[ad_1]

Economy / Recession 2020

September 14, 2019 – 12:07 GMT

By: Dan_Amerman

There is a very good chance that a recession will occur within one to two years, and this could even happen within a few months.

There is a very good chance that a recession will occur within one to two years, and this could even happen within a few months.

As we have explored in this analysis, if there is a recession, the means of containing and overcoming it will necessarily be an unprecedented experience. This means that there is an unusually high risk that the recession is not normal – which could wipe out the fundamentals of many traditional retirement investment strategies that blithely assume that we can know in advance that we can know in advance that a "normal" scenario The short recession is the downside scenario.

Once we have accepted the reality of the "great experience", this means that we will probably see the prices of investments evolve in an equally unusual way. Indeed, amplified benefits are likely to be accompanied by new risks. Crucially, we also currently know (based on the Federal Reserve's public plans) that some of these benefits will not be generated by the usual sources.

Many people believe that we have returned to normal from the economic point of view and the investment outlook. Therefore, if there is a recession, it will be "normal" (according to the criteria of the last half of the 20th century), with "normal". investment results.

This series and this book have developed an entirely different perspective – we are not in a normal economic and investment period. Because a side effect of this anomaly has been (and could continue to be) abnormally high asset prices for equities, bonds and real estate, this produces a superficial placidity that may indeed seem both desirable and "normal" for years potentially at a time. .

The two versions of reality diverge when stress strikes the system, as in a new recession. At this stage, apparent placidity can disappear instantly and financial and economic systems based on anomalies such as extremely low interest rates, quantitative easing and many negative interest rates around the world can be forced to moving can not be anticipated when someone considers our current situation as being "normality".

This analysis is part of a series of related analyzes that support a book being written. Some key chapters of the book and an overview of the series are linked here.

The next recession will be an unprecedented experience

Whether it's the slowdown in global economic growth, trade and currency conflicts, or increasing reversals of the US yield curve, growing signs of an impending recession are appearing on the front pages of the United States. financial media a more or less daily basis. And yes, there are still many signs of economic strength, so we can not say that the recession is guaranteed at this point – but the signs of the recession have clearly increased.

As explored in the previous analysis "Will the Fed's actions create prices for Dow 40,000 – and triple the gold?"(link here), the Federal Reserve does not passively accept the possibility of a new recession, but goes preemptively to the" dovish "mode. In this case, the same situation occurs. is already produced before, when it comes to combining 1) plunging long-term bond yields, 2) inversions and quasi-inversions of the yield curve, and 3) a formidable federal reserve that switch to "dovish" mode in order to prevent such a recession.

One result is that the NASDAQ actually tripled in the next 26 months, from 1,570 at the end of December 1997 to 4,697 at the end of February 2000.

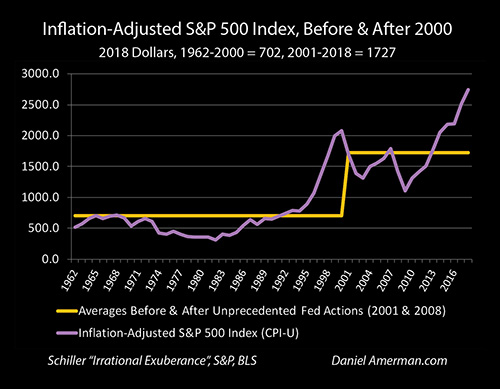

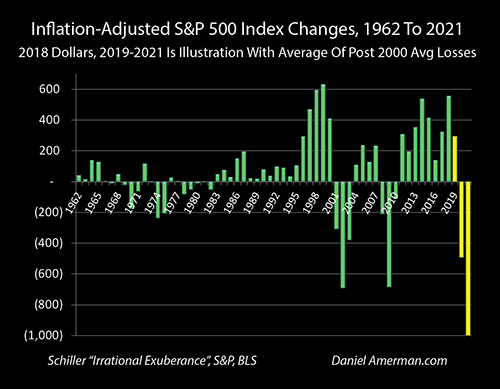

The S & P 500 broadly has not moved much, especially if it is considered in inflation-adjusted terms, as indicated above, but from an already high base (a bit like today hui), the market grew another 50% and created wealth in those three years as the total (adjusted for inflation) value of the S & P 500 from a year prior to 1991.

The Fed eased and is helping to drive stock prices to significantly higher levels, compared to an already historically high base, is now known as the stock market bubble.

