[ad_1]

US President George W. Donald Trump said in an interview with CNBC on the 19th. Despite the removal of a "tariff bomb" to resolve the trade deficit, it was a sign of frustration that the Yuan value continues to fall. It was also a propaganda statement that the trade dispute with China would be extended to a "currency war".

However, the reaction on the Chinese financial market was unexpected. The Shanghai Stock Exchange rose 1.05% on 23 after rising 2.05% in the 20th. After the announcement of Trump, the People's Bank of China (PRC) notified the appreciation of the yuan (appreciation of value), and worries about the currency war have been somewhat softened and the financial institutions have added stimulus measures.

![[그래픽=차준홍 기자 cha.junhong@joongang.co.kr]](https://pds.joins.com//news/component/htmlphoto_mmdata/201807/24/d54f3e40-f64f-42ca-9244-3e1191f9dc68.jpg)

[그래픽=차준홍 기자 [email protected]]

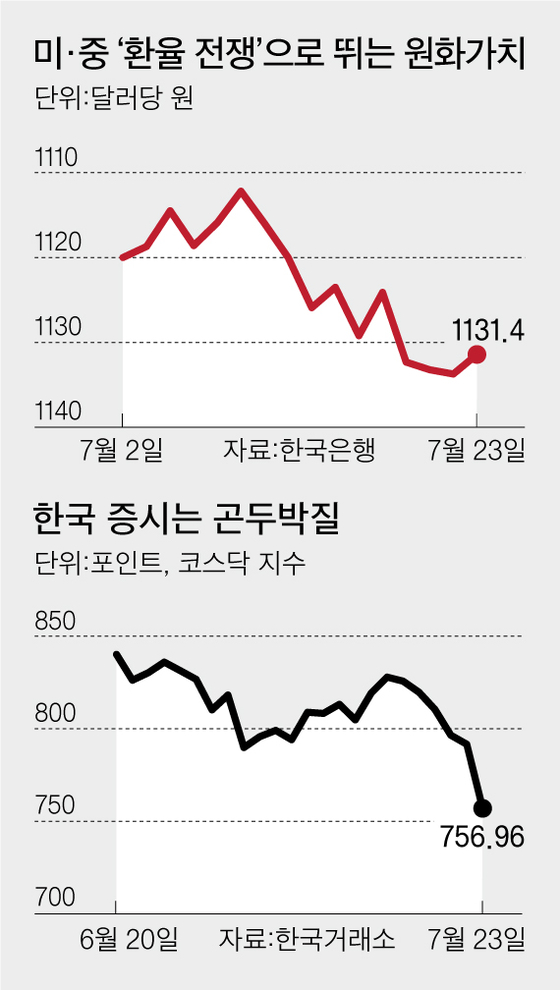

This is a Korean stock market that has been neatly " grenade "to fall like a stone. In particular, the KOSDAQ market, whose physical strength is relatively weaker (fundamentals), was the hardest hit. The KOSDAQ index dipped by 4.38%, or 34.65 points, to close at 756.96. It's the lowest price since seven months since Dec. 21 (740.32) last year. This is the largest decrease since March 23 (-4.81%). Foreign investors (-64.2 billion won) and institutions (-73.7 billion won) came from the "sellers" side and pulled back the index. KOSPI closed at 2269.31, down 0.87% (19.88 points) from the previous trading day, but the decline was lower than that of KOSDAQ.

Kim Young-hwan, KB Securities Researcher, said: "KOSDAQ has been hit harder by the US-China trade conflict and the exchange rate war," We are witnessing a sharp decline in the KOSDAQ market " , he said. "The KOSDAQ market has further declined since there has been controversy over the overvaluation of the pharmaceutical, biotech and media industries."

President Trump has designated the yuan as a front, and the won, which shows the flow of interlocking with the yuan, was also affected.On the same day, the value of the won against the dollar was 2.331 won (falling exchange rate), which was 1131.4 won.

As trade disputes become more widespread as a result of the currency war, Korea becomes increasingly vulnerable to "shrimps" between the two "whales" of the United States and China. " victim of trade conflict is not a big one but a small open economy in the middle of the United States and China, including South Korea, "the Wall Street Journal reported on Tuesday.

According to the World Trade Organization (WTO), Taiwan (67.6%) is the largest share of total exports related to the global supply chain. Korea accounted for 62.1% of the total, followed by Taiwan, Hungary (65.1%) and the Czech Republic (64.7%). The global supply chain refers to the structure of production and export of new products based on raw materials and parts imported from other countries. The higher the ratio, the stronger the protection trade, the higher the import costs and the lower the demand for exports.

Experts badyze the existence of such a context in the "Korean stock market exit" focused on foreign investors. "While the stock market and the value of the won are appreciating, investors who have observed the dollar's weakness and the strength of the dollar are seeing a sudden change in flow," Lee said. "The current situation is likely to be prolonged as President Trump has sparked trade and monetary disputes in favor of a rally of supporters ahead of the November mid-term elections," he said. It would be nice to keep it. "

[ad_2]

Source link