[ad_1]

ON MARCH In the 29th year, Lyft became the first publicly traded brokerage company. The company's stock price jumped 9% from its start, for $ 22.4 billion. On May 7, the day the first quarter results were released as a public company, the portfolio was worth $ 17 billion. Some investors have even thought that it was too generous. Lyft's share price fell another 11% the next day.

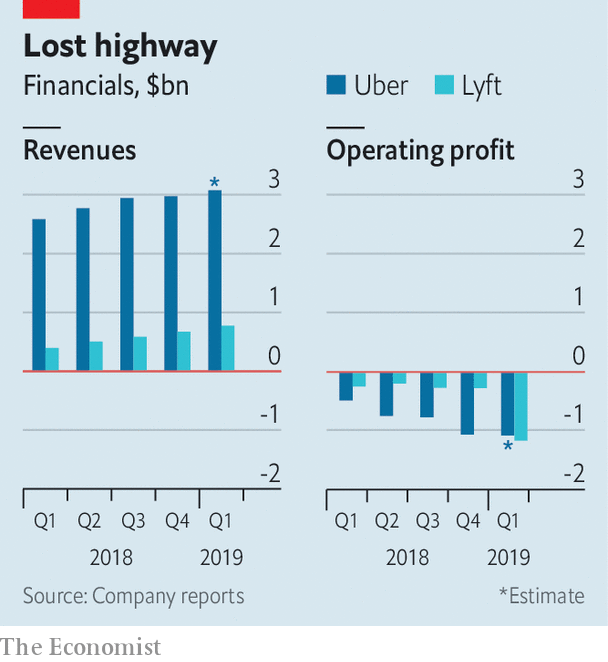

Despite quarterly revenues of $ 776 million, nearly double the level of last year, the company also recorded a loss of $ 1.14 billion, a higher loss than in 2018. consisted mainly of reserving stock-based compensation plans for employees. , which earned $ 894 million through the Lyft IPO. Lyft CFO Brian Roberts acknowledged that 2019 would be "the year of maximum losses". He will "gradually progress towards profitability" thereafter, he promised.

How could this happen is not clear. Lyft continues to bleed, even excluding employee compensation, as selling, marketing and insurance costs increase. The company's adjusted operating loss of $ 230 million increased little over the previous year, despite rapid growth in sales. And Lyft expects sales growth in the second quarter of 2019 to slow sharply.

All that is true of Lyft is also valid for Uber, but more. The Goliath company, which was on strike, was scheduled to list its shares on the New York Stock Exchange on May 10, with a market capitalization several times higher than that of Lyft. His losses are also greater. According to Uber's unaudited first quarter results, Uber again lost about $ 1 billion in the first three months of the year. This brings the total since its inception in 2009 to $ 9 billion.

Both companies have enough cash to continue to spend money for years, but public investors expect a quick path to profitability. To go black, it will either increase prices or reduce the number of bookings sent to drivers. The first will be difficult; In many markets, passenger transport competes with other cheap forms of transport, such as buses, bicycles and cyclists' cars.

The latter looks even harder. Drivers on both platforms complain about income that barely covers the cost of living. They organized a global strike to coincide with the Initial Public Offering. That's why Lyft and Uber wish to get rid of drivers completely. During its call for results, Lyft announced that Phoenix runners could soon book one of ten robotaxis robots (all with human security pilots to start). These will be provided by Waymo, the autonomous vehicle group of Google's parent company, Alphabet. In March, Uber raised $ 1 billion from investors, including Toyota, a Japanese auto giant, for its own business. The initiatives of both companies have no doubt been designed to tell Wall Street that there is a way to turn red ink into gold. Perhaps.

[ad_2]

Source link