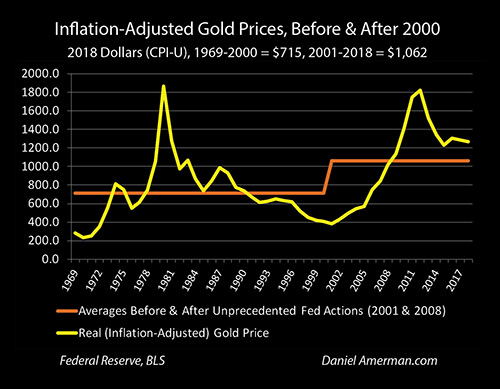

When the technology bubble collapsed, not only did it generate the largest losses in history, it also tripled the price of assets. This second tripling was for the price of gold corrected for inflation and, as can be seen in the graph above, it occurred over a much longer period of time. extending to the high (quite abnormal) prices of gold today.

While there are intriguing parallels between 1997 and the current situation, many more have changed – this includes both our economic situation and the related financial fundamentals that support the current high prices of our assets.

The great experience

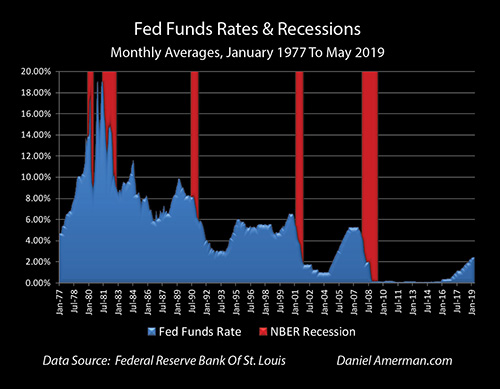

To see why this recession will necessarily be an unprecedented experience, we must start with the graph above. The previous recessions of the past 40 years are shown in red and the level of Fed Funds interest rates is shown in blue.

Note that whenever there is a recession, the federal funds rate drops. This happens every time, without exception, because it's a policy – and the main recession tool of the Federal Reserve's policy book is to lower interest rates in the short term. There is no backup or proven alternative.

Now let's go to the right of the graph above and see why the next recession will be unprecedented in the modern era. The Fed had pursued for seven years an unprecedented experiment: zero percent rate, virtually disappearing the blue zone between late 2008 and late 2015. It then began to slowly increase its interest rates to short-term, but had to stop at the end of 2018, as fears that any future rise in interest rates will lead to the next recession.

This leaves the Fed – and all of us – stuck between "hard and hard". There is no proven method to shorten and contain recessions without lowering federal funds rates. As a result of interest rate policies of zero per cent, interest rates could not reach half the height traditionally required to exit the recession, before the cycle had to be stopped in order to avoid triggering the next recession.

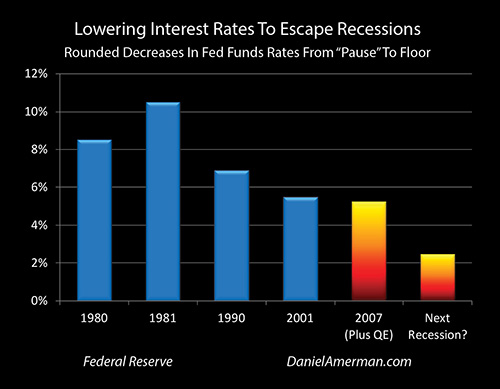

This relationship is also visible in the graph above, where the bars' height shows the power of interventions on interest rates used by the Federal Reserve to contain and exit each recession. For the five recessions between 1980 and 2007, the US Federal Reserve reduced interest rates by an average of 7.25 percent per recession (as discussed in Chapter Four).

If you look at the bar on the right, the current starting level of interest rates is less than one third of the historical average for what has been used. Thus, even if the Federal Reserve immediately reduces interest rates to zero per cent – which is what it plans in the event of a recession – it has only about 29% firepower available for the only proven method to contain and break out of modern-day recessions. (And if the Fed lowered its 0.25% rate at the September meeting, it would be only 26% of the average firepower used to recover from previous recessions.)

It lacks more than seventy percent of the proven firepower needed to contain and exit recessions. And to know if the Federal Reserve can really contain and pull out of another recession as most investors do, it's a great experience, although it's a forced experience that the Fed would strongly prefer to avoid.

Nobody knows what will happen if this experience is attempted. It never happened in the United States.

