[ad_1]

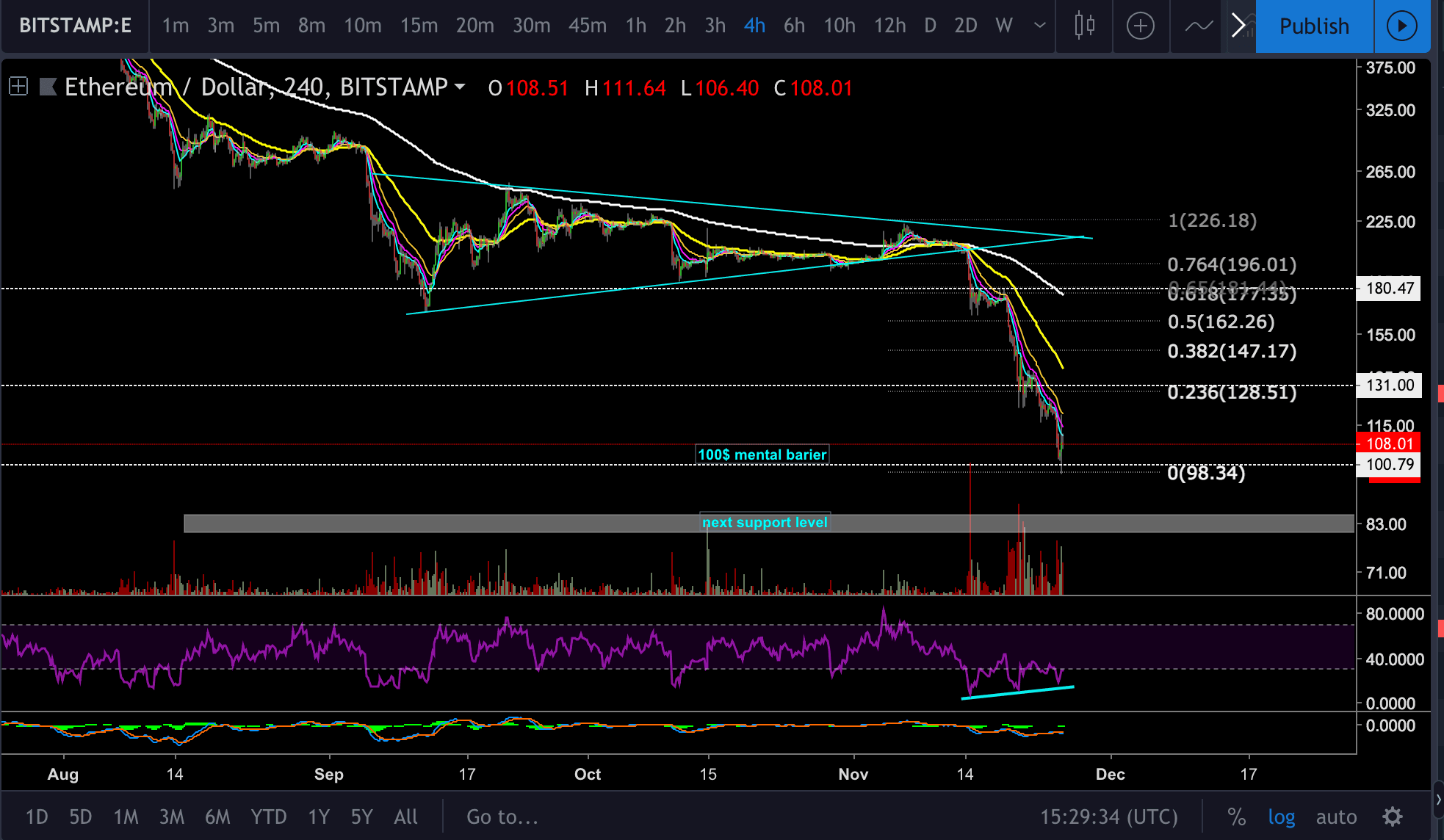

A stormy week has passed in the crypto market. Bitcoin continues its downward trend and other alt coins are crumbling.

The current correction raises the usual question of whether and where the turning point will be imminent. It is difficult to say if the market is nearing the end of the correction and based on the experience of the past, it appears that the market correction has lasted about two years and we have not yet passed a year since the last correction began.

Bitcoin is highly speculative and it is still too early to quantify the value of its technology. If and when the adoption and the massive use of Bitcoin seem to be prevalent, then its price can be estimated more reliably. Until then, market events and trading psychology will continue to cause volatility and potential ETF approval may trigger a new takeover in the near future. This is not a financial advice ..

In addition, the entire market plans to halve the amount of Bitcoin from mining. In the past, the halving had resulted in the price of Bitcoin and the next halving would take place in May 2020.

If all this happens, we must be encouraged to remember that despite the market decline, the infrastructure continues to be built. It will take time for the market and the general public to become familiar with the value of decentralization and how it can change the way people behave, especially with regard to the transparency of the monetary system with blockchain technology. .

It is also important to note that market capitalization reduced to $ 121 billion opens the possibility for big players to manipulate prices. At the same time, the hype of 2017 has attracted the attention of many institutional investors considering their entry into the market. Will they see the decline as an opportunity to buy cheaply or to completely forget the cryptocurrency? We will only know it in the near future.

For Altcoins, the story is different and the trend is mixed given the relationship with the USD. . Most people suffer because they are traded and measured in relation to Bitcoin. The impact on them is stronger and most of them are in the red. In contrast, when traded against Bitcoin, some of them are rising or trading in turn and do not continue to lose value compared to Bitcoin. For example, Factom continues its rise of about 50% this week and it is impossible not to pay attention to Bitcoin SV, which slipped to the 8th place in terms of market capitalization, with a rise of 122% compared to Bitcoin last week. It seems that the market is still generating interest, which can stimulate another wave.

Finally, the nerve index comes from the ego war led by Bitcoin Cash, the tightening of regulations around country offices and media that once again praised Bitcoin as a passing bubble. In the background, the hash rate is down after two consecutive years of steady growth. But the last word has not been said yet.

Crypto News and headlines

Be the first to know our price analysis, cryptographic news and trading tips: follow us on Telegram or subscribe to our weekly newsletter.

Be the first to know our price analysis, cryptographic news and trading tips: follow us on Telegram or subscribe to our weekly newsletter.