[ad_1]

February 25 was a great day for shareholders of General Electric (GE). In the morning, the company announced a major asset sale that few were anticipating that would result in a multi-billion dollar debt reduction for the troubled conglomerate, all with a minimal revenue loss in the future. close. This sale in Danaher (DHR) helps the company do what it needs at the moment: focus on debt reduction and streamlining operations, while finding its core business and focusing on growth. Overall, I believe this was one of the company's best initiatives in recent years and would bring real value to shareholders as long as the rest of the company's reorganization would take place. in a satisfying manner.

Look on the sale

According to a press release issued by the management team of General Electric, the company signed an agreement under which it would sell its GE BioPharma business to Danaher in exchange for $ 21 billion in cash plus the purchase of $ 400 million. $ of pension liabilities. GE BioPharma is engaged in a wide range of activities, some of which have already been described here. These include the creation, marketing and sale of disposable consumables such as Fortem-based products, chromatography equipment, cell culture media, instrument development and various services related to this development, etc. Previously, GE BioPharma was a subsidiary of GE Life Sciences, a sub-segment of the conglomerate's Healthcare segment.

In a previous article I talked in detail about the General Electric management team that was selling or selling in one way or another the health sector (that was before management decides at the end of last year to part with the segment), I compared it to Danaher as suggested that the segment as a whole should be worth about 75.51 million dollars. This may seem important, but with revenues of 19.78 billion dollars last year, against 19.02 billion dollars in 2017, and profits of nearly 3.70 billion dollars compared to 3.49 billion in 2017 dollars, it's certainly not unreasonable.

Not only is my decision to compare Healthcare to Danaher sound, but it is becoming increasingly clear that perhaps the real value of the company might be greater than I expected. I say that because, if BioPharma is probably the best part of the segment (compared to other activities such as digital imaging equipment, services related to this equipment, and many more, which probably represents a margin is lower than BioPharma's specialized operations), the fact The fact is that BioPharma is expected to generate sales of just $ 3.2 billion this year (up from $ 3 billion last year), and sells for 21, $ 4 billion.

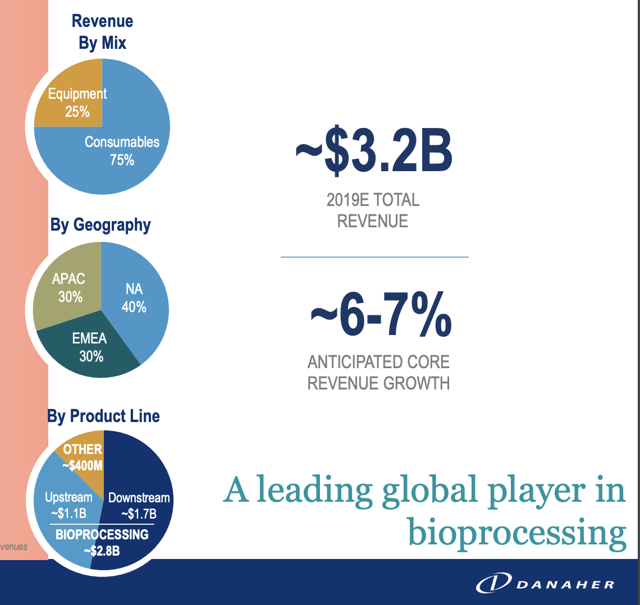

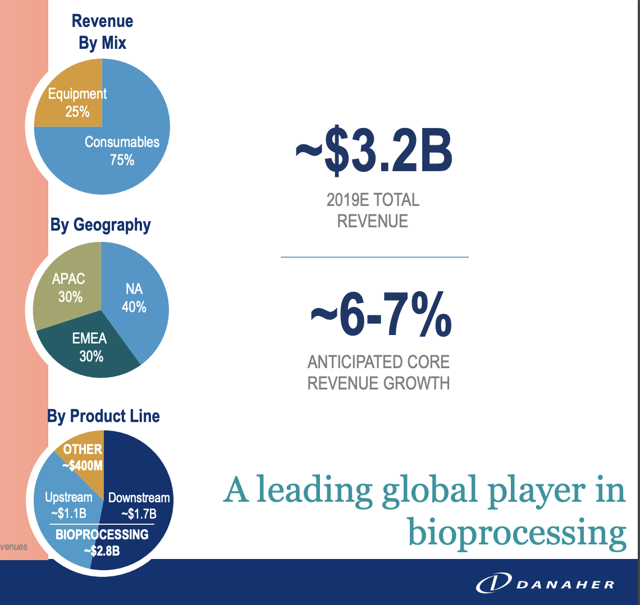

As you can see in the picture above, BioPharma is a set of quite diverse operations. Approximately 40% of its revenue comes from North America, 30% from its EMEA operations (Europe, Middle East and Africa) and the remaining 30% from the APAC region (Asia-Pacific). The Asia-Pacific region should be considered a hot market for single-use products such as those created from Fortem because of the large and aging population in countries like China. The fact that BioPharma is already well established in this market, with an annualized turnover of nearly $ 1 billion and that sales should continue to grow at least 6 to 7% per year, is significant. It should also be mentioned here that BioPharma's sales total $ 2.8 billion and specifically concern bioprocesses, the remaining 400 million being allocated to other activities.

For those who are wondering how Danaher will cover the transaction, it must be said that the company intends to issue equity worth about $ 3 billion in order to bring together funds. At the end of last year, the company also had $ 787.8 million in cash and cash equivalents. She stated that she would use some of this cash, but it is undeniable that the bulk of the value of the transaction will be in the form of debt. For what is worthwhile, management has stated that the weighted average interest rate on the debt it will use will be less than 3% per annum. In addition, it should be noted that even though the purchase price of BioPharma is $ 21.4 billion, the company only pay a net amount of $ 20 billion. Indeed, $ 1.4 billion will come back in the form of tax benefits.

All this is good for General Electric

General Electric is, without a doubt, a big winner here. While Danaher will get a new attractive entity that can generate not only growth but estimated synergies of $ 100 million a year by the third year, General Electric's debt reduction represents a huge advantage. The big question, however, is what happens next. You see, at the end of last year, it was announced that the health sector of the company would be divested, most likely through an IPO. This path does not seem to be optimal any more.

Although I think that a possible IPO or a total break-up and sale of health care is possible, CEO Culp said that an IPO this year is unlikely. Instead, he mentioned that the company would focus on the management of Healthcare's core business. Although Culp has a lot more knowledge and experience than I do in this area, I suppose we will see an orderly sale of the remaining assets as it would likely result in an additional debt reduction of tens of billions of dollars. and the possibility of releasing additional funds. to allocate to the main activities of the conglomerate.

To take away

Based on the data provided, General Electric investors should marvel at these recent developments. The selling price for this set of operations is higher than I would have expected and this shows that my previous assessment of Healthcare as a whole is probably a conservative figure appropriate, if not overly conservative compared to reality. Be that as it may, this money will help management solve many of the conglomerate's problems, while BioPharma's transformation of General Electric's business to Danaher's will help it to continue growing in an attractive space. profitable and competitive.

A community of investors in the oil and gas sectors, eager for E & P space: Crude Value Insights is an exclusive community of investors with a strong taste for oil and gas companies. Our primary focus is on cash flows and the value and growth prospects that generate the greatest potential for investors. You have access to a standard account of more than 50 stocks, in-depth cash flow analysis of E & P businesses and live chat where members can share their knowledge and experiences. Sign up now and your first two weeks are free!

Disclosure: I / we have / we have no position in the actions mentioned, and we do not intend to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link