[ad_1]

Italy falls into recession

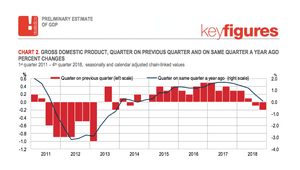

Italy has gone back into recession!

The new GDP figures show that its economy contracted by 0.2% in the last three months of 2018, a worse than expected result.

This follows a contraction of 0.1% in July-September, which means that Italy is now officially in a technical recession.

Italian GDP picture: Istat

The statistical body Istat says:

The change from one quarter to the other is the result of a decline in value added in agriculture, forestry and fishing as well as in the industry and the industry. 39, substantial stability in services.

On the demand side, there is a negative contribution from the domestic component (excluding changes in inventories) and a positive contribution from the net export component.

The euro zone records growth of 0.2%

Newsflash: The euro zone's economy grew 0.2% in the final quarter, as the region continued to post mediocre growth.

This is consistent with the 0.2% expansion in the third quarter of 2018 and is the lowest growth in joint operations in four years.

This means that the euro area has only increased by 1.2% over the last year – a low performance.

The enlarged European Union grew by 0.3% in the last quarter and by 1.8% in the last year.

EU_Eurostat

(@EU_Eurostat)Eurozone #GDP + 0.2% in the fourth quarter of 2018, + 1.2% compared to the fourth quarter of 2017: preliminary flash estimate of #Eurostat https://t.co/QcDZWLywYn pic.twitter.com/5SLGmKtnUL

More soon….

Update

It's not just homes that attract the cold of Brexit.

Overnight, we learned that British car production had fallen to its lowest level in five years in 2018.

The industry blames the risk of a hopeless Brexit – would you invest in new machines if you fear queues in ports and disruptions in the supply chain in a few weeks?

Will Hutton

(@Williamnhutton)Investment in the UK auto industry has now decreased by 80% in 3 years. The growing paralysis defines the London real estate market and extends to the rest of the United Kingdom. Foreign investment has collapsed. This was called "Fear Project" by Leavers. History will curse their arrogant carelessness.

Update

Samuel Tombs, British chief economist at Macroeconomics of the Pantheon, says:

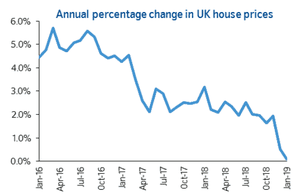

"The uncertainty created by Brexit is largely responsible for the further decline in year-over-year real estate price growth from a generally stable rate of around during the 18 months preceding November. "

The Spanish economy has exceeded expectations, relieving investors in the expectation of the main growth figures of the euro zone at 10 am UK time.

Spanish GDP increased by 0.7% between October and December, a little faster than expected. This is an encouraging sign, one day after France also beat forecasts with a growth of 0.3%.

Jeroen Blokland

(@Jsblokland)EUREKA! #SpainQ4 #GDP growth was 0.7%, more than expected. Year-over-year growth is very good at 2.4%. #La France also beat the estimate of GDP growth yesterday. pic.twitter.com/GRuU40MvRJ

Azad Zangana

(@ AzadZangana)#Spain seems to have resisted the trend in Europe by posting a strong 0.7% increase in #GDP for the 2018 Q4. #economy

We were already waiting for the figures of Italian growth, but I think that they could be made public at 10 am … Will Rome avoid a recession?

In the city, stocks are mobilizing to provide relief that the US central bank is committed to patience before raising interest rates, a sign that borrowing costs may remain unresolved for some time .

The FTSE 100 gained nearly 50 points and reached its highest level in nearly three weeks, while the European indices reached their highest level in two months.

European Stock Exchanges, January 31, 2018 Photography: Refinitiv

Connor Campbell from SpreadEx has the details:

Anxious to catch up after spending a good part of the back of January in the red, the FTSE continued Thursday its closing movement, the index recording 50 points to spawn to 7000.

It is not only the macro-landscape that has stimulated the index; he also received a helping hand with some of his key components. The 36% increase in Shell's annual profits allowed the oil giant to grow by 3.5% early in the session, while Diageo gained 3.7% after gaining a substantial turn, the owner of Guinness and Smirnoff announcing a share buyback of £ 660 million.

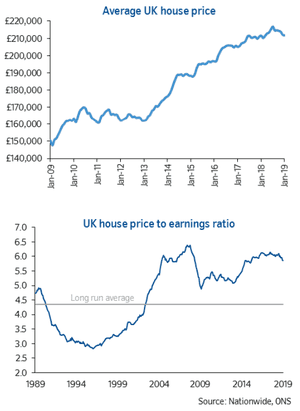

Falling prices since last summer mean that UK homes are slightly more affordable (or slightly less unaffordable).

But as these charts show, housing remains much more expensive – compared to wages – than 20 years ago, and not much cheaper than before the financial crisis.

Data on the price of housing in the United Kingdom Photography: Nationwide

Foxtons profits plummet 80% in a difficult market

A sign of Foxtons.

London real estate agents Foxtons – known for their high fees and screaming minis – are also struggling to rise up.

According to Foxtons, adjusted profits are expected to have fallen by 80% last year – to only 3 million pounds, up from 15 million in 2017, with revenues falling from 118 million to 111 million.

