[ad_1]

Dow surpasses 25-mile mark with Powell and FOMC adapts to global risks

Dow Jones Discussion Points:

– US stocks are rising following the speech of Jerome Powell, president of the FOMC. This took place at noon ET, and as discussed earlier this morningthe markets appeared to be taking a more moderate stance from the head of the world's largest central bank.

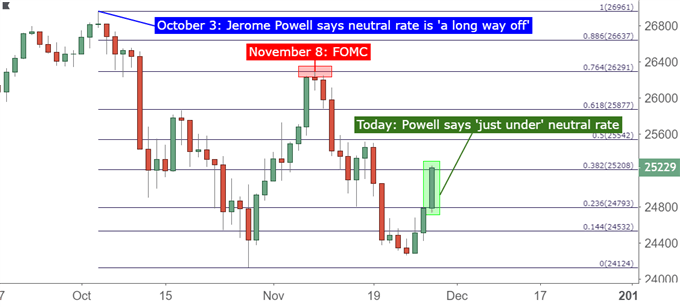

– The big topic of interest was President Powell's comments on the "neutral rate", which is a level of theoretical interest rate at which a policy would be neither stimulating nor supportive. In early October, President Powell said the FOMC was "far" from this level, alluding to rising interest rates and tightening policy in the coming years, as the bank was trying to find this level "in gold" for interest rates. But this speech of October 3rd peaked in equities and the next seven weeks turned into a difficult time for stock bulls.

– In today's speech, President Powell said the FOMC was "just below" the neutral rate, which is a bit different from what was heard in early October. It is also a less hawkish attitude and, in the short term, the US dollar has fallen as US stocks have reached new weekly highs. At this point, we must ask ourselves whether Mr. Powell has just successfully removed the most important pressure point for global risk markets.

– DailyFX forecasts on a variety of currencies and indices such as the US Dollars or l & # 39; euro and are available from the DailyFX Page Guide. If you want to improve your business approach, consult Traits of successful traders. And if you're looking for an introduction to the Forex market, check out our New on FX Guide.

Do you want to see how retail traders are currently trading the US dollar? Discover our Customer sentiment indicator IG.

The day was hectic for US stocks while equity indices rallied strongly after comments by FOMC Chairman Jerome Powell. In a well-attended speech, Powell spoke at the Economic Club of New York, as market players around the world tried to find a clue to the bank's potential aggression in 2019 and by the following.

It had become a major argument of recent: While US equities rose sharply in the third quarter and all Dow indices, the S & P 500 and Nasdaq 100 indexes reached unprecedented highs in early October, a drastic Is operated around the speech of the FOMC President, Jerome Powell on Oct. 3rd. It was at this point that the head of the world's largest central bank estimated that the FOMC was "far" from the neutral rate, which is the deposit rate for which the policy is neither a stimulus nor a stimulus. restriction. It's a bit of an elusive theoretical level, but the mere fact that it appears far from current rates has frightened market participants; This could lead to an even more aggressive and aggressive rise in the rate hike outside the Fed.

In a short time, equities began to retreat from their record highs, and just weeks after the fourth quarter, a widespread sell began to show up. October Price action Almost all of Dow's gains in Q3 were wiped out and a recovery began to emerge in early November. But even that was halted in the short term by the FOMC decision on aid rate at the beginning of the month, and sellers were soon pushing back to 24k on the Dow.

Dow Jones Daily Price Table

Table prepared by James Stanley

In today's speech to the New York Economic Club, President Powell took a distinctly different tone than he did on October 3.rd. While Powell had referred to the neutral rate as "very distant" in early October, he said today that rates were "just below" this level, alluding to a more moderate attitude and more cautious at the FOMC.

In no time, the US dollar fell and US stocks continued their strong rally, with the Dow Jones Industrial Average returning above the psychological level of $ 25,000.

Four-Hour Dow Price Table: Return Over 25k on Powell's Speech

Table prepared by James Stanley

US stocks – is the worst over?

Yesterday's webinar, I mentioned that US stocks seemed to be preparing for bullish reversals. The remaining factor was today's speech, which spoke rather constructively about the bulls of equity. The big question, at this point, is whether these other concerns become more important. This could come from any of the problems related to Brexit, EU-Italy conflict or trade war. But – these are the same worries as the market in the third quarter, so this may not be a total impediment to a return of stock strength on US stock markets.

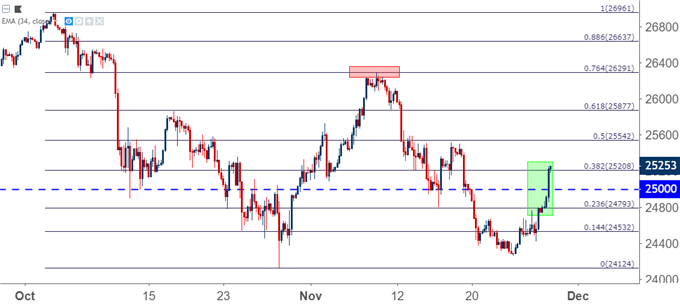

In the Dow, the fear at this point would be to continue the move higher. The same level of 25,500 that I've been using since mid-August could be applied back to the chart to illustrate a bigger show of bull's strength. This can be a line in the sand for bullish continuation games. Alternatively, a withdrawal and a support demonstration around 25,000 could open the door to lower support games, aiming for a new test of this level of 25,500.

Dow Jones Hourly Price Table

Table prepared by James Stanley

You may also be interested in:

The Dow spends a week on technical support: will the bulls follow?

Stock forecast for Dow, S & P 500, DAX, FTSE and Nikkei

Day Trading on the Dow Jones: Strategies, Tips and Trading Signals

To know more:

Are you looking for a longer term analysis on the US dollar? Our DailyFX Forecast for Q3 have a section for every main currency, and we also offer a plethora of resources on USD-pairs such as EUR / USD, GBP / USD, USD / JPY, AUD / USD. Traders can also stay in step with short-term positioning via our Customer sentiment indicator IG.

Forex trading resources

DailyFX offers a plethora of tools, indicators and resources to help traders. For those looking for business ideas, our Sense of the client IG shows the positioning of retail traders with real transactions and positions. Our commercial guides bring our quarterly DailyFX forecasts and our best trading opportunities; and our news feed in real time has intraday interactions of the DailyFX team. And if you're looking for real-time analytics, our DailyFX Webinars offer many sessions each week in which you can see how and why we watch what we watch.

If you are looking for educational information, our New on the FX Guide is here to help new traders as our Research on the characteristics of successful traders is built to help refine the skill set by focusing on risk management and trading.

— Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX

[ad_2]

Source link