[ad_1]

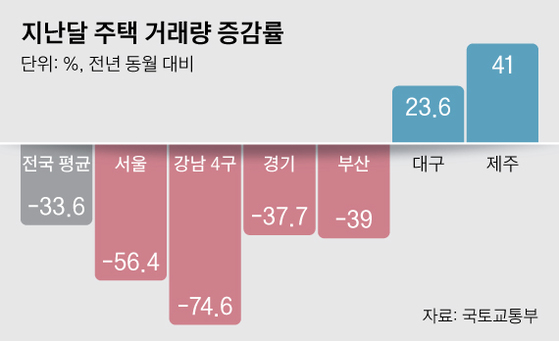

The Ministry of Lands, Transport and Tourism said on July 17, the volume of nationwide housing transactions fell by 33.6 percent compared with a year earlier, The decline was higher than May (-20.3%) and decreased for three consecutive months since April.

By region, the volume of transactions in Seoul decreased by 56.4% from one year to the next. It was the second largest drop among 17 cities and provinces nationwide. The fall in first place in Sejong City is 62.6% less than a year ago.

![[그래픽=차준홍 기자 cha.junhong@joongang.co.kr]](http://pds.joins.com//news/component/htmlphoto_mmdata/201807/18/a824df8b-197a-4b04-9059-a163663ac985.jpg)

[그래픽=차준홍 기자 [email protected]]

Seoul Gangnam, Seocho, Songpa, Gangdong-gu and 4 other openings in Gangnam only 1371 households were traded last month. This is a decrease of 74.6% over the same month last year (5,408 cases). In the northeastern part of the Han River in Seoul, housing transactions decreased by 51.8%, which was relatively better than in the four districts of Gangnam.

In the metropolitan area, which combined Incheon (-32.9%) and Gyeonggi (-37.7%), real estate transactions fell by 44.9% compared to the previous year.

Daegu (23.6%) was the only transaction among the five provinces. The number of transactions on the island of Jeju has also increased by 41%, the largest increase in the nation.

On the other hand, Busan (-39%), Ulsan (-41.8%) and Gyeongnam (-31.8%), the so-called "

In the first half of this year, domestic transactions fell 4.4% from one year to the next.This was due to double-digit growth in January-March, though it has declined since April. [19659002] Although the Seoul metropolitan area has been relatively good, the Bhoolan region has shown a serious narrowing in trade, with the volume of trade in Seoul (1.9%) and the economy (0.4%) has increased slightly, while Incheon (-8.6%) has decreased.

Ulsan (-32.2%) has been the number 1 trading volume down across the country, while transactions in Busan (-30.2%) and Gyeongnam (-25.1%) were also gloomy.

By type of housing, the number of apartments (-37.4%) were similar. is strongly contracted compared to that of the coalition, collective housing (-3 0.4%) and single-family or multi-family dwellings (-21%).

Apart from the home sale market, the pre and monthly rent markets are relatively stable. Last month, the total and monthly transaction volume nationwide reached 133,918, up 5.2% over the previous year. The growth rate in the provinces (7.1%) was higher than in the Seoul metropolitan area (4.2%), including Seoul (4.8%). In the first half of this year, total and monthly transactions increased by 6.9%.

Rent by type of lease increased by 12.5%, but rent decreased by 0.4%. The share of monthly rent in all transactions was 40.6%, down 3 percentage points from 43.6% a year earlier.

Depending on the type of housing, apartment and rent transactions in the first half of this year increased by 6.4%, which was relatively lower than for other homes (7.3%) .

Kim Duk-ryeong, head of the Housing Policy Department of the Housing Industry Research Institute, said: "The feeling of investment is shrinking as the Burden of the global property tax increases. "We expect trade to remain globally sluggish in the second half of the year," he said, "in some regions, the decline could be larger than in the first half."

Journalist Joung Jung-jin [email protected]

[ad_2]

Source link