[ad_1]

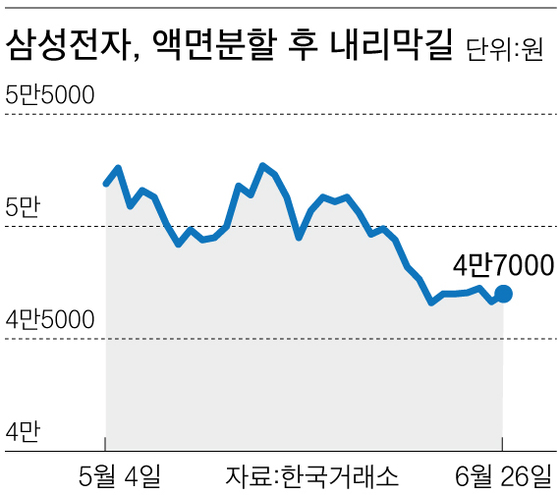

Shares of Samsung Electronics were suspended for four days from April 30 to May 3 due to liquidation, and the transaction resumed on May 4 at an initial price of 53,000 won. However, the 50,000 won line collapsed after 7 trading days, and it fell below the 46,000 won mark on the 2nd. On the third and fourth days, it bounced slightly for two consecutive days and climbed to 46,250 won, but it is still shabby. It fell 12.7% in two months after the division of par value.

![[그래픽=차준홍 기자 cha.junhong@joongang.co.kr]](http://pds.joins.com//news/component/htmlphoto_mmdata/201807/05/cd1067fd-c32d-4a21-9aea-79fb9d3bec84.jpg)

[그래픽=차준홍 기자 [email protected]]

The prospect that stock prices would rise even more at the time of the division of the nominal value would dominate. Indeed, 1Q11 earnings were the highest ever, and supply and demand should stabilize thanks to the flow of individual investors.

As expected, he managed to transform "nationalism". After the liquidation, individual investors bought shares in Samsung Electronics worth 2,537 billion won. However, institutional investors and foreigners were busy selling shares while ants were buying cheaper shares of Samsung Electronics. In the same period, Samsung Electronics sold 2.61 billion won of shares. In the case of foreigners, the net sale for the month of June is 1,103.5 billion won. Kwak, Kap-Bae, a researcher at the Korean Institute for the Promotion of Korean Financial Institutions, said in a report released Feb. 27: "The influx of private investors and the volume of transactions have significantly increased. "I believe the report was less than the expectations of individual investors bought," he said.

The disappointing earnings outlook at 2T accelerated the crash of "Hwangjeju." "Financial information" F & G Guide ", sales and operating profit of Samsung Electronics are expected to reach respectively 60.41 trillion won and 15.22929 trillion won. Business and operating income decreased by 3.4% and 3.2% respectively from the previous month.

Brokerages lowered their target price for last month. investment funds increased from 65,000 won to 65 000 won, while Shinhan Investment and Best Investment Securities also fell by 5.9% and 2.9% respectively. Dohyeon Woo, researcher at NHN Investment & Securities, said: "Slow smartphone sales are a major factor," he said, adding that "the competition has intensified." Kim Jae-jae, researcher in securities and securities, said: "In the past two years, semiconductor prices rose due to lack of supply, an unprecedented boom.

To make matters worse, Short selling has also increased sharply and after the par value split the auction amount (345.9 billion 7231 shares) was the most common on the KOSPI / KOSDAQ market until the last two days. E & C, an inter-Korean economic cooperative, and LG Display, which has been the target of short sales since last year, are twice as numerous.

Samsung Electronics, which had trouble finding its name even among the 100th of the list of sales at d cover before the division of the nominal value. The day the short sale portion of the trading volume exceeds 10% is 7 days.

Can the course of action Samsung regain its past glory? Securities companies are expected to record record earnings and a rebound in stock prices in the third quarter thanks to strong sales of semiconductors and billboards.

Kim Yun-ho, a researcher at IBK Investment & Securities, said, "DRAM prices are expected to continue to rise, and 3T earnings are expected to improve as a result of the depreciation gained and the return of the money. increase in OLED volume. " The launch of the Galaxy Note 9 could offset the lethargic sales of the Galaxy S9 in the first half. There is also an badysis that the expansion of the shareholder return policy of Samsung Electronics will provide an incentive for investment.

Park Won-jae, a researcher at Mirae Asset Daewoo, said, "The dividend yield is 3% in 2018" and "attractive dividend yields will serve as collateral for lower stock prices".

Lee, Hyun-jae, Lee, Hyun,

if (f.fbq) returns; n = f.fbq = function () {n.callMethod? n.callMethod.apply (n, arguments): n.queue.push (arguments)}; if (! f._fbq) f._fbq = n;

n.push = n; n.loaded =! 0; n.version = 2.0 & # 39 ;; n.queue = []; t = b.createElement (e); t.async =! 0;

t.src = v; s = b.getElementsByTagName (e) [0]; s.parentNode.insertBefore (t, s)

} (window, document, script, // connect.facebook.net/en_US/fbevents.js');

fbq (& # 39 ;, & # 39; 712739455529100 & # 39;);

fbq (& # 39; track & # 39 ;, "PageView");

[ad_2]

Source link

Tags Electronics fell humiliation months national Samsung stocks