrelated to the competitiveness of companies such as the level of employment of companies, suppliers, donations and dividends.

◇ Concerns about management intervention rather than raising the national pension rate

◇ The National Pension Plan must create an annual "Business Performance Report Card" based on these 52 factors, It is not clear whether the code of stewardship will lead to "the increase in national pension yield".

In addition, the stewardship code is expected to enhance the shareholder-related dividend activities (planned for the second half of this year), the key management company And advertising (planned for 2020) has already been abandoned. CALPERS Pension for California Public Service employees changed its 2011 priority list to the private list. We conclude that private conversations with companies are better for improving return on investment than for "disgusting cycle" responses. In the case of the Japanese Pension Fund (GPIF), the ROE is valued rather than the dividend paid by the investment company. Lee Won-il, investment advisor to Lee Won-il, pointed out during the recent public hearing that "the exercise of the participation rights of the national pension system is too focused on dividend issues", a- he declared.

Source link