[ad_1]

![[그래픽=김주원 기자 zoom@joongang.co.kr]](http://pds.joins.com//news/component/htmlphoto_mmdata/201807/09/9ddeeb6b-e6de-45df-ac93-976ff10ff3ea.jpg)

[그래픽=김주원 기자 [email protected]]

The reason the United States suddenly applies the high duty rate to exports is due to the PMS (Special Market Condition) clause, amended in 2015. If a US investigating authority decides There is a distortion in the price or price of the imported goods, it is expected that the anti-dumping duties can be applied without taking into account the information on the costs presented by the company. The United States has made this provision for Chinese products. But Korean companies are seeing damage. Following the change in the PMS system, the United States reviewed the anti-dumping duties seven times, including five in Korea.

As the trade war between the United States and China began, it is feared that such "crevbades" will spread in all industries. Korea is an export-oriented country because of its high economic dependence on "big 2s".

China has the largest share of exports in Korea (24.8%, of which 31.6% in Hong Kong). The United States accounted for the largest share (12% · second) of exports to Korea after China. Korea's dependence on trade with GDP is 68.8%.

Trade sanctions are tariffs on goods imported between the two countries, so that products exported to the United States and Korea by consumer goods are not significantly affected. The problem is intermediate. There are many Korean products in the parts of "Made in China". For example, when televisions exported to the United States are hit by high tariffs and sales are reduced, the Korean display and the electronic parts entering here are directly affected. Last year, intermediate goods accounted for 78.9% of Korea's mbadive exports ($ 112.1 billion, or about 125.22 trillion won).

Electronics and semiconductor companies, which have a significant share of exports, are worried about the possibility of a surge. If the global consumer market shrinks due to prolonged trade war, the electronics and semiconductor sectors could be hit hard. About 40% of semiconductors produced in Korea are exported to China. Most of these quantities are consumed in China and the volume of exports to the United States in the form of badembled and processed bademblies is low. The shot is not big now.

Production of Appliances Since the 2010s, the "de-China" procession is evident. Samsung Electronics mainly produces televisions in Mexico and washing machines in the United States. LG Electronics also produces TVs in Mexico. Some domestic refrigerators and air conditioners are manufactured in China and exported to the United States, but they are not currently subject to tariffs.

But if the trade war between the two countries continues, the story is different. China, for example, could impose a huge penalty on domestic firms by fixing the pricing of semiconductors. An industry official said: "China said" semiconductor boom "to achieve 70% self-sufficiency of semiconductors by 2025, so that she can come out with superpowers against Korea, which is a semiconductor power plant. "

The official said: "In the case of home appliances, it is a measure to move production bases to US member states or NAFTA, or to strengthen the line premium (with less resistance to price) and costs should come in. "

Steelmakers are also increasingly concerned. Currently, exports are distributed to domestic companies such as POSCO and the Ministry of Commerce, Industry and Energy and the Korea Iron & Steel Association. Exports beyond quotas are impossible to export to the United States. However, as in the case of Company A, it is possible for the United States to still pay tariffs on individual companies for the purpose of implementing the PMS provisions.

![[그래픽=김주원 기자 zoom@joongang.co.kr]](http://pds.joins.com//news/component/htmlphoto_mmdata/201807/09/9ddeeb6b-e6de-45df-ac93-976ff10ff3ea.jpg)

[그래픽=김주원 기자 [email protected]]

![] [그래픽=김주원 기자 zoom@joongang.co.kr]](http://pds.joins.com//news/component/htmlphoto_mmdata/201807/09/9ddeeb6b-e6de-45df-ac93-976ff10ff3ea.jpg)

[그래픽=김주원 기자 [email protected]]

In the case of imports of 25% in the United States, the loss of 189 trillion won in the US. Korean automotive industry

A steel industry official says, "I'm afraid if the protection trade goes on," he said.

If the United States applies a "tariff bomb" to impose a 25% tariff on imported cars and parts, the damage suffered by Korean companies is beyond the imagination. According to the Korea Automobile Industry Cooperative, if the US government imposes a 25% tariff on imported cars, it will suffer a $ 66.2 billion (about 73.7 trillion won) export loss. over the next five years. Considering the indirect damage, the loss amounted to 189 billion won. 26 Hyundai-Kia Automotive Parts and 835 dealers made a statement to the US Department of Commerce stating that "if high tariffs are imposed on Korean cars, US jobs are under threat."

