[ad_1]

Shares of Micron Technology Inc. rose in the extended session on Thursday after the memory chipmaker’s earnings confirmed the industry was at a turning point.

Micron MU,

earnings and forecasts beat Wall Street estimates, and shares rose 1.8% after-hours, after rising 2.6% to close at $ 79.11 in regular session.

Micron reported first quarter net income of $ 803 million, or 71 cents per share, from $ 491 million, or 43 cents per share, in the same period a year earlier. Adjusted earnings, which excludes stock-based compensation expenses and other items, were 78 cents per share, compared to 48 cents per share the year before.

Revenue reached $ 5.77 billion, up from $ 5.14 billion in the quarter last year. Analysts polled by FactSet had forecast adjusted earnings of 68 cents per share on revenue of $ 5.66 billion.

DRAM sales accounted for 70% of revenue, the company said. Compute and network sales rose 29% to $ 2.55 billion, while mobile sales rose 3% to $ 1.5 billion in revenue for the quarter.

Micron expects second-quarter adjusted tax profit of 68 cents to 82 cents per share on revenue of $ 5.6 billion to $ 6 billion, while analysts forecast profit of 67 cents per share. share on a turnover of 5.55 billion dollars.

“We are excited about the strengthening of the DRAM industry fundamentals,” said Sanjay Mehrotra, CEO of Micron. “For the first time in our history, Micron is at the forefront of DRAM and NAND technologies, and we are in an excellent position to benefit from the accelerating digital transformation of the global economy powered by AI, 5G , the cloud and the smart edge. ”

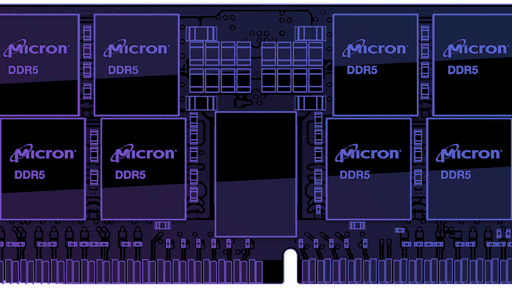

Micron specializes in DRAM and NAND memory chips. DRAM, or dynamic random access memory, is the type of memory commonly used in PCs and servers, while NAND chips are the flash memory chips used in USB drives and smaller devices, such as digital cameras. .

Micron shares have gained 36% over the past 12 months, compared to a 57% increase in the PHLX Semiconductor SOX index,

an 18% increase in the S&P 500 SPX index,

and a 44% gain in the Nasdaq Composite Index COMP,

[ad_2]

Source link