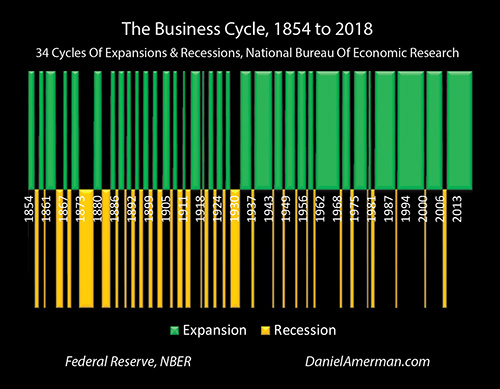

When we look beyond the modern era, when the Fed did not use these ammunition, recessions were much more frequent and lasted longer. As explained in Chapter 2, the long-run averages of economic downturns – as shown in the gold bars on the left side of the graph above – are that they occurred about 40% more often and lasted on average 50% longer. every time.

For some reason, the widespread belief that the Great Recession was a "every hundred years" event was widely encouraged. However, as far as I know, it is simply a round number that was invented from scratch, because it can not even be relied on at a distance on a thorough examination. real economic history.

Events such as the Great Recession were commonplace, they were the norm and much worse events were not uncommon, if we used these 160 years of real economic history.

Now, does this mean that something catastrophic is necessarily on the way? Not at all – assuming that the worst is inevitable would be just another form of false certainty.

The Fed entering into recession while it lacks more than 70% of its only ever-recognized source of firepower in recession, simply means that we do not really know it. The Fed will be forced to try a great deal for the economy, the markets and the future performance of investments.

This has crucial implications for decision making in all major categories of investment, including stocks, bonds, real estate and precious metals. We simply can not assume (as are so many) that the historically light and abnormally short recessions of the post-World War II era will be repeated in the next cycle, with a relatively rapid recovery in stocks and prices. real estate in particular.

Now, again – this very positive scenario could happen. However, there is at least as much chance that this is not the case, given the lack of balance sheet. (And if we want to know why the Fed is doing what it is now, as detailed in the last workshop – it is because it considers that the surest way out of this uncertainty is to intervene. Preventatively in order to maintain the current situation.recession to occur in the first place.)

A real and profound uncertainty is only that: you do not know, I do not know, nobody really knows it.

The next recession will result in unprecedented price changes in investment

Although we do not know if this will work in the end or not, we know what the Federal Reserve has in mind for how it will compensate for 70% to 75% of its missing firepower. As noted in previous chapters, it is planned to make one of the most aggressive interventions in history on the market – something new – in order to pull the US out of a potential recession.

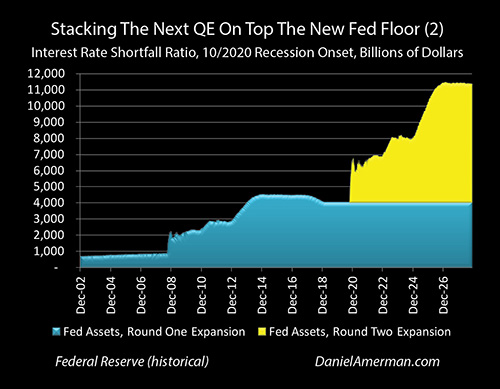

The first step is immediate monetary creation via Quantitative Easing (QE), on a potentially massive scale that will likely involve billions of dollars of new currency. The chart above, presented in Chapter 8, illustrates this phenomenon, with the Federal Reserve's balance sheet still outstanding in blue and a new round of quantitative easing potentially under consideration.

This next step is one of the places where I currently see the biggest difference between sophisticated institutional investors and the millions of individual investors who have no training in this area.

Many people seem to think that measures such as "quantitative easing" and "monetary policy" are either: A) theoretical abstractions that are not really important for the concrete application of the established science of investment decision-making; or B) are high-risk bets involving the operation of printing presses and whose near guarantee is to lead to an imminent monetary and financial collapse.

The goal behind creating billions of dollars of new dollars is 1) spend billions of dollars; to 2) drastically change the price of investment in a very short period of time; and to do so 3) for the intended purposes of create economic stability.

This currently planned 1-2-3 combination is at the opposite of a theoretical abstraction: it is an active and real intervention that can put back hundreds of billions of dollars in cash profits altogether. to investors who understand what the Fed is doing. If it works, the end result will be the direct opposite of a melting scenario (at least for a while and possibly for several years).

