[ad_1]

Hello and welcome to our slippery coverage of the global economy, financial markets, the euro zone and businesses.

Fears of a trade war are reverberating in the markets today, after Donald Trump threatened to impose new tariffs on goods from China.

US President undermined hopes of a ceasefire with Beijing saying it was "highly unlikely" to accept Chinese President Xi Jinping's bid to avoid new taxes coming into effect in January next.

Trump and Xi reached an agreement, possibly at this week's G20 summit, which would deter the United States from imposing higher duties on more Chinese imports.

Speaking in the Wall Street Journal, Trump wiped out his hopes by predicting that he would likely increase existing tariffs on $ 200 billion of Chinese imports in January, from 10% to 25%.

Fercan Yalinkilic

(@FercanY)President #Asset indicates that it will increase tariffs on Chinese goods to the tune of 200 billion, from 10% to 25% https: //t.co/Fx6RQcplf9 pic.twitter.com/KCX51Zb5PT

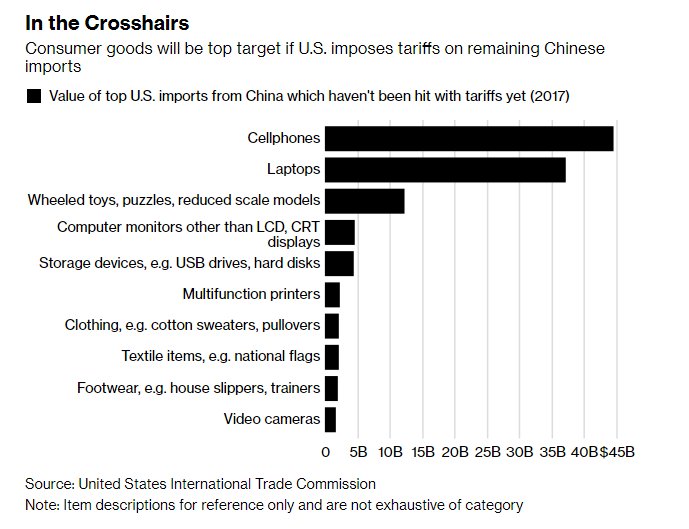

Trump also raised the stakes, threatening to raise tariffs on another $ 267 billion, which means that virtually all Chinese imports to America would be more expensive.

He stated:

"If we do not agree, I will add another 267 billion dollars."

This could include tariffs on Apple products imported from China, the president added, which strikes iPhone and MacBook users in the pocket.

Trump's insisted that Beijing should take into account the US concerns about trade, saying:

China must open its country to the competition of the United States. "

Tariffs are actually a tax on consumers (unless the importer absorbs the cost itself). Trump thinks that Americans can deal with more expensive goods, saying:

"I can do it [the tariff] 10%, and people could handle it very easily. "

The people of Main Street may not agree, so Trump's meeting with Xi at the G20 summit this weekend will be closely monitored.

Also coming today

The Brexit and the Italian budget line will be at the heart of investors' concerns today.

On the economic side, we get UK retail sales figures, as well as home price and consumer confidence statistics in the United States.

L & # 39; s calendar

- 11:00 GMT: CBI retail sales survey in UK in November

- 14:00 GMT: Case-Shiller study of US housing prices

- 15:00 GMT: US consumer confidence report

[ad_2]

Source link