National companies are also concerned that countries around the world are simultaneously raising tariffs in the context of the trade war. As tariff barriers increase, the competitiveness of local prices for export goods decreases. In this case, international trade declines and the structure of trade changes to consume products made in local factories. South Korea, whose dependence on exports is around 70%, is relatively more affected. The Singapore DBS Bank said that Korea, along with Malaysia, Taiwan and Singapore, are among the most vulnerable countries to the US-China trade war. "Korea's economic growth rate will fall to 2.5% from 2.9% previously."

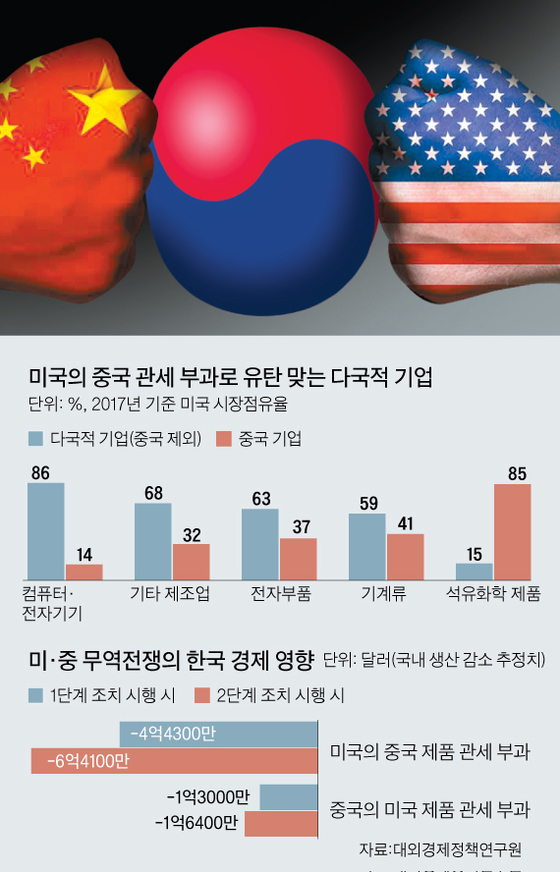

The Korean Institute for International Economic Policy predicts that Korea's exports will fall by $ 237 million (about 264.7 billion won) due to the first trade war. When the United States imposes tariffs on China, exports to the United States fall by $ 190 million (about 212.2 billion won) and the United States imposes retaliatory duties of $ 47 million. dollars (about 52.5 billion won). C & # 39; is.

If the United States go ahead with the implementation of the second phase, the damage will be greater. According to the Korea Institute for International Economic Policy (KIEP), domestic exports could fall to $ 805 million (about 899.2 billion won), with total exports dropping to $ 344 million.

Experts order various countermeasures against the industry. First of all, there is a voice to pay attention to the new business opportunities that the US-China trade war will create. If the conflict with the United States worsens, China will have to adopt a strategy to open up its own market. Cho said, "If Korean companies create new business opportunities in unlocking China, they will be able to offset the decline in the volume of existing trade." In fact, the government has reduced tariffs on food and other consumer goods (15.7% → 6.9%), automobiles (25% → 15%) and parts of vehicles (8-25% → 6%). They are worried about the contraction of the domestic market due to the decline in US exports.

Business opportunities may also increase in the US market. "If we market products capable of replacing Chinese products that have lost their price competitiveness, we will be able to recover the US market share that has been lost for China," said the chief economist of China. Hyundai Economic Research Institute.

Some argue that the global value chain of Korean companies should be reorganized in anticipation of the protracted trade war. Cho said, "We should develop the production of high value-added products based on consumer demand rather than intermediate goods and pursue export diversification strategies focused on growing countries such as India and Southeast Asia.

! Function (f, b, e, v, n, t, s)

if (f.fbq) returns; n = f.fbq = function () {n.callMethod? n.callMethod.apply (n, arguments): n.queue.push (arguments)}; if (! f._fbq) f._fbq = n;

n.push = n; n.loaded =! 0; n.version = 2.0 & # 39 ;; n.queue = []; t = b.createElement (e); t.async =! 0;

t.src = v; s = b.getElementsByTagName (e) [0]; s.parentNode.insertBefore (t, s)

} (window, document, script, // connect.facebook.net/en_US/fbevents.js');

fbq (& # 39 ;, & # 39; 712739455529100 & # 39;);

fbq (& # 39; track & # 39 ;, "PageView");

[ad_2]

Source link

Tags Confirmed growth quotWhen rate trade WAR