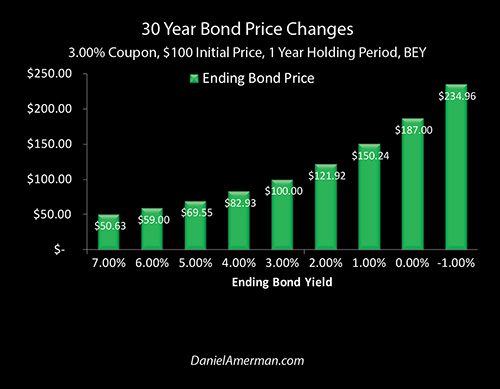

As explained in more detail in Chapter 13, the Fed intends to use its trillions of new money to fund a maturity extension program. Another way of saying this is that the Fed can create a huge amount of money, as shown in the yellow box of the "stackable QE" chart, and spend it to immediately move the green bars of bond prices right into the graphic. above.

By using massive and immediate purchases of medium- and long-term bonds to force medium and long-term interest rates to new lows, the Fed intends to overcome the limitation of the lack of striking power of short term interest rate.

This is the great experience.

The strategy envisaged is to create billions of new dollars and use them to pay exorbitant prices for medium and long-term bonds (deliver huge gifts to what is mainly a select group of insider investors in the process, all in the national interest of course), then the combined use of much lower interest rates in the short, medium and long term to pull the United States out of recession.

Will it work? Nobody knows – we have no idea. It's all an experience. There are theoretical reasons to believe that this might work, but economic theory is often wrong and we lack real world evidence.

If it works, we could have another typical recession for the post-World War II era, which is shorter and shallower than the long-term average.

If the experience does not yield the desired results, many popular retirement investment strategies could all fail again, with potentially devastating losses for equities and real estate, even though the Totally shocked investors rationalize their losses by saying, "Who could have seen two hundred years of consecutive recession?"

The central question

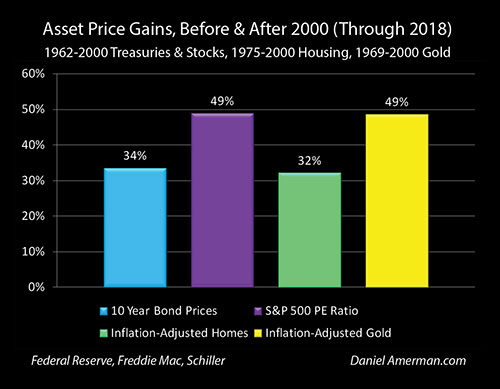

The chart below compares the average ratings for the main categories of investment in stocks, bonds, real estate and gold, over two different periods. The 100% basis corresponds to long-term averages prior to 2001. The bars representing the increase above the base correspond to the averages from 2001 to 2018 – including both the bubble collapse and the technologies and the 2008 financial crisis.

What does the graph above mean? That's the central question, is not it?

Many people – perhaps most people – would say that the graph shows a prosperous normality. A recession is not necessary, but if it happened, it would be just a temporary "divot" on the way to a place where future wealth and prosperity would be more or less blocked, provided the rules were respected. disciplinary. of resolute science of long-term financial planning and wealth creation.

Developing a logical alternative response was my main focus in Chapter 1 (link here), where I showed why the extraordinary interventions of the Federal Reserve, used to contain the crisis since the collapse of the technology bubble, would lead to a rise abnormal valuations of the least temporarily stable assets shown in the graph above.

Because where we are now and in recent years, the two paradigms can coexist simultaneously.

A divergence could be forced either with a new recession – or with major interventions by the Fed to try to prevent a new recession. In both cases, the divergence could occur very quickly, with very little notice.

One possibility (although not quite certain) is that there is a recession and the stock market is reacting pretty much the way it has done the last two times. Only losses occur from the starting point of a much higher base. As noted above and developed in Chapter 15, this simple repetition of the past from current levels could result in the largest losses in the stock market in history, perhaps equivalent to a net loss in value. households of $ 12 trillion.

This could lead to a real recession, which would require everything the Fed has to have the necessary firepower. But that comes back to the Fed that is missing something between 70% and 75% of its proven firepower to contain and out of an average recession, and is considering making up for lost time with the unproven experience of using the EQ to finance a MEP (as explained in Chapter 13).

