[ad_1]

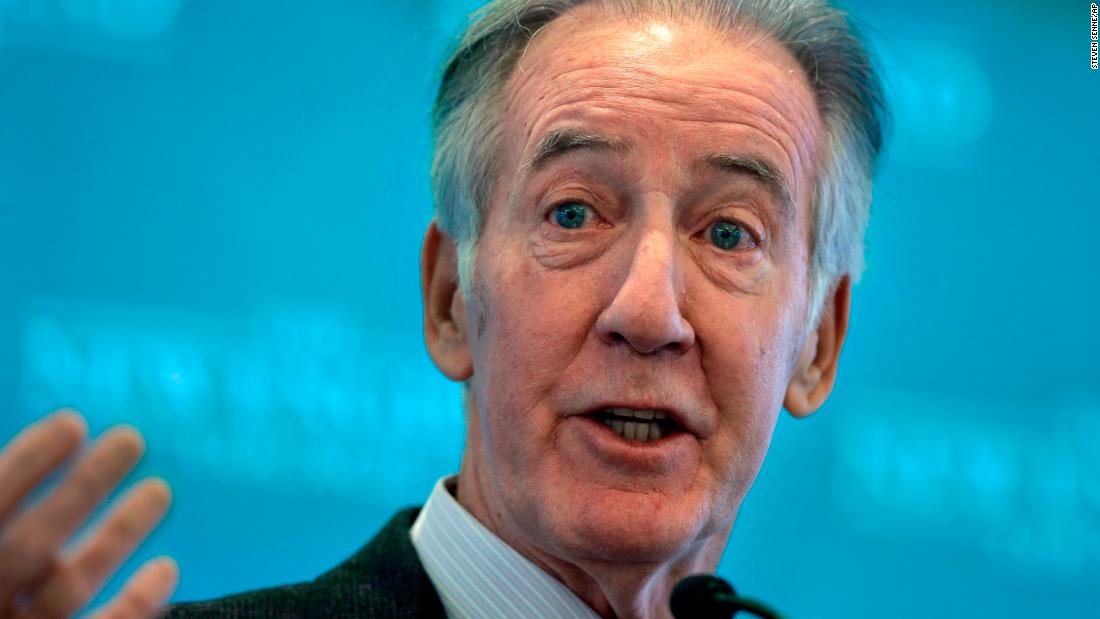

Neal explained in his letter that the application was part of his oversight role. Neal wrote that the committee needed Trump's tax returns to review the laws relating to the practice of verifying presidents by the IRS.

"According to the Internal Revenue Manual, a president's tax returns are subject to mandatory review, but this practice is the policy of the IRS and is not codified in legislation federal tax, "writes Neal in a letter to the IRS. "It is necessary that the committee determine the scope of any such review and that it include a review of the underlying business activities to be included in the personal income tax return."

In a statement to CNN, Neal pointed out that the committee's request was about "politics, not politics".

"My preparations have been made on my own and my schedule, totally independent of other congressional and administrative activities," said Neal. "My actions reflect a constant respect for our democracy and our institutions, and are in no way based on the moment's emotion or partisanship." I hope that in this spirit, the IRS will abide by to the federal law and will provide me with the requested documents in a timely manner. "

Neal gave the IRS until April 10 to comply with the request.

A debate of several months

Neal's announcement follows a month of debate in the Ways and Means Committee about how and when to file Trump's tax return application.

Unlike other sensitive documents that Democratic presidents demanded from the Trump administration, Trump 's tax return application could only come from a single Capitol Hill Democrat. Under IRS code 6103, only the Joint Tax Committee, the Speaker of the Chamber of Deputies and the Senate Finance Committee Chair have the authority to request tax information from an individual. Given that the Senate Finance Committee, Chuck Grassley has long said that asking for Trump's tax returns would amount to manipulating the tax filing committee, the claim fell to Neal.

But behind the scenes, Neal was meticulous about the decision. Democrats believe that the status is clear. Under the code, we read "the secretary shall provide this committee with any return or return information specified in this application". But Neal, a pragmatic and wise president, more interested in working with the administration on common priorities such as infrastructure, and then launching a controversial and partisan struggle that could define his mandate, proceeded cautiously.

"I'm sure we respect our legitimate rights in legislative, legal and oversight," Neal said in his statement Wednesday.

The Liberals on the committee put pressure on Neal both publicly and in camera. Representative Bill Pascrell, a Democrat from New Jersey, announced in early March that Neal was going to ask for Trump's tax returns in two weeks, and then go back a few hours later, to make clear that this was his opinion, and not official guidelines. Democratic representative Llyod Doggett, a member of Ways and Means, lamented that it was time for Neal to apply during the days leading up to the request.

Members also wanted Neal to expand each request so that it was not just a personal return, but also a business return. And in their radical ethical reform legislation H.R. 1, Democrats included a provision that would require presidential candidates and the incumbent president to disclose 10 years of revenue.

In the end, Neal requested information from eight Trump commercial entities, including Bedminster Golf Course LLC and the Donald J. Trump Revocable Trust, DJT Holdings LLC, the managing member of DJT Holdings LLC, DTTM LLC operations. , the managing member of DTTM Operations, the manager, the acquisition of LFB. Member Corp. and LFB Acquisition LLC.

At the beginning of his presidency, Neal focused on building relationships with members of the Trump administration, including Treasury Secretary Steve Mnuchin. Even when Mnuchin refused to appear before his committee for a hearing on the impact of the government's closure on the upcoming tax season, the two men continued to work in coordination. Neal told CNN in March that he had spoken directly to the president about his infrastructure goals.

When Mnuchin appeared before his committee on March 14, Neal's opening statement reflected a president more interested in collaboration with the administration on infrastructure and pension restoration than a Liberal Democrat preparing to call for personal documents closest to the President regarding his income and activity. practices in recent years.

In the end, Neal sent his application to the Internal Revenue Service, not to Treasury, which Mnuchin directs. During the committee hearing where Mnuchin testified, he told the committee that he had not dealt with other requests in the past.

Asked by a member of the committee about this, Mnuchin replied, "It's not something I would normally sign, it would be something the IRS Commissioner would sign."

While Capitol Democrat Presidents want to see Trump's tax returns for their own investigations, Neal's official request is specific and targeted: an investigation into a program that verifies the taxes of current presidents. Under Article 6103, only the information, but not the chairman of the other committees, will be communicated to Neal.

"The IRS's policy is to audit the tax returns of all presiding and sitting vice-presidents, but little is known about the effectiveness of this program," Neal said in a statement.

Ellie Kaufman of CNN contributed to this report.

[ad_2]

Source link