[ad_1]

Global equity markets hit 2019 high

Despite the weak opening in Europe, global stock markets reached their highest level in two and a half months.

With China up 3% today and the Nikkei in Japan up 1.8% at its highest level this year, the MSCI All-World World Index gained 0.3% highest level since December 3 of last year.

IGSquawk

(@IGSquawk)APAC closing price:#ASX 6089.8 + 0.39%#NIKKEI 21281.85 + 1.82%#HSI 28347.01 + 1.60%#HSHARES 11149.02 + 1.94%# CSI300 3445.74 + 3.21%

Ricardo Evangelista, senior analyst at ActivTrades, explains: why inventories have increased:

Trade talks between the United States and China seem to be progressing well. Both sides made positive remarks on the progress of the negotiations, including on President Trump's admission that he could accept an extension of the March mandate.st delay, maintaining the current level of tariffs on products imported from China beyond that date.

The news seems to have calmed the nerves of investors and as fears of escalating trade conflict abate, so does the value of the dollar.

EU auto industry fears new US tariffs

The optimism over the US-China trade war is undermined by the fear that Donald Trump will impose new tariffs on the European auto industry.

The US Department of Commerce has just tabled a report on whether the EU auto industry poses a threat to national security.

Trump now has 90 days to read this "Article 232" report and decide whether or not to impose levies of up to 25% on imported vehicles or components.

The report is expected to focus on emerging technologies, at a time when the auto industry is struggling to develop better electric technologies as consumers avoid diesel.

The American Association of Engine and Equipment Manufacturers has already urged the White House not to open a new trade dispute, stating:

"These tariffs, if implemented, could displace the development and implementation of new automotive technologies off the coast, leaving America behind.

"Not a single company in the national auto industry has asked for this survey."

This weighs on the stocks of European cars, Volkswagen and Daimler having both lost 1%.

This puts the German DAX in the red. The British FTSE 100 also plunged into trading early, while Europe dropped the bullish left by Asia overnight.

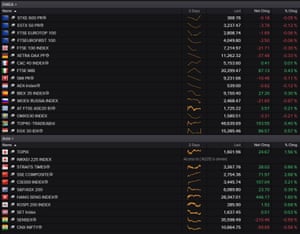

European and Asia-Pacific stock markets Photography: Refinitiv

Rising oil prices are bad news for airline stocks, most of which are down this morning.

International Airlines Group (the parent company of British Airways) leads the FTSE 100 group, down 2%. Cheap airline Wizz Air lost 1.4% and easyJet lost 1%.

The airline industry is also digesting the disappearance of British operator FlyBMI over the weekend. He blamed the Brexit uncertainty and the higher costs of fuels and carbon, which had collapsed, leaving thousands of travelers stranded or in their pockets.

Rakesh Kapoor, CEO of Reckitt Benckiser. Photo: Martinne Geller / Reuters

In the city, the shares of household goods giant Reckitt Benckiser jumped 3% at the top of the FTSE 100 early in the session, after publishing satisfactory results.

Reckitt, whose brands include Dettol, Nurofen and Air Wick, outperformed analysts' forecasts with sales growth of 4% on a comparable basis over the last three months.

CEO Rakesh Kapoor (who will resign later this year) told reporters that "the momentum is improving".

RB has recorded strong growth in emerging markets and North America, but warned that Europe "remains difficult" due to a "difficult pricing environment".

He also announced "a strong performance" in China, thanks to the demand for condoms Durex and Dettol.

But Strepsils sales have been affected by a "weak start to the flu season"[[[[something for the rest of us to welcome, frankly]

A currency trader in the foreign exchange trading room of KEB Hana Bank headquarters in Seoul, South Korea, today. Asian markets were up on Monday, as traders hoped that talks between Chinese and US officials will continue in Washington this week. A photograph: Ahn Young-joon / AP

The Chinese stock market jumped today, partly because of commercial optimism.

The CSI300 index of major Chinese stocks gained more than 3%, which means that it has already gained nearly 15% this year (after heavy losses in 2018).

Australian bank ANZ Bank says:

"Positive signs in US-China trade negotiations have helped strengthen market sentiment."

New data showing that Beijing's attempts to boost investment led to the registration of new loans in January also pleased investors, according to Reuters.

Mike Bird

(@Birdyword)Fierce day for Chinese stocks, Shenzhen A-Share index + 3.7%, Shanghai Composite index + 2.7%. Now up more than 13% and 10% for the year respectively. pic.twitter.com/i1Et0FlhIN

Other Asia-Pacific markets also posted gains, with KOSPI up 0.7% in South Korea, Hong Kong up 1.5%, and up 0.4% for the S & P / ASX 200 in Australia.

Update

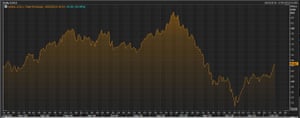

Today's rally means that Brent has increased 25% since the beginning of the year, while trading around $ 53 per barrel.

This reflects the hope that the US-China trade war will calm down, which would be beneficial for global growth (and therefore energy demand).

Photography: Refinitiv

Agenda: Trump says great progress on trade

Hello and welcome to our slippery coverage of the global economy, financial markets, the eurozone and businesses.

The hope of a breakthrough in the US-China trade negotiations is tearing the markets again, at the beginning of a new week.

The price of oil hit a three-month high this morning, bringing Brent crude to $ 66.76 a barrel, a level never seen before in November.

Asian markets also rallied following the announcement that trade talks between the United States and China will continue in Washington this week.

This follows high-level meetings held in Beijing last week that seemed to be going well without anything concrete at the moment.

Experienced locals may remember the old joke thatIt's the hope that kills you"It will be extremely difficult to reach an important agreement between Beijing and Washington, which will really tackle the problems of intellectual property, technology transfer and the reduction of the trade deficit between the United States and China.

But Donald Trump stimulated optimism. After meeting with negotiators, including the trade secretary, Steven Mnuchin, the president said on his blog that "great progress" was made to "so much" on several levels (four "O must be good, no ?!).

Donald J. Trump

(@RealDonaldTrump)Important meetings and calls on the trade agreement with China, and more, today with my collaborators. Great progress has been made on so many different fronts! Our country has fantastic potential for future growth and greatness at an even higher level!

Thus, an extension of the deadline of 1 March – giving more time to reach an agreement – seems possible.

Konstantinos Anthis, responsible for research at ADSSsays the trade will be a big problem this week.

The risk appetite is at the beginning of the week with currencies and stocks supported by signs of progress in US-China trade negotiations. Trump's decision to declare a state of emergency has apparently not disturbed investors, who have become accustomed to the radical character of the US president and the markets are resolutely turned towards any new advance on the trade front this week.

With respect to trade, the latest news from the US-China talks suggests that the two sides have moved closer and that an extension of the March 1 deadline for tariff increases seems likely.

Holger Zschaepitz

(@Schuldensuehner)Global equities start the week in the Risk-On mood. Asian equities are at their highest level since October in terms of trade talks and stimulus rallies. Signs show that the big CenBanks are reviving. BUT exchanges will be thin for Presidents' Day in the United States. Oil rises to 2019 high. Bitcoin at 3.7k. pic.twitter.com/Q8qh0JmIT8

Otherwise, the day looks calm, with nothing important in the economic calendar. Wall Street will be closed for Presidents' Day.

Update

[ad_2]

Source link