Thus, years of extremely low rates producing abnormally high asset prices lead (still) to abnormally high losses with a mere 35th iteration of the business cycle, the theory of great planned experience turns out not to to be at the height of the particularly difficult task The task of each to manage a severe recession in practice, as well as the depth of the recession and its duration, remains to be guessed.

Is this a scenario so far-fetched? I guess those who are fond of rounded numbers call it a "once in a millennium" opportunity instead of the so-called "once in a century" occurrence of 2008. However, each of these steps is not so unreasonable, and if someone wanted to be pessimistic or get into "sadness" completely, then one could argue for a much worse case.

That said, simply assuming that the situation is catastrophic and entering a bunker mentality could be a serious mistake. Indeed, understanding the actions of the Fed to avoid and / or contain a new wave of recession and crisis could lead to new high assets in several categories is a key element of chapters 3, 5, 7, 9, 11, 13 and 14 (until now). ).

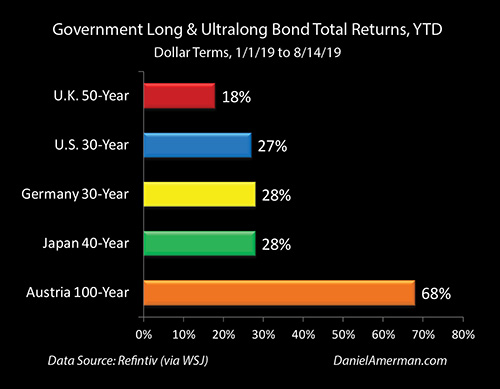

For example, whether it works or not, the Fed openly intends to use an unprecedented program to create billions of dollars in order to directly supplant the forces of the free market, with the specific objective of creating competitive prices. long-term bonds setting records – and therefore, long-term records bond capital gains.

The chart above shows the total returns of long-term and very long-term bonds worldwide in 2019, up to mid-August. It was these savvy institutional investors who anticipated the recession and tried to capitalize on what the Fed plans to do in the event of a recession. In fact, it is very solid (as I wrote over the last year) to demonstrate that it is this behavior seeking profit from savvy investors that creates inversions of the yield curve.

Keep in mind that, according to the Merrill Lynch survey of fund managers, The purchase of long-term bonds was the most crowded trade by fund managers in June and July 2019 – a large part of the market was trying to get some of this action.

This situation creates an interesting divergence. The plan is known – and investing in its execution is extremely popular among savvy institutional investors, although most millions of average individual investors seem to have no idea what is going on. There is therefore a fairly significant redistribution of wealth in progress between different categories of investors.

At the same time, it is totally unknown whether the intended experiment will work or not, and shorten or contain the next recession (and may be more or less relevant to bond price movements and massive redistribution of the wealth that has occurred before). .

Thus, the most sophisticated and "insider" segments of the markets understand that the Fed intends to hand them rather colossal gifts as part of an unprecedented experiment to reduce the recession and to get out. In the meantime, for many millions of average investors, they do not understand the gifts or risks that will come from this new great experience, but instead continue to invest in a world that has long since disappeared.

The playing field is quite uneven and maybe there should be no surprises. Let us hope that this, as well as the associated chapters and analyzes, have given the reader something to think about in this regard.

Daniel R. Amerman, CFA

Website: http://danielamerman.com/

E-mail: [email protected]

Daniel R. Amerman, Chartered Financial Analyst, holds an MBA and a BSBA in Finance, is a former business banker who has developed new sophisticated financial products for institutional investors (in the 1980s) and was the author of McGraw-Hill's leading reference book on mortgage derivatives. in the mid-1990s. A great critic of preconceptions about long-term investments and retirement planning, Mr. Amerman spent more than 10 years creating a radically different set of solutions for individual investors. , designed to thrive in an environment of economic turmoil, broken promises and repressive government. Taxation and the collapse of traditional retirement portfolios

© 2019 Copyright Dan Amerman – All rights reserved.

Disclaimer: This article contains the ideas and opinions of the author. It is a conceptual exploration of general financial and economic principles. As with any financial discussion of the future, there can be no absolute certainty. What this article does not contain is professional, legal, tax or other investment advice. If specific advice is needed, seek the advice of a competent professional. Any liability or warranty for the results of the application of the principles contained in the article, the website, readings, videos, DVDs, books and related materials, directly or indirectly, is expressly disclaimed by the author.

© 2005-2019 http://www.MarketOracle.co.uk – The Oracle Market is a FREE Daily Online publication of financial markets analysis and forecasting.

[ad_2]

Source link