[ad_1]

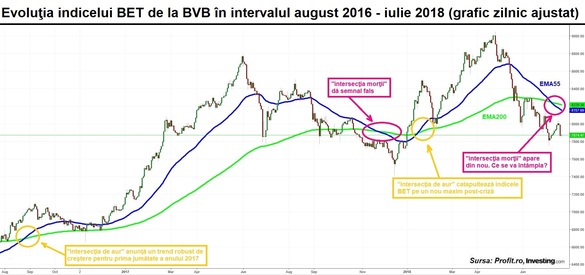

The last weeks of trading in which investors were negatively fueled by the prospect of a pension fund adjustment have highlighted a negative daily BET index in mature markets with a high degree of credibility, at to know the intersection of death ", given by the exponential moving average of 55 days under the 200-day exponential moving average, that defining the trend.

Last week ended on the Bucharest Stock Exchange in a note pressed, the market being marked by contradictory news on the prospect of cap on the price of natural gas at 55 lei / MWh at a price lower than the pre-liberalization applied since April 2017. There were two contradictory sessions, one with a significant rebound and a second rebound, both influenced by the shares of the two domestic gas producers Romgaz Mediaş (SNG) and OMV Petro m (SNP) [19659003] Significant fluctuations and volumes did not change the Romanian stock market situation, affected by the decline initiated during the second part of autumn, and supported both aversion at risk emerging markets investors, as well as the internal history of the possible adjustment of funded pension plan private schemes, called Pillar II

The negative trend of BSE could continue in the coming period, comes a technical signal that has emerged in recent weeks. Thus, for the BET index, we have what is called the "cross of death", respectively the exponential moving average of 55 days (EMA55), the most credible moving average speed of the Fibonacci ratio. below the 200-day exponential moving average (EMA200), which defines the trend

The technical signal that anticipates a more complex and sustainable sequence of declines generally has a high degree of credibility to the general market trend, being mobile environments with periods of time which shows the broad impressions impressed by the investor market. As indicated in the attached table, the "intersection of death" was obtained with a good separation angle, indicating the vendors' determination and the strength that they led down

What could be the negative stories that investors already take into account? A first story is that of the pension funds, on which the representatives of OTP Asset Management, a management company of 610 million lei, declared that they were not "included" in the price at the end of the decline. According to them, they reflect only investor aversion to emerging markets and are heading towards the US market where increasing returns of dollar-denominated income instruments have become more attractive than those of developing countries

" We do not consider Pillar II discussions in the Bucharest indices, "says Alexandru Ilisie, Director of Investments for OTP AM, who expects the additional information to be the ones that will move the market in the second half of the year: The evolution in the second semester will revolve around this issue. "

The possibility of materializing the risks of the international financial markets linked to an escalation of the tariff wars led by the United States is often indicated by the professionals as being able to induce stages of depreciation

Also, an action re-pricing and returns of government securities would have the potential to push even more stock quotes

The "Intersection of Death" was preceded by a tour of the "the black crows "

The strong sales trend of ESB, most likely fueled by non-resident institutional investors, has sent strong signals regarding the major trend." The Intersection of Death "n & rsquo; Is not the first negative technical signal to alert the market Profit.ro indicates that the graphic formations known as "3 black crows" indicate the most likely scenario of the followed by declines as early as mid-May. Since then, the BET index of the Romanian stock market has lost another 6%. Below we insert the graph presented by Profit.ro 2 months ago

Recently described "Intersection of Death" is an additional reason for warning. Warning! Although credible, there are cases where the signal is wrong. An example that I had at the end of last year, when also the exponential mobile media of 55 days went below the 200-day exponential mobile media, and even had a good angle of separation. Profit.ro also reported the moment, but the market had a strong reverse trend.

The sustained rally came in the first few weeks of the year, and by the end of April, the BET index reached 9,000 points in a new maximum after the crisis. On the other hand, the technical mirror signal, called "intersection of gold," was giving correct signals in two ranks, both last fall and the beginning of the year.

A case with greater notoriety "The intersection of death" sent a false signal in the summer of 2010, but the technical alert was heavily popularized in the media. ;business. The market, however, experienced a contradictory development in the fall of this year, as the stock markets were fueled by liquidity injections from the US central bank, called "quantitative easing."

What does the tactical moment look like? Is this the right time to reduce exposures? One of these logical outputs was technically described in the first part of last week, when the BET index tested a confluence of 4 resistances: 1) the psychological threshold of 8,000 points, 2) the relatively low precedent of end of May, 3) 21-day exponential moving average (EMA21) downhill, 4) Fibonacci withdrawal from last ascending pulse

The information published by Profit.ro can only be retrieved within 500 characters and citing the source with an active link. Any derogation from this rule constitutes a violation of the Copyright Act 8/1996

[ad_2]Source link