[ad_1]

House prices in the Bay Area area fell from one year to the next last month for the first time in seven years, according to a report released Monday by research firm CoreLogic.

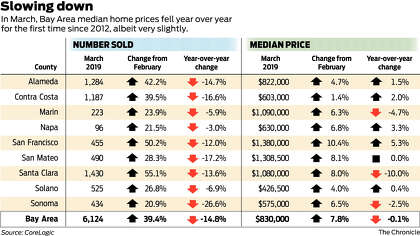

The median price paid for a new or existing home or condo in the nine counties was $ 830,000 in March, up 7.8% from February but down 0.1% from March from March. Last year.

The last time prices fell from one year to the next, it was in March 2012. After that, they rose for 83 consecutive months, often at double digits for long periods. In March of last year, the median price had increased by 16.2% compared to March 2016. Subsequently, the rate of appreciation slowed down, but was still positive up to In February.

"It's not surprising that we're facing the wall, at least in terms of a break," said Andrew LePage, an analyst at CoreLogic.

Sales and house prices generally rise between February and March, as buyers position themselves to relocate during the summer. And they did it this year, "but not as much as last year," said Glen Bell, a broker at Better Homes and Gardens Reliance Partners in East Bay.

"It's not like the sky is falling," he said. "We are gradually moving from the successful seller market to a more balanced market. There are fewer offers, properties stay longer in the market, you see price reductions and decreasing sales. "

Santa Clara County experienced the largest year – over – year decline, down 10% to $ 1.08 million. But it was also the most popular market in the Bay Area, if not the nation, early last year.

"We have seen some weakness and some deceleration," said Michael Repka, General Manager and Senior Legal Advisor at DeLeon Realty in Palo Alto. One of the main reasons, he said, is the change in federal tax legislation.

Starting last year, the federal deduction for all state and local taxes was capped at $ 10,000. In Silicon Valley, many homeowners alone pay more than $ 10,000 in income taxes, which means they get no deduction for property taxes, which can reach tens of thousands of dollars on newly purchased homes.

It did not seem to matter much at the beginning of last year. "People did not understand how bad it was until they taxed," Repka said.

The number of homes sold in the San Francisco Bay Area last month reached 6,124, up 39.4% from February, but down 14.8% from the previous year. previous, CoreLogic announced.

Home sales and prices recorded in March "mainly reflect buyers' buying decisions in February," LePage said in a press release. In February, the market was recovering from the partial closure of the government, the stock market was improving and mortgage rates were falling.

Since the end of February, the stock market has gone even higher, mortgage rates have gone down and three major Bay Area companies, Lyft, Pinterest and Zoom Video Communications, have gone public, and others to come up.

The next two months will likely determine whether many new buyers last year – when prices hit a record high of $ 875,000 in May and June – can be tempted by lower mortgage rates, lower prices and more. lower and cash flotation – or if something more fundamental happens.

Census data released this month showed that the Bay Area's estimated population growth over the last two years had slowed significantly from the previous six years, and that the astronomical housing prices in the area were at least responsible party. In the counties of Sonoma, Napa and Marin, the population has decreased in the last two years ending July 1, with fires leaving many people homeless.

Jason Nelson, agent at Alain Pinel / Compass in Mill Valley, said that in South Marin, "there could be some slowdown in the market, especially in the high end. For cost-effective homes that meet what people are looking for – level of finish, location, uniqueness – they will always ask too much with multiple offers on short dates in the market. "

"The houses that remain on the market are priced that the market simply can not stand. People say that this house cost $ 2 million, so my house has to cost $ 2 million, but it has different points of view, different equipment. "

In the counties of Alameda and Contra Costa, the inventory of homes is almost double that of last year, Bell said. At the end of March, there was a stock of 39-day homes on the market, which means that if houses were selling at the same rate they were selling in the last 12 months, it would take 39 days for all to sell. At the same time last year, there was a 24-day supply. With this type of increase in supply, "you think that there would be an increase in sales. We do not see that. "

In "still-hot" cities, such as Berkeley, Albany, El Cerrito, Alameda and parts of Oakland, many houses are still selling at prices above the asking prices. "We are seeing more weakness in the west and central Costa Costa County."

But in general, he said, most homes sell at list prices or slightly above or below. In other words, a more normal market.

Kathleen Pender is a columnist at the San Francisco Chronicle. Email: [email protected] Twitter: @kathpender

[ad_2]

Source link