Nic Budden, CEO, said that last year had been one of the worst ever:

"The year 2018 was one of the toughest sales markets we've ever had in London, as transactions fell from historically low levels last year.

Given this, we have achieved a solid performance and taken steps to better prepare our company for these conditions, by taking prudent cost measures and improving our proposal. We are confident in our model that provides high service levels to achieve the best results for our customers.

Foxtons also collected £ 16m in charges this morning, including £ 6m to cover the costs of branch closures.

Economist Howard Archer of the EY Item Club warns that the real estate market will be driven by the Brexit saga this year:

- If the UK finally manages to leave the EU with an "agreement" at the end of MarchWe expect real estate prices in the UK to post a modest gain of 2% over 2019. A likely gradual recovery in real consumer income growth is expected to help the housing market. in 2019, while the high employment rate, still low interest rates and the scarcity of homes on the market will also likely offer support

- If the UK leaves the EU in late March without "agreement" approved on Brexit, housing prices could fall by around 5% in 2019 due to increased uncertainty and a slowdown in economic activity

- If the Brexit is delayed, lingering uncertainty is expected to weigh on the housing market and could well see real estate prices stagnate or even fall slightly

Mark Harris, general manager of the mortgage broker SPF private customers, also accuses the economic anxiety of the slowdown in real estate prices.

"Uncertainty seems to be the biggest problem in the real estate market, with potential buyers and sellers in their hands waiting to see what happens with Brexit.

This means that lenders should offer attractive offers to anyone looking for a mortgage, he adds.

Update

Jeremy Leaf, real estate agent in North London, said the UK real estate market "was struggling to weather the Brexit storm but was not going to collapse"

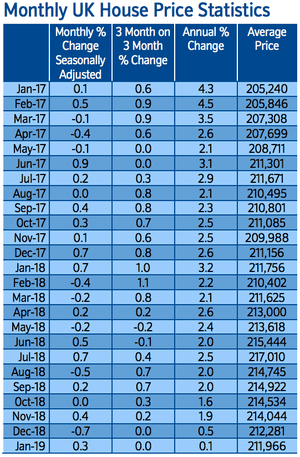

The average British home now costs nearly £ 220,000, Nationwide reports, about £ 5,000 less than last summer.

Good news for first time buyers, of course.

House prices in the United Kingdom

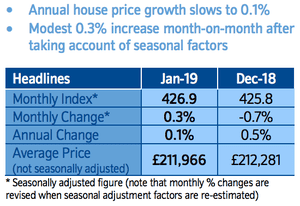

Introduction: real estate prices in the UK stagnate

Hello and welcome to our slippery coverage of the global economy, financial markets, the eurozone and businesses.

The UK real estate market is feeling the cold of Brexit, prices stagnant as economic uncertainty grows.

New figures released by Nationwide show that prices rose only 0.1% from the previous year, down from an annual growth of 0.5% in December.

This is the lowest annual growth rate since February 2013.

The average house price is now lower than that of summer, even though it rose 0.3% in January after a sharp decline in December.

Photography: Nationwide

This is another sign that the economy is under pressure, with less than two months before Britain leaves the EU.

Robert Gardner, Nationwide According to the chief economist, the annual growth in real estate prices "virtually halted completely in January".

Photography: Nationwide

Gardner blames the "uncertain economic outlook" for driving the real estate market down.

"Real estate market activity indicators, such as the number of real estate transactions and the number of mortgages approved for the purchase of a home, have remained broadly stable over the past few years. months, but forward-looking indicators had suggested a slight slowdown.

"In particular, consumer confidence indicators weakened in December and investigators reported a further decline in inquiries from new buyers by the end of 2018. The number of properties placed on the market has also declined. but this does not seem to have been enough to prevent a modest change in the balance of supply and demand in favor of buyers over the last few months.

Gardner adds that the economic outlook remains "unusually uncertain," adds Gardner. But he hopes the prices could rise this year if the economic conditions resist.

If the economy continues to grow at a moderate pace and the unemployment rate and borrowing costs remain close to current levels, we expect real estate prices in the United Kingdom to rise. United Kingdom are growing at less than 10% in 2019. "

Reaction to follow ….

Also coming today

Italy could fall into recession this morning! The new euro area GDP figures, expected at 10 am, could indicate that the third largest member of the euro area contracted by 0.1% for the second consecutive quarter.

The broad euro area is expected to have grown by only 0.2%.

European equity markets could record gains after a strong rally on Wall Street last night after the US Federal Reserve said it would be patient for a further rise in interest rates.

Holger Zschaepitz

(@Schuldensuehner)Christmas in January! dovish #Nourris increases global risk assets. This is the first day of the Fed's meeting during which the S & P 500 has rebounded since President Powell's term began, breaking a series of 7 consecutive losses on the days of the Fed's meeting, DB said. Bonds are up with US 10y at 2.67%. Euro> $ 1.15. pic.twitter.com/JgfIs5F8pU

L & # 39; s calendar:

- 10 o'clock in the morning

9 am

- 10:00 GMT: Euro zone GDP for the fourth quarter of 2018

- 13:30 GMT: US weekly unemployment figures

Update

[ad_2]

Source link