[ad_1]

The three major determinants of the health of the oil industry are currently 1) global demand, 2) US production and 3) OPEC production. Every month OPEC, as an organization, publishes its own forecasts for the oil industry. If they do not plan their own production as a team, they provide a glimpse of the last few months that gives market players an idea of how much oil has been produced and what it means for the global market. In its latest report, the group targeted the April output, which was about flat compared to the previous month. But combined with global demand, illustrates a very optimistic picture for investors moving forward.

Production of OPEC flat

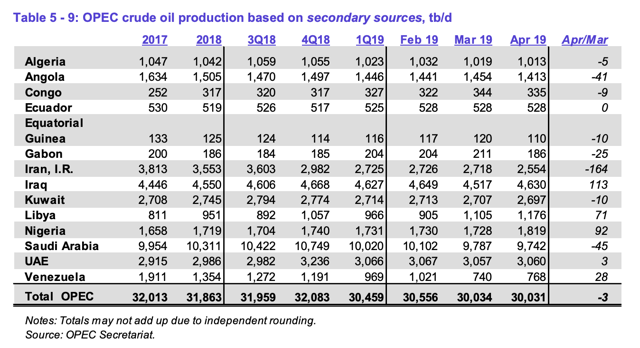

In April, OPEC production averaged 30.031 million barrels a day, or about 3 billion barrels a day., 000 barrels a day lower than what had been seen just a month earlier. This does not mean, however, that each member country has seen its production also flat. Far from there. For an overview of the group as a whole and each country, please refer to the image below.

As you can see by looking at the picture, several members of the group have made significant fluctuations. The largest movement came from Iran, whose oil output fell by 0.164 billion barrels a day, from 2,718 million barrels per day in March to 2,554 million barrels per day in April. This decline can almost certainly be explained by the proliferation of sanctions and the (realized) fear that waivers for some nations purchasing crude oil from Iran will not be renewed. Saudi Arabia was the only other major downward trend during the month. It produced 9.742 million barrels a day., 000 barrels a day lower than what we saw in March.

Although these declines were significant, other countries intervened and offset these declines. Iraq leads with production rising by 0.113 billion barrels per day, from 4.517 million barrels to 4.630 million barrels per day, almost the same as the decline from February to March. Libya and Nigeria saw their production climb 71, 000 and 92, 000 barrels a day, respectively, month after month, and even Venezuela, despite a major economic crisis, has seen a modest increase of 28, 000 barrels per day (probably a recovery caused by the drop of 0.281 million barrels per day in the previous month, partly due to temporary power cuts nationwide).

In the coming months, it is likely that Saudi Arabia's output will remain essentially stable (adjusted for possible increases to cover Iran's losses), but, as latest news has indicated, geopolitical risks are increased from Iran. Iraqi production is likely to increase during this period, but countries such as Libya, Nigeria and more particularly Venezuela are expected to experience extreme volatility, with the first two countries recording real ups and downs, while Venezuela is expected to target mainly lower production.

Balance is positive for bulls

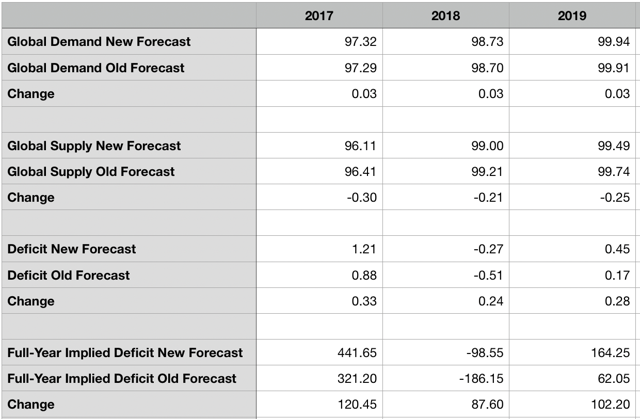

Whatever your point of view, the situation of oil investors is undeniably optimistic at the moment. Without even taking into account Russia-related considerations, which I had already written in a previous article on OPEC data and which I still consider relevant, the world is either in deficit or in progress quickly. To see this in detail, just look at the chart below.

As you can see here, global demand figures look a little more optimistic (up to 30, 000 barrels per day for 2017, 2018 and 2019) compared to what was seen in March. The offer, however, seems much more appealing to bulls. In 2017, production would have been 0.30 million barrels a day lower than it was estimated a month ago. This should translate into a drop in supply of 0.21 million barrels a day last year and 0.25 million barrels this year, all in relation to previous forecasts. It is worth mentioning that, for procurement, I used OPEC's first quarter results this year, and then annualized the month of April for the remainder of this year, so that significant changes from April's production levels could have a significant impact on gross balances.

As the table illustrates, these changes, particularly on the supply side, have major implications for global oil markets. Assuming everything that the OPEC has presented is accurate, the end result is exciting. Not only was the global deficit in 2017 estimated at 120.45 million barrels higher than expected worldwide, but the change in excess production of 87.60 million barrels last year is offset by the overall production of 102.20 million barrels this year. Overall, this year's overall deficit is expected to reach 164.25 million barrels, bringing the overall global deficit between 2017 and 2019 to 507.35 million barrels, or about 310.25 million barrels more than what was been posted a month earlier. While most of this money has been used to address the overabundance problem, the problem is largely solved and we are in a state where real stocks may be declining around the world.

To take away

Based on the data provided, it looks like the market is really looking for bulls. Despite rising global production, supply figures appear attractive and, as OPEC production is limited, it seems very likely that the market will only improve for bulls. Some activities, such as the slowdown in the economy, or OPEC and some non-OPEC countries (mainly Russia), or US production rising even faster than expected, could change this situation for the worse, but in the absence of any of these events, the bullish situation seems about to prevail.

Crude Value Insights offers an investment service and community focused on oil and natural gas. We focus on cash flows and the companies that generate them, generating value and growth prospects with real potential.

Subscribers can use a standard account of more than 50 years, in-depth analyzes of E & P's cash flow and a live discussion of the industry.

Sign up today for your free two week trial and get a new lease on oil and gas!

Disclosure: I / we have / we have no position in the actions mentioned, and we do not intend to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

[ad_2]

Source link